In August 2012, we created a Growth Portfolio for readers of my Internet Wealth Builder newsletter who were prepared to accept a greater degree of risk in exchange for potential higher returns.

The original portfolio was valued at $10,000, distributed among eight stocks. Three were U.S. companies while the rest were Canadian. There are no bond positions in this portfolio. The target average annual compound rate of return is in the 12 per cent range.

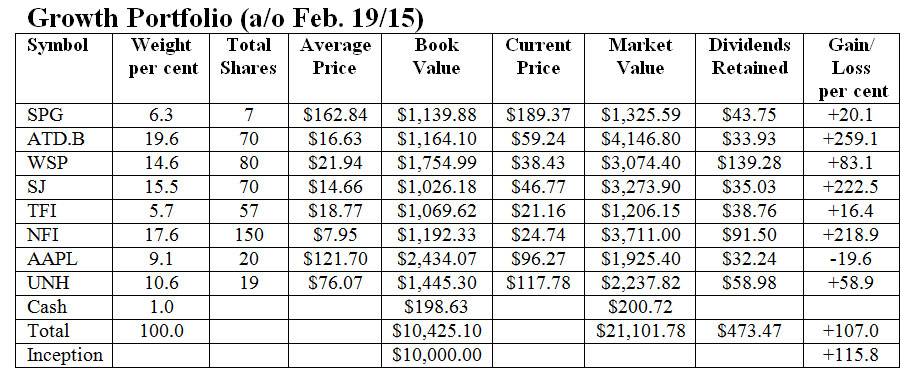

Here are the securities that make up the portfolio, with an update on how they have performed since our last review in August. Prices are as of the afternoon of Feb. 19.

Simon Property Group Inc. (SPG-N). SPG is the largest retail property group in the United States, with interests in shopping malls across the country. The stock had been performing well for us but the price retreated by $3.87 since the last review in August, following the broad market. We received two dividends totaling $3.20 (U.S.).

Alimentation Couche-Tard (ATD.B-T). Although it has pulled back a little recently, this stock has been a great performer for us. When it was added to the portfolio the shares were trading at a split-adjusted $16.53 (Canadian). As of Feb. 19 they were trading at $59.24. We have a total return of 259 per cent on this one, and it is still the best performer in the portfolio.

WSP Global Inc. (WSP-T). WSP Global is one of the world's leading professional services companies, employing some 32,000 specialists in 39 countries on five continents. The share price has weakened since the last review, giving back $7.21. However, it is still up significantly from the original price. We received two dividends totaling 75 cents per share.

Stella-Jones Inc. (SJ-T). This is one of only two stocks in the portfolio that have gained ground since the August review. The shares are up $1.61 since then. That's not a lot but it's impressive in the context of the overall results from the TSX. The dividend is 8 cents per quarter, so we received 16 cents per share during the latest six months. Total return since inception is 222 per cent.

TransForce Inc. (TFI-T). TransForce shares fell as low as $18.94 in early February on concerns the economic slowdown in Western Canada would hurt its business. However, the company came out with respectable fourth-quarter and year-end results and the stock has rallied somewhat. It is still down $1.89 since our August review but hopefully the worst is behind us. We received two dividends totaling 34 cents.

New Flyer Industries Inc. (NFI-T). This Winnipeg-based heavy-duty bus manufacturer is one of the beneficiaries of a lower Canadian dollar since much of its production is sold in the U.S. As a result, its financial results have picked up and the stock has gained $5.40 since the last review, making it the best performer during the period. The monthly dividends over the six months totaled $0.31 per share.

Apple Inc. (AAPL-Q). This has been a big disappointment so far. The stock was added in February 2015 as a replacement for Michael Kors but it has not performed to expectations. We added to our position last August but the shares are off $16.76 (U.S.) since then, making this the only losing stock we own. We'll keep it in the portfolio for now as it appears to be oversold, but I'll watch it closely. We received two dividend totaling $1.04.

UnitedHealth Group (UNH-N). This U.S. health insurance provider had been generating strong returns but it has retreated recently and is down $2.64 since the last review. We received two dividend of $0.50 each.

Cash. We received interest of $2.09 on our cash holdings.

Here is how the portfolio stood on the afternoon of Feb. 19. Commissions are not taken into account and the U.S. and Canadian dollars are treated as being at par but obviously gains (or losses) on the American securities are increased due to the significant exchange rate differential.

Comments: The total value of the portfolio, including retained dividends, is $21,575.25. That is up by $134.86 (0.6 per cent) since August. Considering what has happened in the broad market during that time, we should be quite satisfied with this result. Thank the strong showing from New Flyer Industries for keeping us in the game.

Since inception three and a half years ago, the Growth Portfolio is up by 115.8 per cent. That works out to a compound annual growth rate of 24.6 per cent. That's down from 29 per cent last August but I stressed at that time that a return of that magnitude was clearly unsustainable. The target for this portfolio is around 12 per cent a year so even after a weak six months we are still well ahead of that pace.

I'm not going to make any changes in the portfolio at this time. We'll hold our positions and hope that the tone of the market improves over the next six months. The cash will be invested in a high-interest account paying 0.8 per cent. I'll update the portfolio in August on its fourth anniversary.