Illustrations by Dom McKenzie for The Globe and Mail

It was a year when drug stocks got drop-kicked, the Mexican peso got pummelled and the world's biggest athletic shoe and apparel maker just didn't do it.

But 2016 also had plenty of, er, high points. Marijuana producers left other stocks in a cloud of smoke, and miners unearthed some big gains after years of losses.

But you didn't have to be an expert stock picker to win big in 2016. Putting all of your money into an index – whether it was the S&P/TSX composite or the Dow Jones industrial average – would have worked out just fine. As easy as it was to make money, however, there were still plenty of ways to screw up, as the Stars and Dogs of 2016 reveal.

Stars

🌟 Teck Resources (TECK.B-T)

A year ago, if you'd told people you were planning to invest in struggling Teck Resources, they would have laughed at you. Then they would have called up their friends to laugh at you some more. Well, who's laughing now? In one of the greatest comebacks for a Canadian stock since, well, since Teck Resources pulled off a similar feat in 2009, the diversified miner made yet another miraculous recovery in 2016 when it was the top-performing stock year-to-date on the S&P/TSX composite index. Lifted by rebounding prices for metallurgical coal – the kind used in steel-making – Teck's beaten-down shares soared nearly tenfold from their January low of $3.65 to their November high of $35.67 before giving back some of those gains. Coal doesn't get all the credit; cost-cutting, debt reduction and improving prices for copper and zinc also gave the shares a lift. Investors are laughing … all the way to the bank. – John Heinzl

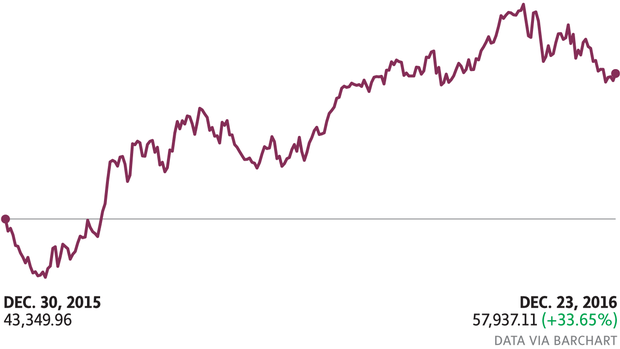

🌟 Dow Jones Industrial Average (DJIA-I)

The real reason U.S. stocks surged to record highs this year? The Clinton Foundation secretly funnelled money from the Saudi royal family into a Swiss bank account controlled by billionaire George Soros, who then hired employees of a pizza restaurant in Washington to execute a series of trades to deliberately drive up the prices of Goldman Sachs, JPMorgan Chase and other Dow stocks. It's so obvious, people! For those who aren't swayed by conspiracy theories, there may be a simpler explanation: The U.S. economy is in good shape, corporate profits are recovering and president-elect Donald Trump is vowing to cut corporate taxes, deregulate industries and invest billions to rebuild infrastructure. Sure, his plan would add to the U.S. government's already massive debt and probably take years to stimulate growth. But when Wall Street wants to party, nothing can stop it – except maybe a Chinese-led plot to unleash North Korean short sellers on the U.S. market in early 2017. You heard it here first. – JH

🌟 Brasil Sao Paulo Stock Exchange Index

An impeached president. The worst recession since the 1930s. A summer Olympics plagued by street crime, pollution and a diving pool that had to be closed after it turned a mysterious shade of green. These are not the sorts of conditions one normally associates with a healthy stock market, yet none of them stopped investors from diving back into Brazilian equities in a big way this year. Enticed by rebounding commodity prices, cheap valuations and hopes that Brazil’s economy – and its political problems – couldn’t possibly get any worse, capital poured back into South America’s largest and most populous country and sent Brazil’s main stock index to its highest levels since 2012. All of which proved the old investing adage that the best time to take the plunge into stocks is when the water looks the least inviting. – JH

🌟 Sleep Country (ZZZ-T)

Money-saving tip: When you're shopping at Sleep Country, lie down on a mattress and pretend to fall asleep. When the salesperson gives you a nudge, "fall" onto the floor as if you are hurt and yell: "Are you going to give me a 50-per-cent discount or do I have to call a personal injury lawyer?" Works every time. If you'd bought Sleep Country's stock earlier this year, on the other hand, you could afford to pay full price. Shares of the mattress retailer surged as revenues and earnings rose, driven by new store openings, growing sales of pillows, linens and other accessories and – of course – the chain's ubiquitous advertising (sing it with me: "Sleep Country Canada, why buy a mattress anywhere else?" Now good luck getting the stupid song out of your head for the rest of the day). With the third quarter marking the 13th consecutive period of higher same-store sales and Sleep Country continuing to expand, shareholders are sleeping like babies – rich babies. – JH

