There is ample reason to believe that Monday's sharp upward move in the West Texas Intermediate crude oil benchmark price was driven by technicals, and the renewed slide Tuesday suggests we may have been looking at a proverbial dead cat bounce.

Like many skeptics, I previously believed that technical analysis was a Rorschach test and about as effective as astrology. Although I still believe fundamental research must be part of every investment decision, being around professional traders changed my mind on technicals. Even the most conservative, value-oriented portfolio managers hand their buy or sell orders to traders who use technical analysis as their primary method of picking buy and sell points.

In my mind, technical analysis is merely a way to quantify sentiment – the buy or sell interest on every stock at every price. Few if any investors would argue that market sentiment is irrelevant, so this helps validate the use of technicals to some extent.

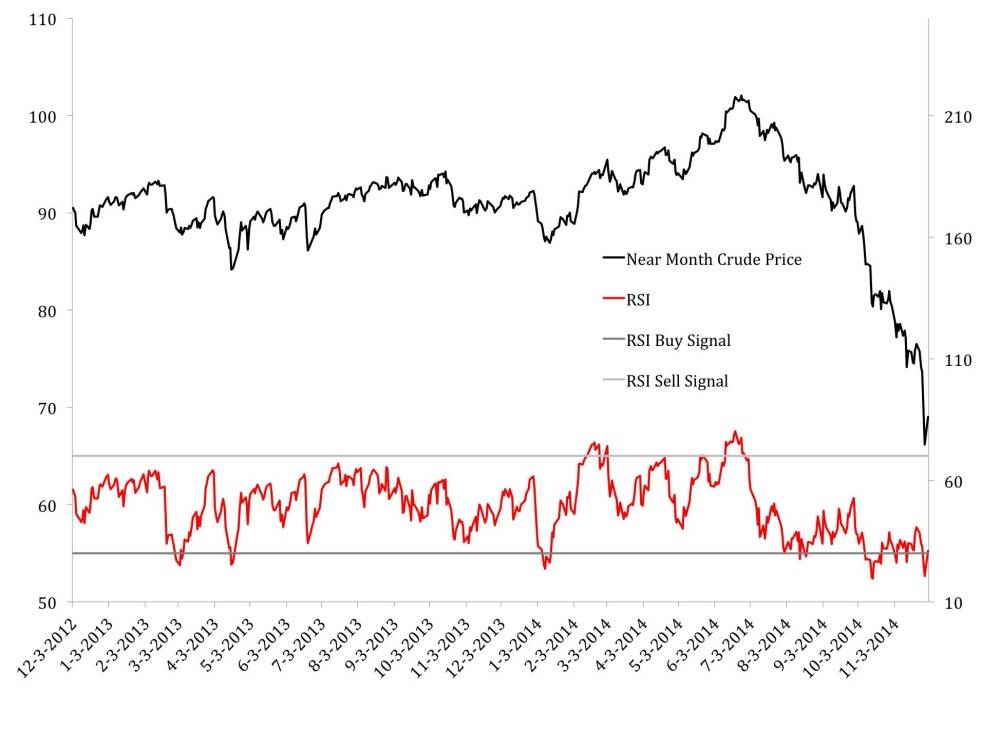

The crude chart below uses my favourite technical tool, Relative Strength Index (right hand Y-axis), to gauge the technical attractiveness of crude oil.

The important RSI levels are 30 (the buy signal that indicates an asset is oversold and due for a technical bounce higher) and 70 (which indicates the price is extended and a decline is likely in the short term).

Monday's sharp $2.85 rally is the last data point on the chart. The simultaneous change in the crude oil price's RSI is telling – it went from a deeply oversold reading of 20.6 to above the buy signal of 30. In one day, the WTI price went from hugely oversold to no-longer oversold.

This move, combined with the fact that there was no major oil-related news on Monday, suggests to me that the almost $3 spike in the oil price was caused mainly by technically-minded traders buying WTI because the price was so obviously oversold.

Tuesday's trading session began with the oil price above the 30 buy signal and began drifting lower – another sign that technical analysis played a big role in Monday's rally.

Technical readings like RSI, moving average convergence/divergence (MACD) and moving averages are only meant for short-term use. They change extremely quickly and, often, longer term investors can afford to ignore them. And again, while technical analysis has a long history of success in identifying attractive buy and sell targets, fundamental analysis should be part of every investment decision.

Follow Scott Barlow on Twitter @SBarlow_ROB.