A humorous look at the companies that caught our eye, for better or worse, this week.

PERFORMANCE SPORTS GROUP - DOG

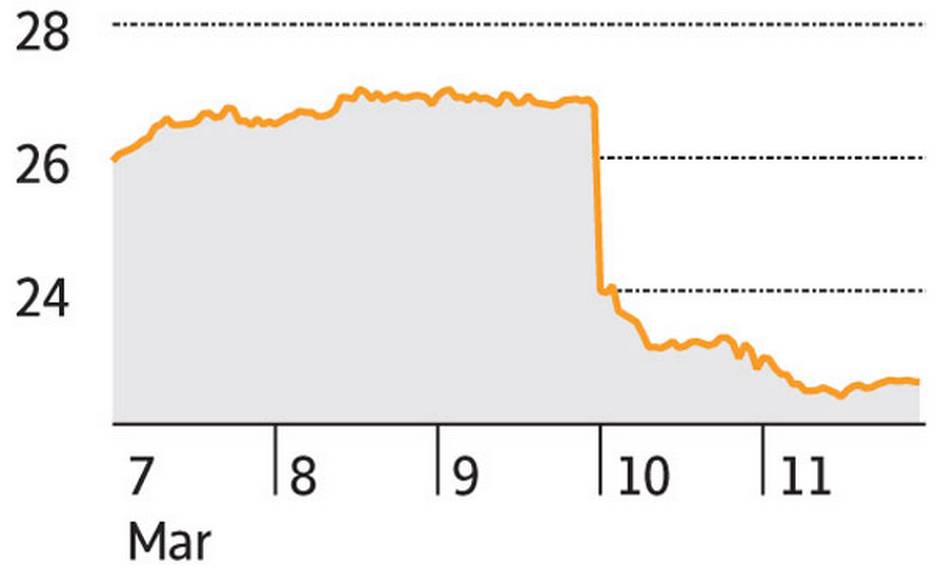

You know when a hockey player loses an edge and goes crashing into the boards? Performance Sports shareholders know the feeling: The maker of hockey, baseball and lacrosse equipment under brands including Bauer and Easton slashed its fiscal 2016 earnings guidance by about 80 per cent, citing the Chapter 11 filing of U.S. retailer Sports Authority and soft sales of baseball and hockey gear. Two minutes for losing so much of investors’ money.

PSG (TSX), $5.62, down $6.07 or 51.9% over week

BLUE BUFFALO PET PRODUCTS - STAR

Great. As if having celebrity chefs and wall-to-wall cooking shows wasn’t irritating enough, now we’re creating a new generation of four-legged food snobs. Blue Buffalo – whose premium pet foods include ingredients such as “garden vegetables,” “whole grains” and “fruit” – posted double-digit gains in sales and adjusted earnings for the fourth quarter and issued 2016 guidance that topped expectations. Rover, do you want the “grain-free lamb and potato” or the “wild salmon, venison and halibut”?

BUFF (Nasdaq), $23.02 (U.S.), up $3.72 or 19.3% over week

EMPIRE CO. - DOG

Selling groceries is a nice, stable business, right? Try telling that to an Empire Co. shareholder. Citing weak sales and heavy promotional activity in Western Canada, the owner of Sobeys posted sales and profit below expectations and took a writedown of more than $1.7-billion on its West business unit, which consists principally of the struggling Safeway chain. Just a wild guess, but Empire might regret acquiring Safeway for $5.8-billion a few years back.

EMP.A (TSX), $22.63, down $3.38 or 13% over week

CRUDE OIL - STAR

Sell oil? No, buy! Buy more! Buy, buy, buy! In a dramatic reversal of investor sentiment, crude oil posted its fourth consecutive weekly advance – its longest winning streak since last May – propelled by strong demand for gasoline and slowing U.S. crude production. With Iran restoring wells at a slower pace than expected and the International Energy Agency declaring that “prices might have bottomed out,” oil bears are getting mauled.

Oil (Nymex) $38.50 (U.S.)/bbl., up $2.58 or 7.2% over week

SHAKE SHACK - DOG

You might say Shake Shack investors are all shook up. Even as fourth-quarter revenue surged 47 per cent thanks to new restaurant openings and rising traffic at existing locations, the premium burger chain forecast 2016 sales growth of 2.5 per cent to 3 per cent at established stores – trailing the 3.1 per cent that analysts were expecting. With Shake Shack’s stock down by nearly two-thirds from its 2015 high as the chain embarks on an aggressive expansion, investors have lost their appetite.

SHAK (NYSE), $34.58 (U.S.), down $7.41 or 17.6% over week