I knew markets had been weak in the five trading sessions ending with Thursday's close, but didn't realize the full extent of the damage - the S&P/TSX Composite fell a stomach-churning 5.3 per cent for the period. The benchmark is not yet technically oversold according to my preferred short term technical analysis method, Relative Strength Index (RSI). The TSX's current RSI reading of 40 is merely at the low end of the neutral range between the oversold buy signal of 30 and the overbought sell signal of 70.

The list of oversold, technically attractive stocks by RSI has increased (unsurprisingly) to 26 this week. ATS Automation is the most oversold stock in the benchmark as the investing conundrum in the auto sector continues. North American auto sales remain extreme strong while Canadian companies in the sector – Magna International and Linamar are also on the oversold list – continue to take a beating.

Major insurers are also well represented on the oversold list with Industrial Alliance and Manulife stock prices remaining weak. Brookfield Property Partners, CI Financial and Bombardier are other notable names trading at oversold levels.

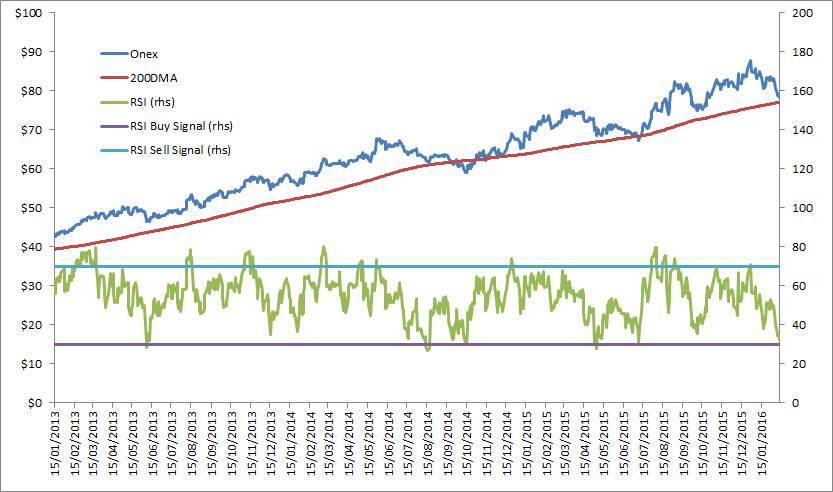

As noted previously, I'm only focusing on stocks trading above their 200-day moving averages in this weekly technical update. RSI Buy signal continue to perform poorly for stocks trading in a sustainable downtrend below their 200 days. For this reason, I picked Onex Corp for the focus stock this week even though it is not technically oversold – trading under 30 by RSI.

RSI has worked really well uncovering buying opportunities for Onex Corp stock – helped by the fact that the stock price has been extremely consistent and less susceptible to volatility. An oversold signal in June 2013 preceded a 45-per-cent rally to May 2014. There was a slight false alarm buy signal in August 2014, but it was quickly followed by another buy signal two months later that was followed by a 39-per-cent rise before September 2015.

To reiterate, Onex is not yet officially oversold (below 30) by RSI. It also looks like its about to re-test its 200-day moving average. If it does so, and history is any guide, there's a good chance it will bounce higher.

Usual warnings apply: technical analysis has proven a very useful tool for investors but is not enough on its own. Investors should complete fundmanetal analysis before any market transactions.

Follow Scott Barlow on Twitter @SBarlow_ROB.