🌟 Nvidia (NVDA-Q)

N-what-ia? Nvidia may not be a household name like its competitor Intel, but if you play video games, own a smartphone or drive a car with an on-screen navigation or entertainment system, chances are you've used one of Nvidia's graphics processing units (GPUs). The top gainer on the S&P 500 by a wide margin this year, Nvidia owes much of its recent success to a new generation of "Pascal" chips that are taking aim at virtual reality games, artificial intelligence, cloud computing and other applications requiring massive processing power. "Our new Pascal GPUs are fully ramped and enjoying great success in gaming, VR, self-driving cars and datacentre AI computing," CEO Jen-Hsung Huang said after Nvidia's third-quarter results crushed estimates – again. With Nvidia's stock hitting record highs all year, there was nothing artificial about the intelligence of investors who saw Nvidia's massive potential. – JH

🌟 S&P/TSX composite index (TSX-I)

Prior to 2016, relative stock market performance offered up plenty to nourish a Canadian inferiority complex. For five calendar years straight, the S&P 500 index had outperformed the S&P/TSX composite index. In 2013, when the Canadian index rose by a respectable 10 per cent, the U.S. counterpart notched a 30-per-cent gain. In 2015, when U.S. stocks declined slightly, Canadian stocks fully corrected. The losing streak finally ended in 2016, and all it took was for the price of oil to double. But the year certainly didn't start out promising. The ongoing collapse in commodity prices had ravaged the resource-heavy Canadian stock market, while China's economic slowdown had stifled risk appetite. But an abrupt reversal in commodity markets sent Canadian stocks on a fairly steady upward trajectory beginning in January, and by the end of the year, the index was closing in on its all-time high of 15,657. That performance was good enough to claim the top spot among all developed markets' major indexes. But far more importantly, we finally beat the Americans. – Tim Shufelt

🌟 Encana (ECA-T)

Once Canada's largest company by market capitalization, Encana spent the following several years steadily destroying its own value. From a pre-financial crisis peak in excess of $50 per share, the company's stock over time declined by 95 per cent to hit an all-time low of $3 in February at the depths of the oil crash. The stock was a victim of global forces exacerbated by some extraordinarily bad timing. With the industry decimated by the financial crisis, the company decided to spin off its oil assets and focus on natural gas. Then oil prices promptly rallied while gas prices tanked. Encana eventually pivoted back into oil assets just in time for the worst crude oil crash in a generation. On the bright side, that long grind downward made for all the more potential upside upon the recovery in oil prices. Since hitting bottom, the stock has more than quadrupled, and occupies the sixth spot among the best stocks in the S&P/TSX composite index this year. – TS

🌟 TMX Group (X-T)

It serves to show how much the Canadian stock market is dominated by resources that the top-performing non-resource stock is itself partly fuelled by the resource rally. Last year at this time, shares of TMX Group, which owns the Toronto Stock Exchange and the TSX Venture Exchange, were bearing the effects of the commodity rout through low trading volumes. Then Nasdaq announced its entry into the Canadian market, causing shares in TMX to end 2015 under considerable selling pressure. But the emerging competitive challenges, including the alternative trading platforms introduced by Aequitas Innovations Inc. last year, have yet to pose a mortal threat to TMX's dominance. Combine that with the resource rally, and continuing cost-cutting, and the year was set up for a significant upswing. Then in November, TMX released third-quarter profits that beat estimates while announcing a dividend increase – the magic words for Canadian investors. That provided the last leg up in what proved to be more than a doubling of its share price. – TS

🌟 Canopy Growth Corp. (CGC-T)

Buy one measly pot stock and pretty soon you could have yourself a nasty habit. Say you bought a small stake in Canopy at the end of last year. By November it would have swelled sixfold, crowding out the duller parts of your portfolio – stocks your parents kept telling you to own, like utilities. They were a drag anyway. Then you buy another pot stock, and another. It's all very innocent at the start. Maybe you start spending a little more on video game and snack stocks than usual. Suddenly, you can't focus at work so well, all you can think about is Canopy's stock chart, checking in on it four, five times a day. Then one night you find yourself in a dank alley, buying a gun stock from a twitchy guy who says you need to diversify. This happened to a friend of mine. – TS

