A humorous look at the companies that caught our eye, for better or worse, this week.

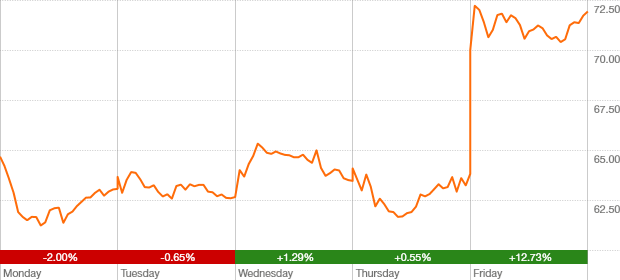

Restoration Hardware

RH (NYSE)

March 28, 2014 close: $71.93 (U.S.)

up $7.58 or 11.8% over week

Whether you’re in the market for a $10,000 Italian leather sectional sofa or a $3,000 reclaimed Russian oak dining table, Restoration Hardware has everything you need to furnish your home in style – for only pennies more than you’d pay at Ikea. Investors aren’t complaining about the hefty price tags: The shares surged after the high-end home furnishings retailer posted better-than-expected results for the fourth quarter and gave a bullish forecast.

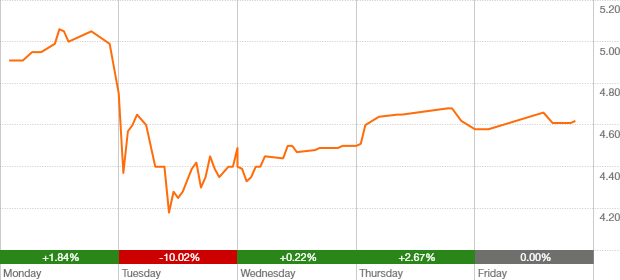

Legumex Walker

LWP (TSX)

March 28, 2014 close: $4.62

down 28 cents or 5.7% over week

Side effects of beans:

1) bloating;

2) gas;

3) financial losses.

Hurt by a rail shortage and startup costs for a canola oil plant in Washington State, the processor and merchandiser of seeds, peas, beans and canola products said its annual loss doubled to $25.4-million in 2013 compared with a year earlier. The company is using trucks to move more product and said there’s relief on the horizon, but it didn’t stop the stock from stinking up the joint.

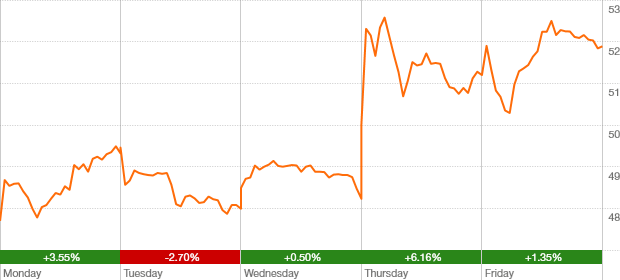

Lululemon Athletica

LULU (Nasdaq)

March 28, 2014 close: $51.89 (U.S.)

up $4.26 or 8.9% over week

Business quiz!

Shares of Lululemon rose this week because:

a) The new line of doggy yoga wear is selling briskly;

b) Warren Buffett disclosed a position in the company and, in a publicity stunt, appeared on CNBC modelling the pants;

c) Helped by strong sales of seasonal items, the company announced better-than-expected fourth-quarter results and said it will accelerate its global expansion.

Answer: c.

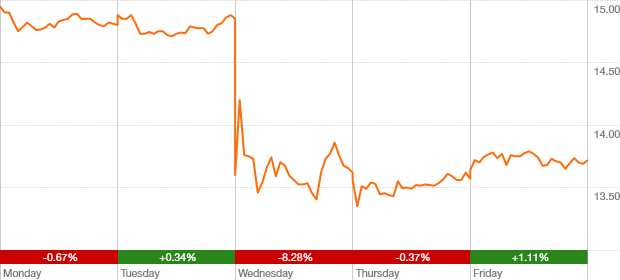

Int'l Game Technology

IGT (NYSE)

March 28, 2014 close: $13.72 (U.S.)

down $1.18 or 7.9% over week

If you play the slots, you’d better be prepared to lose. International Game Technology investors have learned that lesson the hard way: Citing a soft gambling industry, the video slot machine maker slashed its 2014 earnings guidance and said it would lay off 7 per cent of its staff. “We did not expect such a sharp decline in North American gross gaming reviews,” said CEO Patti Hart. Investors are selling their shares and putting their money into something safer – like lottery tickets.

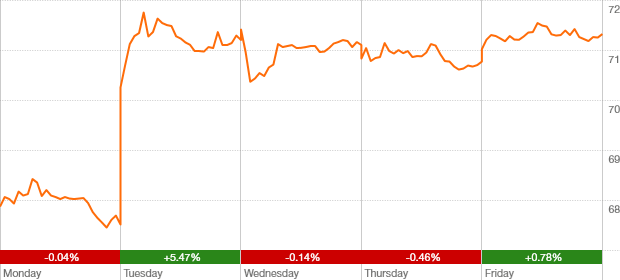

McCormick

MKC (NYSE)

March 28, 2014 close: $71.32 (U.S.)

up $3.78 or 5.6% over week

Want to spice up your portfolio? Try a dash of McCormick. The maker of flavours and spices announced strong growth in first-quarter sales and profits, helped by international expansion, higher marketing spending and new product launches. With the stock near record highs, investors haven’t had this much fun since they tricked mom into inhaling some hot Mexican-style chili powder.