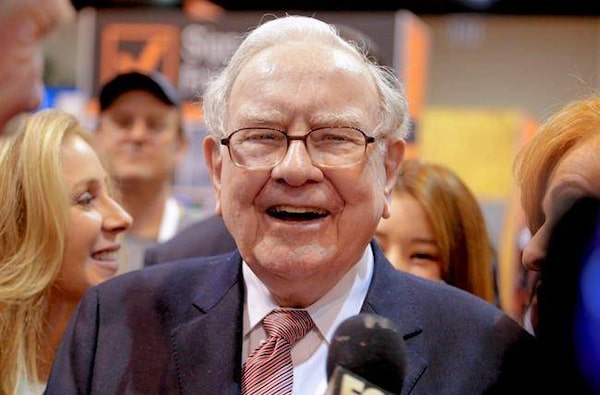

Berkshire Hathaway Chairman and CEO Warren Buffett laughs while touring the exhibit floor at the CenturyLink Center in Omaha, Neb., Saturday, May 6, 2017. THE CANADIAN PRESS/AP-Nati HarnikThe Associated Press

Polish and French mathematician Benoit Mandelbrot is best known for his pioneering work in fractal geometry and complexity but also made substantial contributions to investing knowledge. His study of commodity markets, specifically long-term cotton prices, paved the way for Nassim Taleb's Black Swan theses.

Above all, Mr. Mandelbrot's analysis of financial markets focused on what investors can predict about future returns and what they can't. In an excellent summary of the mathematician's study of finance, the 25IQ site wrote,

"Making short-term predictions about how a price chart reflecting the actions of millions of people will fluctuate is more than just hard. The word Mandelbrot uses is "unpredictable" rather than difficult. Again: not predictable… Mandelbrot is not saying that investors should throw their hands in the air and quit, but rather that they should use the tools of probability in a more refined and nuanced way… Risk comes from now knowing what you are doing and avoiding those areas [that are inherently unpredictable] is a very good thing."

Mr. Mandelbrot's concepts do not make for easy reading and I don't pretend to understand even a majority of their implications. It is important, I think, for investors to have a general understanding of his findings nonetheless.

For one thing, Mr. Mandelbrot's work throws a huge wrench into Modern Portfolio Theory, the highly popular efficient frontier investing strategies that use distribution curves and standard deviation as a measure of risk. As Berkshire Hathaway's Charlie Munger said, "if you think [distribution curves] apply to markets, then you must believe in the tooth fairy. It reminds me of when I asked a doctor at a medical school why he was still teaching an outdated procedure, and he replied, 'It's easier to teach.' "

I highly recommend 25IQ's "Benoit Mandelbrot's Ideas about Investing and Markets (Made as Simple as Possible, but not Simpler)" for a summary of Mr. Mandelbrot's finance research and for the practical investing applications that arise from it. For those looking for an even deeper look, How Nature Works, an early (published in 1996, some of the terminology is outdated) and accessible book on complexity, was a huge influence on my investing.

-- Scott Barlow, Globe and Mail market strategist

This is the twice a week Globe Investor newsletter. If someone has forwarded this e-mail newsletter to you, you can sign up for Globe Investor and all Globe newsletters here.

NEW: We have a new newsletter called Amplify. It will inspire and challenge our readers while highlighting the voices, opinions and insights of women at The Globe and Mail. Amplify will land in your inbox every Saturday morning, with a different guest editor each week -- a woman who works at The Globe -- highlighting a topic of the author's choice. The topics will vary and will dive deep into issues and events around the world. The newsletter will also highlight Canadian women who are inspiring others. Sign up today at this link.

Stocks to ponder

Rogers Communications Inc. (RCI.B-T) This industry leader, as Canada's largest wireless provider and a leading provider of cable television and internet services, was on the negative breakouts list on Monday. Its share price has been under pressure in recent weeks, falling over 7 per cent since Nov. 21. In the past, a pullback has represented a buying opportunity as the stock's underlying uptrend remains intact. As the stock price continues to fall, its valuation is becoming more compelling. On Friday, there was unusually high trading volume in the stock. As a result, the selling pressure may not be over quite yet – wait to see the share price stabilize. Jennifer Dowty reports.

Berkshire Hathaway Inc. (BRK.A-N) Its A shares stock price Berkshire Hathaway Inc's stock price touched $300,000 for the first time on Monday, reflecting investors' confidence in Warren Buffett's conglomerate despite four straight quarters of lower operating profit. Crossing the $300,000 threshold put Berkshire's Class A shares up 22.9 per cent for the year, compared with a 20-per-cent gain in the Standard & Poor's 500. Berkshire's Class B shares, worth about 1/1500th of Class A shares, traded at around $199.75. Neither class pays dividends. The gain occurred even though 2017 has been Berkshire's second straight year of mediocre operating performance relative to prior periods. Jonathan Stempel from Reuters reports.

Atrium Mortgage Investment Corp. (AI-T). This stock appears on the positive breakouts list. However, for patient investor seeking income (the yield is attractive at 7 per cent), I recommend waiting for the stock price to pullback before accumulating shares. There may be a more attractive entry point in the future for investors. Furthermore, given the stock's low liquidity, the share price can be volatile. To illustrate, on Monday, the share price had an intra[day swing of 2 per cent, peaking at $12.62 and dipping down to $12.37 during the day. Toronto-based Atrium Mortgage Investment Corp. is a mortgage lender that specializes in providing loans outside of the traditional lending environment. Jennifer Dowty reports.

The Rundown

The best- and worst-performing TSX Composite stocks of 2017

The S&P/TSX Composite hit a record intraday high Monday – but what's not at its peak is Canadian investors' exposure to the big sectors that have traditionally dominated this country's equity investing. As 2017 heads to a close, the financial sector – Canada's big banks – has maintained its significant share of the index, roughly 35 per cent of the overall value. Energy stocks, however, have slipped from 21.4 per cent of the Composite to less than 20 per cent. Materials, the sector that contains Canada's gold miners, remains at around 11 per cent of the Composite. David Milstead reports.

Investors are still getting a distorted view of TSX stocks' financials - and regulators are promising to act

Canadian companies are hooked on their own, rosier versions of their earnings performance. And Canadian securities regulators are going to crack down. Cameron McInnis, chief accountant at the Ontario Securities Commission, tells The Globe and Mail his agency will combine with other provincial regulators to publish formal rules next spring on how companies use what are known as "non-GAAP financial measures," which are results not calculated in accordance with generally accepted accounting principles. David Milstead reports. Read the related opinion piece from Veritas' Anthony Scilipoti.

Why Merrill Lynch thinks the loonie is about to take a sudden turn lower

Merrill Lynch foreign exchange strategist Ben Randol notes that global hedge funds are rapidly selling their bullish bets on the Canadian dollar and retail investors could soon join the trend, setting the stage for a sharply lower loonie to begin 2018. Scott Barlow explains.

Canadian credit unions eye wealth management with Aviso launch

Credit unions are known in Canada for their high-interest savings accounts, mortgages and insurance products. Now, they've set their sights on a much bigger slice of the investment industry while becoming more formidable competitors to Canada's big banks. Last week, Credential Financial Inc., Qtrade Canada Inc. and NEI Investments announced they will be banding together to launch a new independent wealth-management firm known as Aviso Wealth. The new firm will be jointly owned by Desjardins Group and a limited partnership comprised of five provincial credit union centrals and CUMIS Group Ltd. (which is partly owned by Co-operators Life Insurance Ltd.). Both Desjardins and the limited partnership will each hold a 50-per-cent stake. Clare O'Hara reports.

Five important investing lessons from bitcoin fever

At John Heinzl's Saturday pickup hockey game, the dressing-room banter normally revolves around the Leafs, Raptors and Toronto FC. But last week, as he and his peers laced up their skates and threw on their jerseys, the topic turned to – what else? – bitcoin. "Say I wanted to invest $1,000, just as a flyer," one of his D-men asked. "How would I do that?" "Don't," he implored. "Stick to stocks and ETFs." As with all speculative manias, it's impossible to predict when the bitcoin bubble will burst or what will trigger its collapse. These things become clear only in hindsight. But when an asset's spectacular gains start drawing in regular folks craving a piece of the action, that's usually a bad sign. John Heinzl reports.

What is bitcoin really worth? Don't even ask -- read the opinion piece from Yale economist Robert Shiller.

What you need to know about bitcoin -- Alexandra Pasadzki reports.

How this top-ranked investor has been averaging 18.5% annual returns

Tim Beyers manages his family's portfolio and writes about stocks at MotleyFool.com. For nearly 10 years now, he has published his stock picks on TipRanks.com. This website recently ranked him ninth-best out of 6,202 financial bloggers, and reports that his average return in the year after recommending a stock is 18.5 per cent. The Globe and Mail asked Mr. Beyers to shed some light on how he is outperforming his peers. Larry MacDonald reports.

Enough with your excuses for not investing globally

One of the most common investing mistakes Canadians make is to over-emphasize domestic stocks and downplay markets in the United States and internationally. If you've been ignoring advice to diversify beyond Canada, here's some incentive to change your mind. At a time when so many assets are expensive, international stock markets are a comparative bargain. Rob Carrick reports.

Top Links

Economists' biggest mistakes of 2017

'Everybody should be very afraid of the Disney Death Star'

Others

Tuesday's Insider Report: Companies insiders are buying and selling

Monday's Insider Report: Companies insiders are buying and selling

TSX short sales: Investors gear up for a big pullback in pot stocks

Eight dos and don'ts for your personal finances in 2018

The Globe's stars and dogs for last week

A bitcoin hedge fund's return: 25,004% (that wasn't a typo)

Number Crunchers

These 12 Canadian stocks are wealth creators – and bargain-priced

Ask Globe Investor

Question: When you make an in-kind withdrawal from a registered retirement income fund (RRIF) to a non-registered account and then transfer the shares to your TFSA, what are the tax implications if the stock has either a gain or loss in your RRIF?

Answer: The tax consequences of an in-kind withdrawal of shares from your RRIF are no different from a withdrawal of cash. In either case, the amount withdrawn is added to your taxable income for the year. (With an in-kind withdrawal, the dollar value of the withdrawal is determined by multiplying the number of shares by the stock's market price at the time of transfer.)

Whether the shares had a gain or loss inside the RRIF is irrelevant because, apart from withdrawals, RRIF accounts are non-taxable. Furthermore, immediately transferring the shares to a TFSA does not get around the tax consequences; the amount withdrawn from the RRIF is still added to your income. Also keep in mind that, if your RRIF withdrawal exceeds the mandatory minimum withdrawal requirement for the year, tax will be withheld on the excess amount.

--John Heinzl

Do you have a question for Globe Investor? Send it our way via this form. Questions and answers will be edited for length.

What's up in the days ahead

How smart of an investor were you in 2017? Find out by taking John Heinzl's annual Investor Clinic quiz Saturday in Globe Investor. But before we get to the end of the week, find out what AGF vice-president and portfolio manager Peter Imhof has been buying and selling of late.

Click here to see the Globe Investor earnings and economic news calendar.

More Globe Investor coverage

For more Globe Investor stories, follow us on Twitter @globeinvestor

Click here share your view of our newsletter and give us your suggestions.

Want to subscribe? Click here to sign up or visit The Globe's newsletter page and scroll down to the Globe Investor Newsletter.

Compiled by Gillian Livingston