🌟 Caterpillar (CAT-N)

It took all of one day for investors to go from dreading the idea of Donald Trump occupying the White House to humming Hail to the Chief while frantically buying into his agenda. Aside from financials, there is perhaps no greater example of the sudden faith the market has in the Donald's economic platform than in Caterpillar's shares. On day one after the Nov. 8 election, its stock rose by 8 per cent. Within one month, it was up by 15 per cent. To be fair, investors had been bidding on a recovery in heavy equipment well before the election, pushing the stock on a general upward trajectory through the year. But the promise of tax cuts, regulatory reform and a vast infrastructure spending program unleashed the bulls, who lifted Caterpillar to a two-year high. In early December, the company itself attempted to manage expectations, calling analysts' estimates for earnings growth "too optimistic." Investors responded by pushing up the stock a little more. – TS

Dogs

🐶 Valeant (VRX-T)

Side effects of investing in Valeant Pharmaceuticals may include, but are not limited to, staggering financial losses, delayed financial statements, regulatory investigations, repeated guidance reductions, screaming, crying, throwing chairs across the room and generally feeling a pervasive sense of hopelessness and despair. Even as Valeant replaced its CEO and moved to pay down debt and restructure its operations, the stock – once the most valuable on the TSX – kept falling, as did shares of another debt-bloated, growth-by-acquisition Canadian drug maker, Concordia International. As Morgan Stanley's David Risinger, one of the few analysts who had still been recommending Valeant, said in December when he cut the stock to the equivalent of a "hold" rating and slashed his price target: "Our investment thesis that management would stabilize the business and execute accelerated deleveraging via divestitures has been wrong." You don't say. – John Heinzl

🐶 First Solar (FSLR-Q)

There's a lot to like about solar power: It's renewable, affordable and better for the planet than burning fossil fuels. Unfortunately for First Solar shareholders, those virtues don't guarantee that investors will make money. Hurt by plunging prices for solar panels – with cheap Chinese imports the main culprit – the Arizona-based company announced plans to accelerate development of more efficient models to help it compete. The move will lead to layoffs for about one-quarter of its employees, a pretax restructuring charge of $500-million to $700-million (U.S.) and a net loss of $2 to $4 a share in 2016. The largest U.S. solar-equipment maker – it also designs utility-scale power plants – First Solar lost more than half of its value from March to November before recovering some ground in December. Even with the rebound, however, investors are still nursing a nasty sunburn. – JH

🐶 Nike (NKE-N)

Like a sports dynasty that seemingly could do no wrong, Nike came into 2016 with a seven-year stock market-winning streak under its belt. Posting percentage returns well into the double digits for most of those years, the shares seemed as unstoppable as LeBron James going in for a layup. Well, even King James misses once in a while. Faced with growing competition from Adidas – whose casual athletic styles are appealing to a growing number of consumers – and from upstart apparel-maker Under Armour, Nike's already wobbly stock blew out a knee in the fall when future orders missed expectations. If you'd predicted that Nike would be the worst performer on the Dow Jones industrial average in 2016, people would have thought you were nuts. But that's the thing about sports dynasties – they all come to an end eventually. – JH

🐶 DH Corp. (DH-T)

Back when it was called Davis + Henderson, the company now known simply as DH was famous for two things: printing cheques and paying dividends. Unfortunately for investors, it's run into problems with both. Having spent the past several years diversifying into financial-technology solutions for things like lending and payments processing, DH's stock posted double-digit annual returns from 2012 through 2014, only to see the gains almost totally evaporate over the following two years as its cheque-printing business declined faster than expected and banks slowed purchases of new technology. When DH's third-quarter earnings came in well below analyst estimates in October, the shares plunged 43 per cent in a single day. A few weeks later – in a move that should not have surprised anyone – DH slashed its quarterly dividend to 12 cents a share from 32 cents – a drop of 62.5 per cent. Well, it was fun while it lasted. – JH

🐶 British Pound

The Brexit vote may have faded from the headlines – overtaken by an even more shocking vote across the Atlantic Ocean – but if Britain's reeling currency is any indication, the fallout from its decision to leave the European Union may just be getting started. Defying predictions by some that the pound would recover after the initial Brexit shock wore off, the currency instead kept falling. By mid-December it had plunged all the way to $1.24 (U.S.), down nearly 17 per cent from $1.49 immediately before the June 23 referendum sent the currency into spasms. With Prime Minister Theresa May taking a hard line on immigration, investors are worried that trade may fall down the list of priorities when the details of Brexit are ultimately hammered out, potentially making it more difficult for British banks and other firms to do business in the EU. That fear is being reflected in a British pound that keeps on getting, well, pounded. – JH

