The "all financials, all the time" trend continued in the Canadian equity market, while grocery stores earned a big enough beating to be worth a look as a buying opportunity.

The S&P/TSX Composite is taking another run at 2013 highs this week but with a relative strength index (RSI) reading of 66, it remains just below the 70 sell signal.

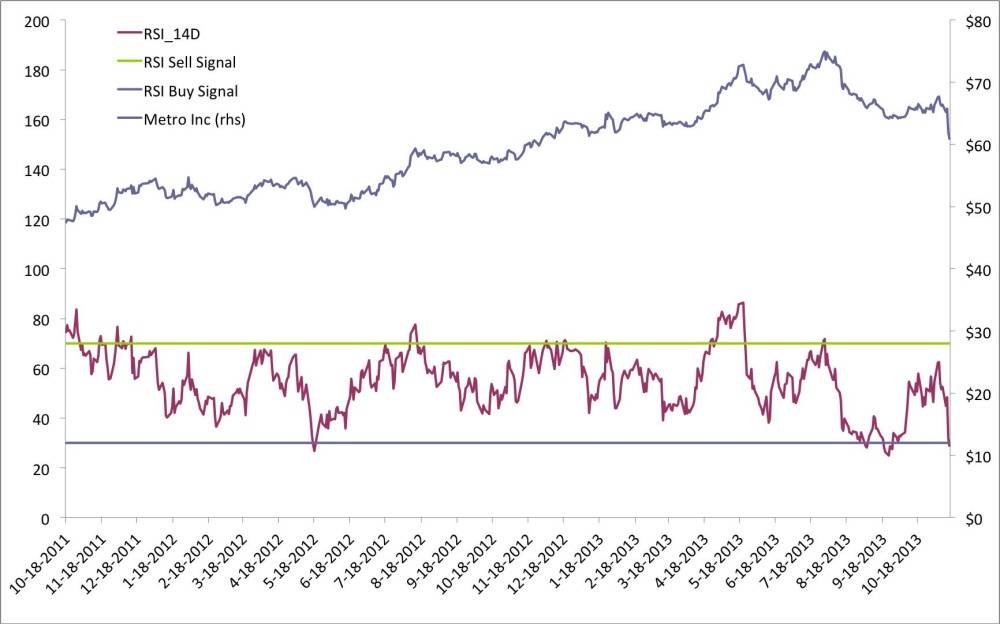

The domestic food retail sector is the interesting story of the week after Metro Inc. and Loblaw Cos. Ltd. fell 8.2 and 7.6 per cent respectively (Thursday to Thursday). They are not deeply into oversold territory yet, but it's rare for a company like Metro – with its long history of stable cash flow generation – to decline so sharply. Incursions into the industry from U.S.-based chains may have changed the game somewhat, but Metro is definitely worth a closer look.

Financial stocks make up 12 of the 32 domestic stocks trading above the RSI sell signal. Investors continue to ignore market history by driving Air Canada continually higher. Industrials also continued to be strong this week, pushing Stantec Inc., Linamar Corp. and transport company Transforce Inc. well into overbought territory.

Over the long term, there has rarely been a bad time to buy Canadian bank stocks so I’m not worried about them being technically extended. Elsewhere in the financials, the market sensitivity of insurance and asset management stocks does suggest that investors would be better off ignoring those names until they cool off.

The strong showing for industrials is encouraging – it could mean that fears of a slowing North American economy are overblown. Performance in the months ahead will be dependent on the growth backdrop and thus hard to predict using technical analysis.

As always, screening the benchmark by technical measures like RSI is a great first step but not sufficient grounds for buying and selling stocks on its own. More homework is required. For my part, I’m going to start with Metro Inc.

To view the tables on mobile devices, click on the following links:

Overbought: http://bit.ly/1e84knb

Oversold: http://bit.ly/1acn3xd

Scott Barlow

Scott Barlow