In March 2012, I launched a High-Yield Portfolio for readers seeking above-average cash flow and who were willing to live with a higher level of risk. I cautioned at the time, and continue to do so, that this is a 100-per-cent equity portfolio with no bonds to cushion losses when stock markets retreat. Therefore it is best suited for non-registered accounts where any capital losses can be deducted from taxable capital gains. Also, a high percentage of the payments from this portfolio will receive favourable tax treatment as eligible dividends or return of capital.

The portfolio did not do well during the six months from March to September 2015, losing 3.7 per cent. However, it snapped back during the latest review period, led by an outstanding performance from Premium Brands Holdings.

Here is a rundown of the securities we own and how they have performed in the six months since my last review, on Sept. 18. Results are as of March 18.

The Keg Royalties Income Fund (KEG.UN-T). This fund is the leading operator and franchisor of steakhouse restaurants in Canada and has a substantial presence in select regional markets in the United States. It was added to this portfolio in April 2013 when it was trading at $15.25. It has been up and down since, falling back to the $15 range at one point. But it is now in an uptrend and the shares have gained 75 cents since my last review in September. We received dividends of 59.2 cents per share during the period, including a special dividend of 7 cents in December. The shares yield 5.6 per cent at the current price.

DH Corporation (DH-T). After briefly falling below $30 in November, DH shares have staged a significant rally and remain in an upward pattern. However, we are still down by $1.98 since the September review. We received one dividend of 32 cents per share during the period.

Vermilion Energy (VET-T). We added Vermilion to the portfolio one year ago. Despite the weakness in the energy sector, we like this stock because of its well-diversified international holdings and good management. However, the share price has weakened in the face of continued low oil prices. The good news is that this is one of the few mid-size energy companies that hasn't cut its dividend, although the payout ratio in 2015 was over 100 per cent. The stock continues to pay 21.5 cents per month, to yield 6.3 per cent.

FLY Leasing (FLY-N). In November, FLY announced that its board of directors had approved a plan to eliminate the dividend entirely and instead spend the money on a $100-million share buyback program. This decision means that FLY is no longer a suitable investment for this portfolio. See below for information on a replacement.

Premium Brands Holding Corp. (PBH-T). This specialty food manufacturer and distributor was added to this portfolio in October 2013. It has been a very strong performer, closing on March 18 at $51.98. That's more than double our book value and up 58 per cent since our last review in September. The quarterly dividend will be increased to 38 cents from 34.5 cents, effective with the March 29 payment.

Morneau Shepell Inc. (MSI-T). Morneau Shepell Inc. is the largest Canadian-based firm offering benefits and pension consulting, outsourcing, as well as health management services. The shares are up $1.34 (8.7 per cent) since the last update and we continue to receive good cash flow from the monthly dividend of 6.5 cents (78 cents a year).

Pembina Pipeline Corp. (PPL-T). Pembina shares are up 51 cents from the time of our last review, suggesting that the stock may have finally bottomed out. The shares pay a monthly dividend of 15.25 cents ($1.83 annually), which appears to be safe.

Sun Life Financial (SLF-T, SLF-N). This blue-chip insurance company posted a small gain of 40 per share since the last review. We also benefited from a dividend increase of 2.6 per cent in November to 38.99 cents per quarter. It was the second dividend increase in 2015.

Chemtrade Logistics Income Fund (CHE.UN-T). Chemtrade is one of the world's largest suppliers of sulphuric acid, liquid sulphur dioxide, and sodium chlorate and is one of the few income trusts still remaining. The share price is down slightly since the last update but that was more than offset by the 10 cents per unit monthly distribution ($1.20 a year).

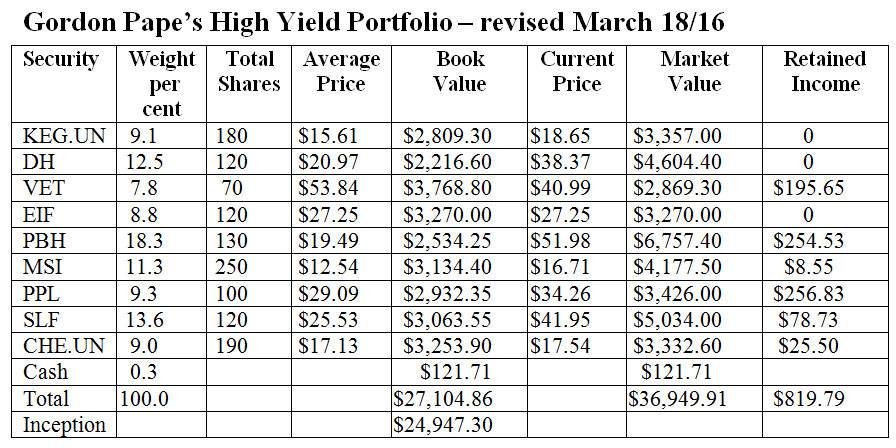

Here's what the portfolio looked like as of the close of trading on March 18. The weighting is the percentage of the market value of the security in relation to the total market value of the portfolio. The gain/loss shows the performance of the security since inception, or since it was added to the portfolio. Sales commissions are not taken into account, and the U.S. and Canadian dollars are treated as being at par. Note that the original book value was $24,947.30. The return since inception is based on that amount. We received interest on our cash position of $6 during the latest period.

Comments: We enjoyed a very strong six months, with the total value of the portfolio increasing by 9.8 per cent. Most of our securities gained in value, especially Premium Brands, and any losses were relatively small.

Since inception four years ago, the portfolio is up 53.2 per cent. The average annual compound rate of return is 10.93 per cent, well above our target of 7 per cent to 8 per cent a year. So far, this High Yield Portfolio has been doing its job for us.

Changes: As mentioned, we have to drop FLY Leasing from the portfolio, as it no longer pays a dividend. We'll replace it with Exchange Income Corp. (EIF-T), which is also in the aircraft business, albeit on a much different scale.

After dropping to the $21 range in January, EIF has rallied strongly and closed on March 18 at $27.25. The shares pay a monthly dividend of 16 cents ($1.92 per year) to yield just over 7 per cent at the current price. The company recently reported strong results for fiscal 2015, with adjusted net earnings of $51.6 million ($2.09 per share), up from $14.8 million (67 cents per share) in 2014.

The total value of our position in FLY Leasing, including retained dividends, is $3,245.30 (U.S.). Since we are treating the currencies as being at par for purposes of this portfolio, we will buy 120 shares of EIF at a cost of $3,270 (Canadian). We will take $24.70 from our cash to make up the difference.

We'll also make some other small purchases as follows. Please do not initiate such small transactions yourself unless you have a fee-based account. Use dividend reinvestment plans instead.

KEG.UN: We'll add 10 shares at a cost of $186.50 to bring our total to 180. This will use all the retained income and we'll take $36.71 from cash to make up the difference.

DH: It's a stretch but we'll buy 10 more shares for $383.70, to increase our position to 120. Here again, we'll use all the retained income and dip into the cash reserve for $76.40 to make up the difference.

MSI: We have enough in retained income to add 10 shares at a cost of $167.10. That will leave $8.55.

SLF: We can afford five more shares for a cost of $209.75. That will bring the total shares to 120 and reduce retained income to $78.73.

CHE.UN: We'll purchase 10 more shares at a cost of $175.40. That will bring the total to 190 and leave retained income of $25.50.

We will invest the remaining cash of $941.50 in a high interest savings account paying 0.8 per cent.

Here is the revised portfolio. I will review it again in September.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. Follow him on twitter @GPUpdates and on Facebook.