In March 2008, I created a model defensive portfolio designed for investors who were concerned that the stock markets were getting frothy. They didn't want to bail out of stocks entirely but they wanted to contain their risk.

To achieve that goal, the initial portfolio weighting was 40 per cent fixed income, 60 per cent stocks. The original value was $10,000. Because of the defensive nature of the portfolio, I set a target of 5 per cent to 6 per cent annual returns.

I've made several changes to the portfolio over the intervening seven and a half years but I have always aimed at keeping the fixed income exposure to about one-third of the total assets or more. The rest is invested in blue chip, dividend-paying stocks from both Canada and the U.S.

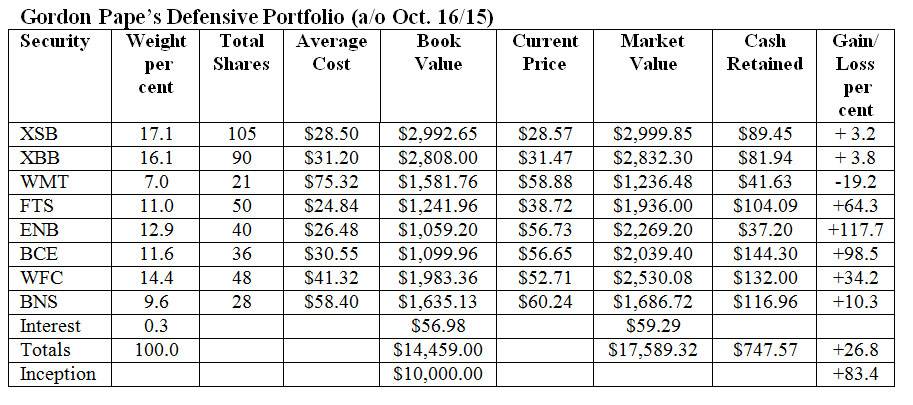

Here's a summary of the securities we currently hold with some comments on how they have performed since my last review in mid April. Prices are as of the morning of Oct. 16.

iShares Canadian Short Term Bond Index ETF (XSB-T). This short-term bond fund was added to the portfolio in October 2013 in anticipation of higher interest rates. That scenario has been much slower to materialize than expected. As a result, we sold part of the position in October 2014 and invested the money in units of the companion XBB fund (see below). Since the last review in April, the units have slipped in value by 36 cents, but we received about 35 cents in distributions so we were just about break-even over the period.

iShares Canadian Universe Bond Index ETF (XBB-T). This ETF tracks the performance of the broad Canadian bond market, including both government and corporate bonds. The fund, which had done well previously, suffered a reversal of fortune in the latest period, with the unit value dropping by $1.17. The monthly distributions totalling 45 cents partially made up for that but we still saw a net loss of 2.2 per cent for the six-month period.

Wal-Mart (WMT-N). I don't expect a defensive stock to lose almost $21 a share in six months but that's what happened here. Investors have been battering the stock over concerns about slowing sales and higher labour costs. The shares were hit especially hard last week after the company issued a profit warning. This stock has been a disappointment and is not doing the job I expected in the context of this portfolio.

Fortis (FTS-T). The utility stock is trading 56 cents lower since the time of the last review. However, we received two quarterly dividends of 34 cents each, giving us a small net gain for the period.

Enbridge (ENB-T). In the six months prior to the last review in April, this stock gained about $12 a share. We gave back about two-thirds of that in the latest six-month period as all energy-related stocks retreated. Despite the setback, we have a total return of 117 per cent since the launch of the portfolio, making this our top performer.

BCE Inc. (BCE-T). BCE shares recorded a gain of $1.22 during the period, making it one of the few securities to show a profit over the last six months. Two quarterly dividends of 65 cents each added to the modest advance.

Wells Fargo (WFC-N). This major U.S. bank was added to the portfolio in October 2013. The share price is down 96 cents (U.S.) since the April review, which was partially offset by two dividends of 35 cents each. Remember that we treat the currencies at par for purposes of this portfolio, so the figures do not include the profit from the rise of the U.S. dollar against the loonie.

Bank of Nova Scotia (BNS-T). The weakness in the Canadian banking sector continued over the summer, resulting in a loss of $3.98 per share for BNS. Dividends totalling $1.38 made up for some of that but we still recorded a loss of 4 per cent for the period.

Interest. We put our cash holdings of $513.88 into a high interest savings account paying 0.9 per cent. We received $2.31 in interest over the six months.

Here is how the portfolio looked based on prices on the morning of Oct. 16. Brokerage commissions have not been taken into account and the Canadian and U.S. dollars are deemed to be at par for tracking purposes.

Comments: A defensive portfolio doesn't mean it is risk-free. Rather the goal is to limit downside risk in rough markets, such as we have experienced in recent months. Over the period from April 14 to Oct. 16, this portfolio lost 3.8 per cent of its value. To put that in perspective, the S&P/TSX Composite was down 9.8 per cent during that time. So despite the loss, the Defensive Portfolio achieved its goal by minimizing the damage.

Our total return since inception is now 83.4 per cent. That works out to an average annual compound rate of return of 8.4 per cent, well above our target of between 5 per cent and 6 per cent annually. I'm quite satisfied with those results, especially considering that they include the crash of 2008-09.

Changes: Wal-Mart is under continuing pressure and no longer seems to be an appropriate fit for this portfolio. There we will sell our position for a total of $1,278.11 including retained dividends.

We will replace WMT with another retail stock, Canadian Tire (CTC.A-T), which was trading at $114.45 at the time of writing. We will buy 11 shares at a cost of $1,258.95 and add the remaining $19.16 to our cash reserve.

We will also add two more shares of Wells Fargo at a cost of $105.42 to bring our total position to 50. That will leave cash of $26.58.

These small trades are for portfolio modelling purposes only. Readers should not initiate such small transactions because of the high commissions involved.

Here is the revised portfolio. We'll invest the cash of $678.97 in a high-interest savings account paying 0.8 per cent. I will review the portfolio again in March, which will mark its eighth anniversary.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters.