A humorous look at the companies that caught our eye, for better or worse, this week.

Torstar

TS.B (TSX)

May 2, 2014 close: $8.15

up $1.40 or 20.7% over week

Actual Harlequin Romance titles: Summer with the Millionaire; The Millionaire’s Homecoming; Safe in the Tycoon’s Arms; Swept Away by the Tycoon.

Not that Harlequin readers are obsessed with rich men or anything, but they could have made some cash of their own if they’d invested in Torstar: The shares surged after the company sold its Harlequin division to News Corp. for $455-million, giving the story a happy ending for Torstar shareholders.

TWTR (NYSE)

May 2, 2014 close: $39.02 (U.S.)

down $2.59 or 6.2% over week

Reasons to open a Twitter account:

1) Between Facebook, YouTube and Candy Crush, you aren’t wasting enough time on your smartphone;

2) You’ve been looking for a way to insult people without meeting them face to face, and this seems perfect;

3) The company could really use your business.

Shares of the messaging service plunged after growth in its user base came up short of expectations, sending the stock to its lowest level since its November IPO.

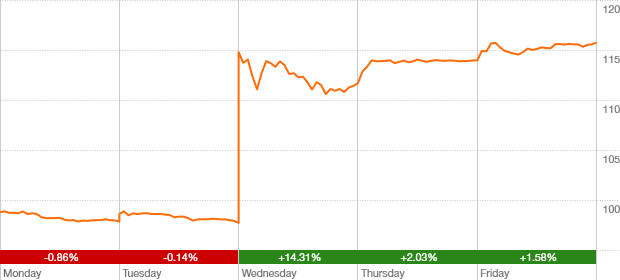

Energizer Holdings

ENR (NYSE)

May 2, 2014 close: $115.76 (U.S.)

up $17.06 or 17.3% over week

If you thought the Energizer Bunny had a lot of get-up-and-go, check out Energizer’s stock. Aiming to unlock shareholder value, the company announced plans to split itself into two publicly traded entities – one focused on household goods including batteries and portable lighting, and the other devoted to personal care items such as razors, shaving gel and feminine care products. After the announcement, the stock kept going, and going and going.

CCL Industries

CCL.B (TSX)

May 2, 2014 close: $107.42

up $9.34 or 9.5% over week

Ever looked at the empty plastic containers, tubes and bottles in your recycling bin and wondered: How can I profit from all this excess packaging? No? Well, maybe you should. Shares of CCL – which makes a wide range of containers and labels for beverages, cosmetics and household products – jumped after quarterly earnings grew 54 per cent, buoyed by acquisitions and a weaker Canadian dollar. Investors can barely contain their excitement.

AutoCanada

ACQ (TSX)

May 2, 2014 close: $71.05

up $7.54 or 11.9% over week

When you buy a new car, the value depreciates as soon as you drive it off the lot. Shares of car dealership operator AutoCanada, on the other hand, have done nothing but appreciate. The country’s largest publicly traded owner of vehicle retailers announced the purchase of eight new stores with revenue of $422-million and said it is pursuing “additional opportunities,” giving the stock that brand new car smell.