The S&P/TSX Composite's 7-per-cent return for the week ending with Thursday's close is great news for investors but not for this weekly report on domestic oversold stocks. The sharp rally leaves only two stocks in official oversold territory, according to Relative Strength Index (RSI), WestJet Airlines Ltd. and Colliers International Group Inc. The equity benchmark currently has an RSI reading of 58, in neutral territory but far closer to the sell signal of 70 than the oversold, buy signal of 30.

I picked WestJet as the focus stock this week, mostly out of desperation. The analysis should not be considered a buy recommendation in any way – it's merely a study in case the fundamental backdrop for the stock changes in the coming months. WestJet's stock price remains well below its 200-day moving average which, as we've discussed previously, means that technical buy signals like RSI work less well than when the stock price is in an uptrend above the 200-day.

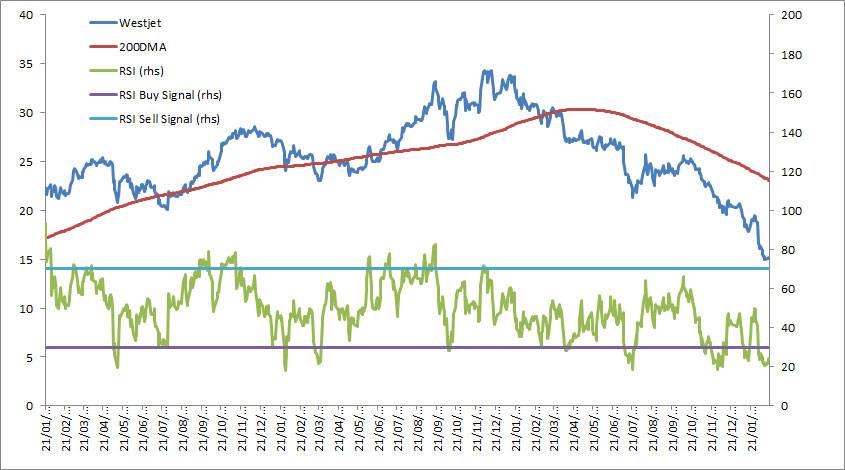

The WestJet chart provides further evidence that a policy of ignoring technical buy signals when stocks are mired deeply below the 200 day moving average is the correct one. Before March 2015, when WestJet's forays below the 200-day were brief, RSI provided some effective buy signal for investors.

The RSI oversold signal during the taper tantrum in May 2013 was only moderately useful but only a few months later, in July, a buy signal was followed by a 41-per-cent rally. A similar pattern occurred in January 2014 saw an initial buy signal predicting a small rally while a second buy signal in March kicked off a lucrative 43-per-cent appreciation.

After WestJet stock fell below the 200-day moving average in March 2015 the RSI buy signals became more or less worthless. An oversold reading in July 2015 started a small rally but the sell-off in the stock barely slowed down during futrue buy signals in December 2015.

WestJet stock is now trading eight dollars below its 200 day moving average and has a lot of catching up to do before it regains an uptrend and RSI buy signals can be taken seriously.

The overbought, technically vulnerable list of S&P/TSX Composite stocks is larger than the oversold list as we'd expect after the sharp rally. Takeover target Rona Inc. is the most overbought stock in the index but unless the Lowe's bid for the company is pulled, it won't be vulnerable to a pullback.

Precious metals stocks dominate the remainder of the overbought list with Pan American Silver Corp., First Majestic Silver Corp., Kinross Gold Corp. and Detour Gold Corp. all represented.

As always, technical analysis is only a portion of the required research before investor market transactions. Fundamental analysis should be completed before any trades are made.

Follow Scott Barlow on Twitter @SBarlow_ROB.