Getty Images

Time to reassess your risk profile, says award-winning senior portfolio manager Thane Stenner

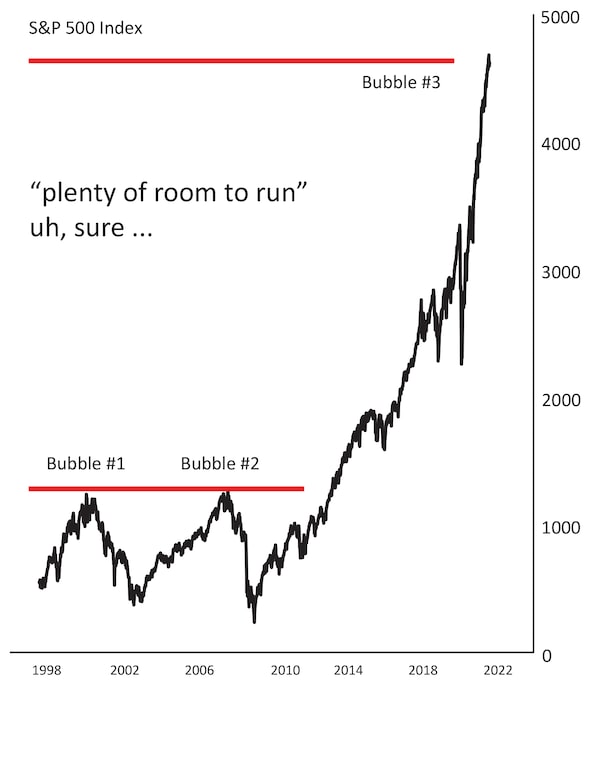

Many investors look at the steep rise in the benchmark S&P 500 over the past decade (see the chart down below) and see hope.

With clients across Canada, veteran money manager Thane Stenner sees something different: “I see a lot of risk,” says the investment advisor with Stenner Wealth Partners+ of Canaccord Genuity Wealth Management.

Thane Stenner, senior portfolio manager, Stenner Wealth Partners+ of Canaccord Genuity Wealth ManagementSUPPLIED

Forget FOMO, or “fear of missing out.” Instead, Mr. Stenner believes investors should have what he calls “FOGO, or fear of getting obliterated,” if their portfolios aren’t positioned for a market drop some forecasters say is coming.

“Valuations are very stretched,” says Mr. Stenner who, with his team, manages assets for 43 clients, each with a net worth of between $25-million and $2.5-billion and investable assets of at least $10-million per household.

As the son of an investment manager, an investor himself since age 11, and a manager of other people’s money for 33 years, Mr. Stenner says he’s never witnessed a market like we’re in today: Stocks are expensive; bonds are expensive; real estate is expensive.

“From the point of view of putting new money to work, this is probably the most challenging period to be navigating,” he says. “There are still a few pockets of opportunities but you have to dig a lot deeper to find them.”

SOURCE: INVESTING.COM AND STENNER WEALTH PARTNERS+ STENNERWEALTHPARTNERS.COMSUPPLIED

His solution: Don’t be afraid to hold more cash than normal, consider shorter-term bonds over long-term ones and invest in sectors that still have reasonable valuations, such as energy and other commodities.

The goal for wealthy investors in particular, Mr. Stenner says, is to preserve capital, while also keeping ahead of rising inflation and taxes.

As an immediate action, he urges investors to reassess the risk in their portfolios and make necessary adjustments to ensure they’re comfortable with what could be a prolonged downturn on the horizon.

“The stress test question is simple, but not easy to do: Assess whether you’d be willing to hold your current investments for the next five to seven years. There could be a significant downdraft in the markets soon and it may take a while for it to come back up in value.”

Thane is the host of “Smart Wealth™ with Thane Stenner’, a podcast produced by BNN Bloomberg Brand Studio. Listen here: https://stennerwealthpartners.com/bnnbloombergpodcasts.

Advertising feature produced by Globe Content Studio with Stenner Wealth Partners+ of Canaccord Genuity. The Globe’s editorial department was not involved.