Gluskin Sheff economist David Rosenberg cited the earnings revision ratio – the number of stocks with improving profit estimates divided by those with declining earnings expectations – as a basis for optimism regarding S&P 500 performance for the remainder of 2015.

An improving revisions ratio is clearly a good sign as it presaged an equity rally in the fourth quarter of 2014. But a closer look at the numbers reveals the optimism is largely limited to the industrials sector, and so far the improvement is nothing to write home about.

In the Tuesday version of his widely read daily missive, Mr. Rosenberg wrote, "The three month earnings per share (EPS) revision ratio for the S&P 500 ticked higher in August to 0.98x [times] from 0.94x in July, 0.78x in June, 0.66x in May and the low of 0.51x in April. We have not seen an analyst revision ratio this high since last September which, if you recall, helped touch off the Q4 market rebound that saved the year."

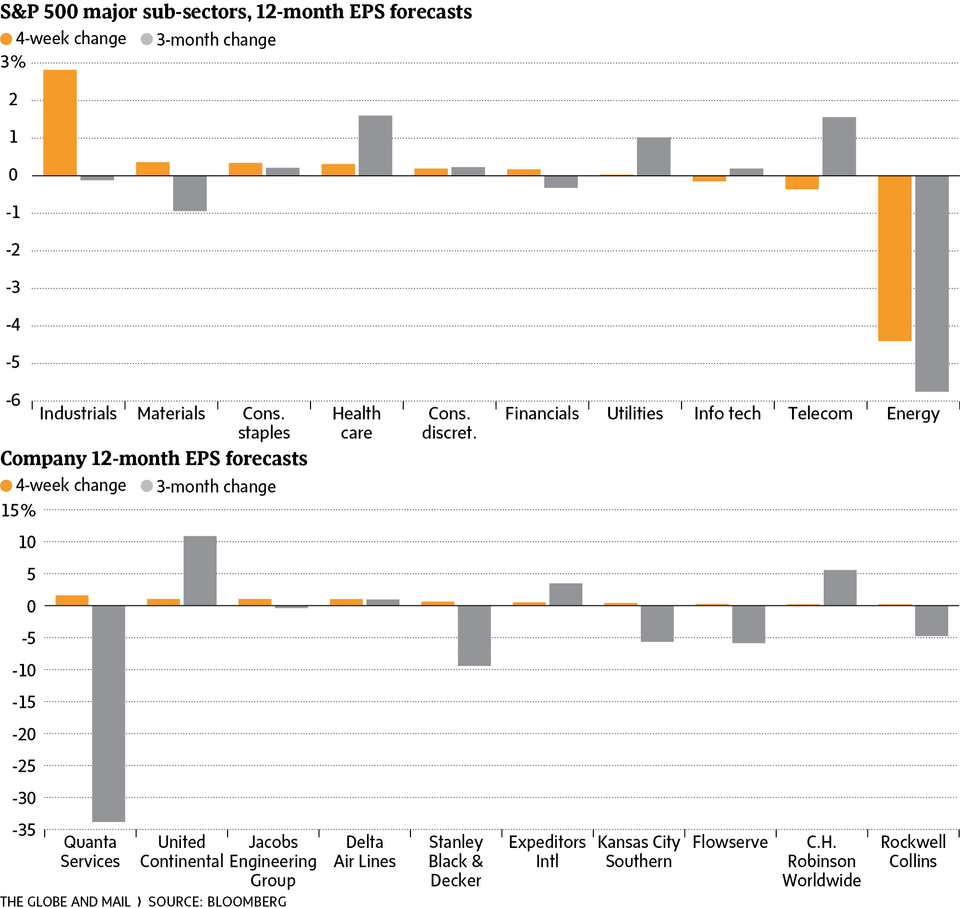

To identify which market sectors were seeing the biggest improvement in profit outlook, I looked at the one-month and three-month change in analyst profit expectations for each major S&P 500 subsector. The top chart shows the results.

In the past 30 days, the industrials sector has seen by far the biggest jump in earnings outlook with the average analyst profit forecast rising 2.82 per cent. The second-biggest upgrade to growth occurred in the materials sector, but it was a marginal 0.36-per-cent gain.

The lower chart shows the 10 U.S industrial stocks with the largest increase in profit forecasts in the past month. Quanta Services Inc., a relatively obscure logistics provider, tops the list, but the recent 1.6-per-cent upgrade in expectations is only a small uptick relative to the 34-per-cent cut in profit forecasts for the past three months.

Two of the 10 companies are airline stocks but, given the wealth-destroying long-term history of investment in the sector, most investors should ignore them. (Traders, on the other hand, are free to take their chances).

Jacobs Engineering Group Inc., which manages construction projections, is likely the most interesting company on the list in light of recent strength in U.S. construction activity. Further fundamental analysis here may uncover an investment opportunity.

Canadian investors are understandably reluctant to invest in U.S. railway stocks with Canadian National and Canadian Pacific as domestic options, but Kansas City Southern might also reward further study by investors.

Mr. Rosenberg is absolutely correct to highlight that an improving revisions ratio is a positive for U.S. equity markets. It represents a change in trend from most analysts slashing the profit outlook to a rosier environment of broadly rising earnings. In the short term, however, investors should be very careful on how to play the trend until more compelling quantitative evidence is apparent.

Follow Scott Barlow on Twitter @SBarlow_ROB.