The S&P/TSX Composite had a solid week, rising 1.1 per cent for the five trading sessions between last Friday and Thursday's close. According to Relative Strength Index (RSI), the benchmark is in technically neutral territory with an RSI reading of 55 that is not close to either the sell signal of 70 or the oversold, buy signal of 30.

The market's overall strong performance leaves only three benchmark stocks trading with an attractive RSI level below 30: Avigilon Corp., Hudson's Bay Co. and Valeant Pharmaceuticals International Inc.

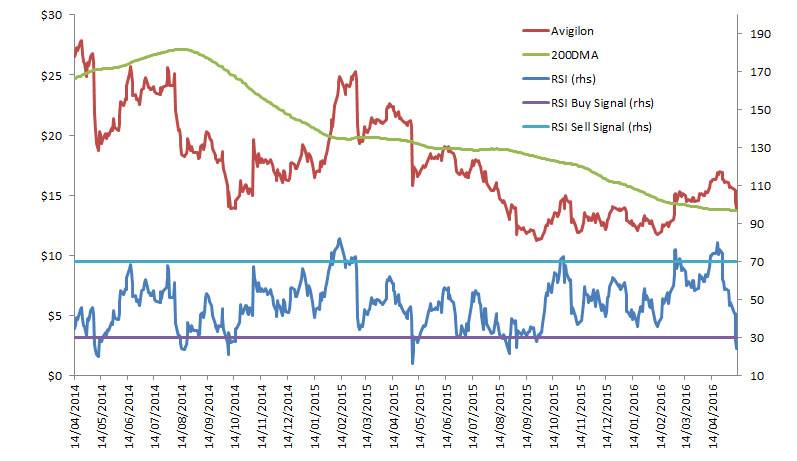

Avigilon, a manufacturer of high definition video software and camera components, is the focus this week. It is the most oversold stock in the S&P/TSX Composite but is still trading above its 200 day moving average.

The stock shows a pattern we've seen often in recent weeks – RSI buy signals work well when it's trading above the 200-day moving average and not consistently when it's below the 200-day. Avigilon is currently trading right just above the 200-day, which implies that the current RSI buy signal will only be reliable if stays above the green line on the chart. Beneath that line, we can consider the stock in a downtrend where technical analysis measures like RSI should be ignored.

The usual caveats apply. Traders and investors should always complete fundamental research before buying any asset – technical are helpful but not sufficient reason on their own to buy a stock.

The list of overbought, technically vulnerable stocks is dominated by the real estate sector as Crombie REIT, Chartwell Retirement Residences, Allied Properties REIT, CanREIT and Milestone Apartment REIT are all in the top 10 most overbought S&P/TSX Composite members. Investors might want to hold off buying these until some froth burns off.

Follow Scott Barlow on Twitter @SBarlow_ROB.