A humorous look at the companies that caught our eye, for better or worse, this week

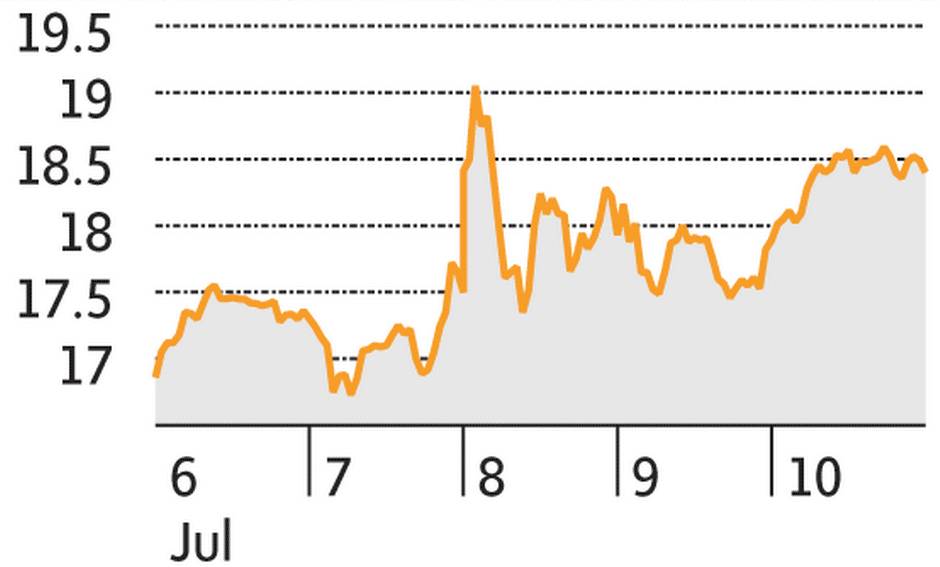

SHANGHAI COMPOSITE INDEX - STAR

How to stop a stock market meltdown in three easy steps: 1) Prohibit major shareholders, executives and directors from selling; 2) Halt trading in 1,300 companies representing nearly half the market; 3) Cut interest rates, offer financial support to brokerages to buy shares and relax rules on margin loans (even though that’s what helped to create the bubble in the first place). Good to see that the free market is alive and well in China.

Shanghai composite, 3,877.8, up 190.88 or 5.2% over week

THE CONTAINER STORE - STAR

The Container Store sells everything you need to restore order to your messy house, from closet organizers and storage bins to shelving units and filing cabinets. This week, investors were the ones who cleaned up: The shares jumped after the retailer posted better-than-expected results for the first quarter and maintained its full-year profit forecast of 30 cents to 38 cents a share. You’ve got to admit that’s pretty neat.

TCS (Nasdaq), $18.40 (U.S.), up $1.37 or 8% over week

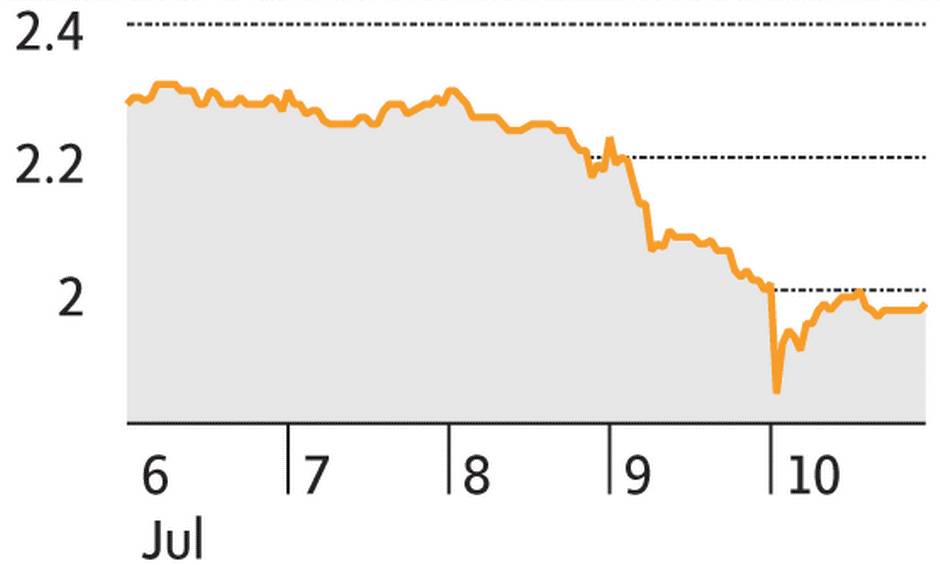

BOMBARDIER - DOG

How many Bombardier shareholders does it take to change a lightbulb? None. They can’t afford a lightbulb. Knock-knock. Who’s there? Needle. Needle who? Needle little money because I lost everything on Bombardier. Why did the Bombardier shareholder cross the road? To get away from the collection agency. With Bomber’s stock hitting a 22-year low after the company hinted at delays for its Global 7000 and 8000 jets, investors could use some levity.

