The S&P/TSX Composite inched higher by 0.3 per cent for the trading week ending with Thursday's close, and stands 15.3 per cent higher year to date.

According to Relative Strength Index (RSI), the benchmark stands in technically neutral territory with an RSI reading of 51.4 approximately halfway between the buy signal of 30 and the sell signal of 70.

There are 12 S&P/TSX Composite stocks on the oversold, technically attractive list this week, led by Kirkland Lake Gold Inc.. Cameco Corp., Genworth MI Canada Inc., and First Majestic Silver Corp. are close behind.

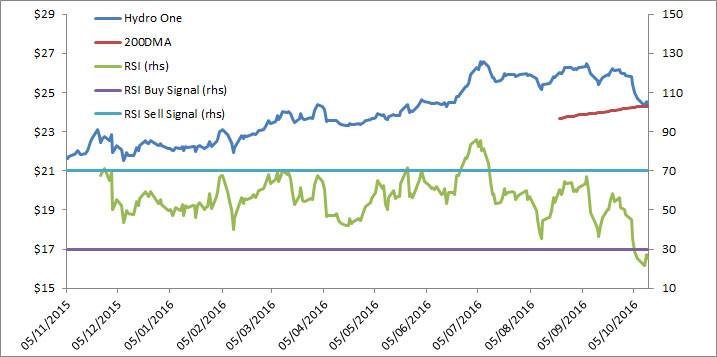

I picked Hydro One Ltd. for the focus chart this week despite its short history. The stock has been extremely volatile in terms of RSI and is currently deeply oversold with an RSI of 25.3.

Hydro One has only been trading since November 2015, and this is the first time the stock has been oversold.

The 200-day moving average is not a long series because of the shorter trading history, but it's likely important that the price is exactly at the 200-day right now. A drop significantly below the trendline would be bearish for Hydro One in the near term and bounce higher off of the 200-day would be a positive sign.

It's difficult to know how important the RSI buy signal is at this point because of the lack of precedent. This is another case where fundamental research will be a key factor in deciding whether now is a good time to buy Hydro One and benefit from the 3.5-per-cent dividend yield. The chart does make clear that RSI overbought signals have worked well, predicting brief pullbacks for the stock price.

The list of overbought, technically vulnerable benchmark constituents is remarkably small at three members this week – Air Canada, Methanex Corp., and Saputo Inc. I'd expect a list this small to be accompanied by a significant market sell-off, but the index was positive for the week.

Follow Scott Barlow on Twitter @SBarlow_ROB.