🐶 BlackBerry (BB-T)

BlackBerry has been an easy and frequent target over the years for short sellers and this column alike. In the years since BlackBerry shares peaked in mid-2008, the stock has been named as a dog in these pages no fewer than three-dozen times. This instalment is no exception. The problem this time around was largely one of timing. BlackBerry's stock ended 2015 on a 60-per-cent run in the calendar year's final quarter after introducing its latest handset. The company followed that with financial results that beat expectations on software and services revenue, setting up a difficult starting point for the stock in 2016. That brought out the shorts, which soon amounted to nearly 20 per cent of the company's float. The short-lived rally ended up paying off for short positions – a refrain far too common for investors on the other side of the BlackBerry trade. Uncertainty surrounding growth in its software business – on which the company's foreseeable future is almost exclusively riding – quickly snuffed out the rally, relegating the stock price to single digits for most of the year. – Tim Shufelt

🐶 TripAdvisor (TRIP-Q)

Fall came early for TripAdvisor shares this year. As 2016 got under way, a global equity sell-off consumed investors over concerns for slowing global growth. Travel stocks, being particularly sensitive to global macroeconomic changes, were hit hard. TripAdvisor, and its contemporaries Priceline and Expedia, were all traded down in the order of 25 to 35 per cent in the first five weeks of the year. As the market frenzy fizzled out and major indexes bottomed, TripAdvisor's competitor stocks rallied. TripAdvisor did not. It started out vulnerable because of a relatively high valuation. Then it disappointed on earnings. Even as online travel spending rose, TripAdvisor lost share to competing alternatives. The fierce competition saw TripAdvisor's marketing costs soar even as profits from hotel bookings declined. – TS

🐶 Chipotle Mexican Grill (CMG-N)

Owning Chipotle shares this year was just as likely to produce a disquieting feeling in the pit of the stomach as scarfing down a large pulled-beef burrito. Since an outbreak of food-borne illnesses tied to lapses in food safety sickened more than 500 of the chain's diners in 2015, Chipotle has made little headway in repairing its reputation. From its peak, the oncetrendy stock has declined by nearly 50 per cent, wiping away about $11-billion (U.S.) in market capitalization. An overhaul of food-safety measures, food giveaways and discounts, and a share-buyback program well in excess of $1-billion have all failed to reverse the losses in restaurant traffic or revive the company's stock. In a kind of union of struggling brands, Bill Ackman, the activist investor fresh off a string of losing bets in Herbalife and Valeant Pharmaceuticals, announced a 10-per-cent stake in Chipotle in September. Badly in need of a big win himself, Mr. Ackman's quest to rescue the burrito chain has yet to find any favour in the market. – TS

🐶 Mexican Peso

Has anyone checked out the peso since Donald Trump won in the biggest election landslide ever in the history of elections? Way down, big trouble, dead! Total loser currency! Sad! Considering how much Mr. Trump targeted Mexico throughout the election campaign, the peso became a proxy for the expected outcome of the election. In two of the three presidential debates, following what were widely considered to be Hillary Clinton wins, the peso responded the day after with big upward moves. Having an incoming president promise to install a vast border wall at your expense and rip up the continent's free-trade deal might be slightly negative for Mexico and its currency, according to the market. Going into election night, the peso, like most other markets, was priced for a Clinton victory. As the opposite result dawned on the markets, the Mexican currency buckled in response to its new reality, falling to a new all-time low against the U.S. dollar in the days after the vote. – TS

🐶 FTSE Milano Italia Borsa

The ghosts of the European debt crisis awoke in Italy this year, as the financial system of the most indebted euro zone country not named Greece came under renewed scrutiny. Stress tests on European banks last summer identified Monte dei Paschi di Siena – the world's oldest bank – in danger of collapsing. By early July, the Italian banks index was down by nearly 60 per cent, dragging the main Italian stock index into a 30-per-cent sell-off over the first half of the year. The fragility of the Italian financial system could even pose a threat to the recovery of the euro zone. Over the past month, talks of a rescue package for Italian banks have mitigated the worst of the equity losses, but that still wasn't enough to save the index from dog territory, in a year when most of the developed world realized decent equity gains. – TS