BBD.B (TSX), $1.96, down 35¢ or 15.2% over week

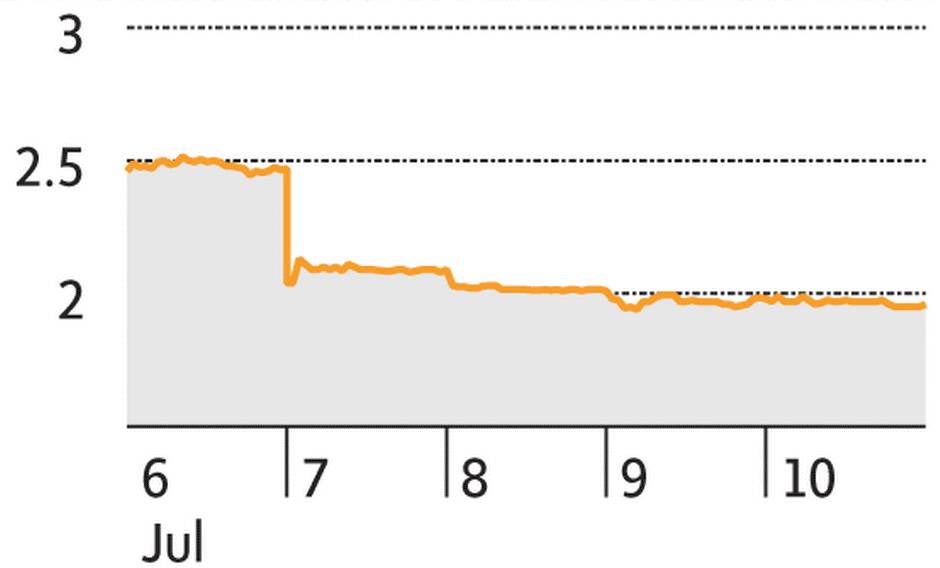

ADVANCED MICRO DEVICES - DOG

“Tell me again about desktop computers, Grandpa.” As the world embraces smartphones and tablets, shares of chip maker AMD – which still gets about half of its revenue from PCs – have been plunging. And they tumbled some more this week after AMD warned that second-quarter sales will be lower than expected. The fact that the company missed earnings estimates in three of the past four quarters should have given investors a clue.

AMD (Nasdaq), $1.96 (U.S.), down 57¢ or 22.5% over week

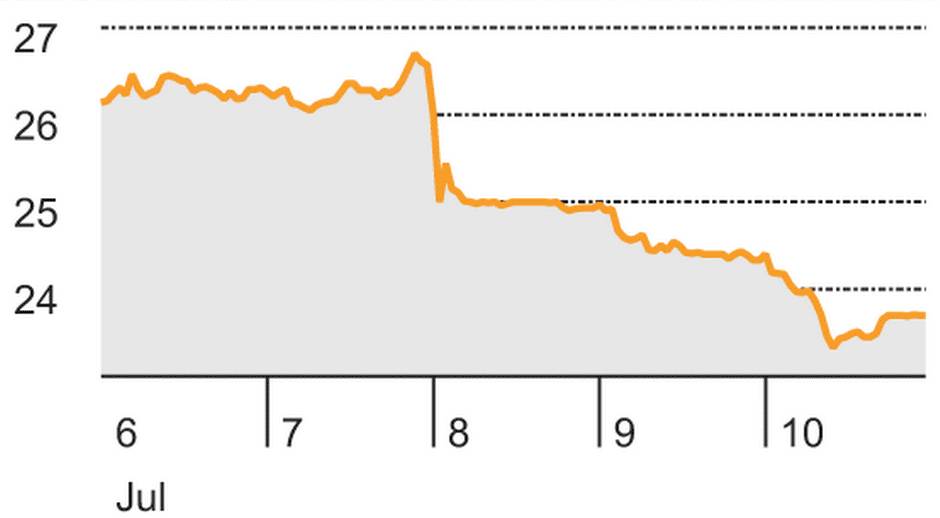

WESTJET AIRLINES - DOG

Poor WestJet. First, several of its planes are grounded by phony bomb threats. Then its stock is grounded by a disappointing second-quarter forecast. Hurt by lower fares and higher capacity, the airline projected that its revenue per available seat mile – a measure of airline profitability – will fall 5.7 per cent in the second quarter, compared with its previous forecast of a “moderate year-over-year decline.” Deploy the landing gear.

WJA (TSX), $23.70, down $2.83 or 10.7% over week