A humorous look at the companies that caught our eye, for better or worse, this week

WAJAX (DOG)

“… below our expectations … further deterioration … increasingly difficult conditions … negative effect. … ” Those are just a few of the uplifting phrases from Wajax’s third-quarter earnings report. Hammered by the slump in energy and mining activity, the distributor of heavy equipment, power systems and industrial components posted a 42-per-cent drop in earnings per share, crushing its stock like a beer can under the wheels of a backhoe loader.

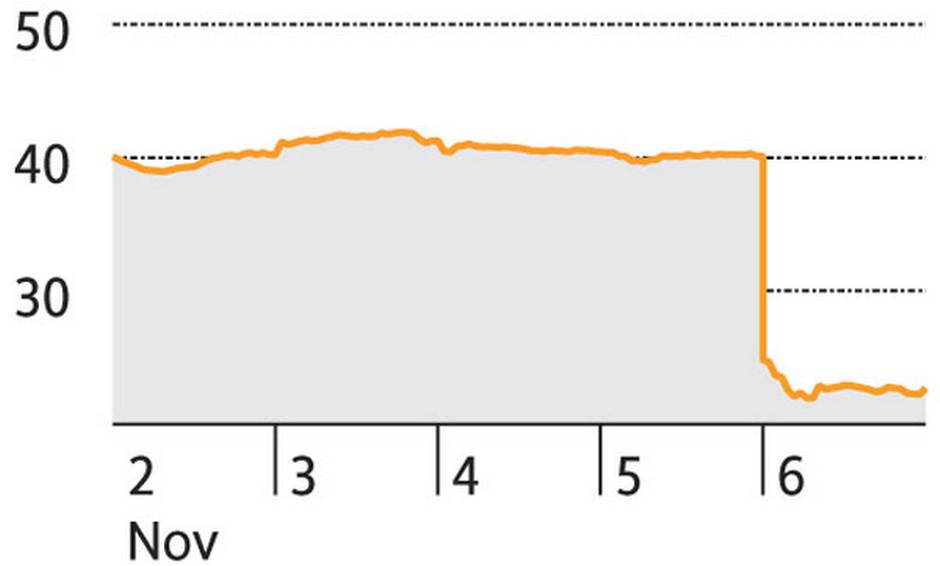

WJX (TSX), $18.99, down $5.00 or 20.8% over week

MEN’S WEARHOUSE (DOG)

Business quiz! Shares of Men’s Wearhouse plummeted after the U.S-based clothing retailer:

a) hired Don Cherry as an adviser for its Moores suit business in Canada;

b) wrote off $1-billion (U.S.) of inventory following a moth infestation at one of its distribution centres;

c) reported a 14.6-per-cent drop in same-store sales at its Jos. A. Bank subsidiary after the chain terminated its popular buy-one-get-three-free promotion.

Answer: c

MW (NYSE), $22.70 (U.S.), down $17.28 or 43.2% over week

RUSSEL METALS (DOG)

You might say Russel Metals’ stock is going down the tubes. Hit by falling sales of tubular and other products to the energy industry, the metals distributor reported a 26-per-cent drop in revenue and 61-per-cent plunge in net income for the fourth quarter. With Russel battling what its CEO called a “collapse in exploration activity and industry-wide oversupply of pipe,” an imminent rebound in stock is probably a pipe dream.

RUS (TSX), $19.26, down $1.14 or 5.6% over week

RETAILMENOT (STAR)

Not fun: Standing in line at the grocery store while the person in front of you hands the cashier 10 different coupons.

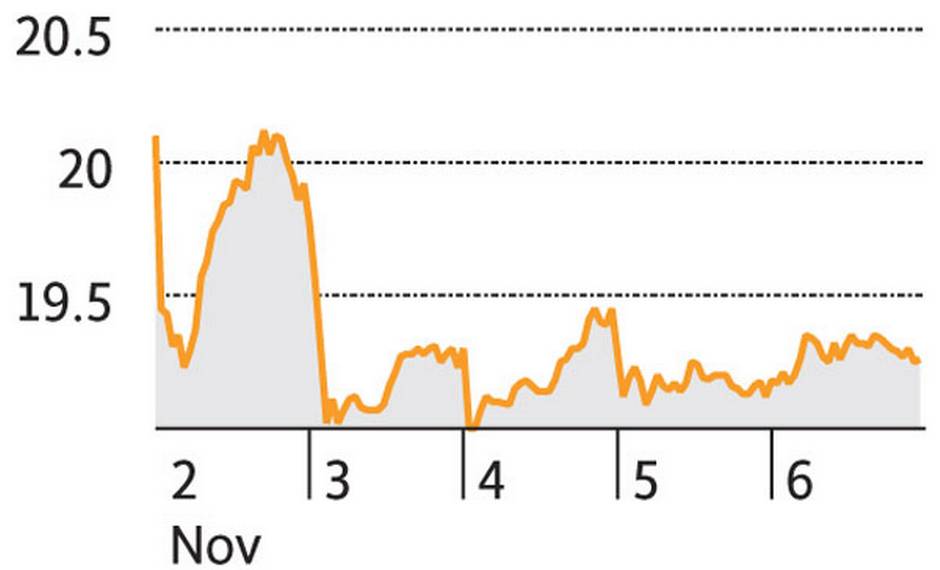

Fun: Owning shares of coupon website operator RetailMeNot. Fuelled by growth in mobile transactions, the company beat analyst estimates for its third-quarter earnings, giving its battered stock a lift. Unfortunately, the shares are still well below their 52-week high of more than $21 (U.S.) – which means investors will be clipping coupons for a while.

SALE (Nasdaq), $10.89 (U.S), up $2.10 or 23.9% over week

TASER INTERNATIONAL (DOG)

Getting hit by a Taser can be dangerous to your health. And investing in Taser can be hazardous to your portfolio. Even as third-quarter revenue rose 13.6 per cent to $50.4-million (U.S.), the maker of Taser stun guns and Axon police cameras said net income plunged 80 per cent to $1.5-million, or just 3 cents a share. With higher research and development, marketing and other costs for its Axon line zapping profits, Taser investors were stunned all right.

TASR (Nasdaq), $20.19 (U.S.), down $3.22 or 13.7% over week