Hello, and welcome to Green Investing 101, The Globe and Mail’s brand new newsletter course.

This week, it’s me, David Berman. I’m The Globe’s investment reporter and your (very first) guide to green investing this week. Let’s get started.

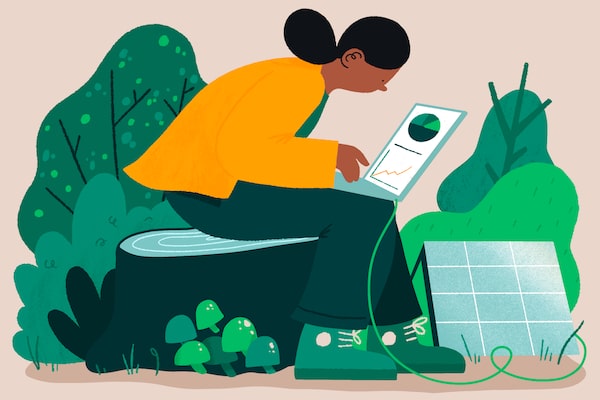

ALLY JAYE REEVES

Green Investing 101: What is green investing?

In this issue, we’ll cover:

- Green Investing 101

- Is green investing a niche?

- Is ethically minded investing growing?

We’ll start with the foundations of green investing: core concepts, the good news about green investing, and what else you need to know to get going.

What is green investing?

In a perfect world, the concept of green investing might not exist. But alas, our world has a few blemishes caused by human activity. Green investing is appealing to those of us who like the idea of putting our money to work in areas that limit environmental harm – or perhaps even nudge things in the right direction (as we’ll cover later in this course).

- That can mean investing in stocks of companies that generate power from wind, or manufacture solar panels, or develop electric vehicles.

Ethical investing isn’t new, although it is gaining traction: For years, ethically minded investors have been selecting stocks based on their views of corporate responsibility, often under a label known as socially responsible investing (or SRI).

Avoiding handgun manufacturers and tobacco companies are central to many SRI approaches, but there are environmental elements at work here too.

Today, green investing is often included with ESG – or environmental, social and governance principles – which is attracting a lot of attention.

The reasons: More people see the ways climate change is affecting the world around them. Another reason: People like us believe we can speak with our wallets and demand positive change through ownership. And a third: There is a belief that some companies can offer a solution to our environmental challenges.

Whatever the reasons, green investing is growing, and asset managers cater to rising demand, especially from younger investors.

- Sustainable funds captured about 25 per cent of investment dollars in U.S. equity and bond mutual funds last year.

- Millennials are the dominant generation within the work force and they also stand to inherit big money from their boomer parents, giving them additional heft – and influence – within investing circles.

Interest in green investing is coming from more than small retail investors, though.

Sophisticated asset management firms and pension funds are also becoming increasingly vocal about sustainability as an essential component to a long-term investing strategy.

Guess who said this: “I believe that the pandemic has presented such an existential crisis – such a stark reminder of our fragility – that it has driven us to confront the global threat of climate change more forcefully and to consider how, like the pandemic, it will alter our lives.”

It was Larry Fink, the chief executive officer of BlackRock (the world’s largest asset manager), who wrote that in an open letter to the world’s CEOs earlier this year.

Zoom out: The world’s largest asset manager also says that climate risk is investment risk, meaning that global warming could damage companies that are exposed to the changing environment or contribute to the problem. Climate risk, Mr. Fink believes, will be reflected in stock prices, contributing to a re-allocation of capital as investors seek safer long-term bets.

Okay, but are green investments delivering strong returns?

Some investors will not see the need for their sustainable investments to beat broad stock market indexes like the S&P 500 or the S&P/TSX Composite Index. Aligning their investments with their values is good enough.

For others, though, strong returns are the driving force here. Why invest in a wind farm if it can’t compete against coal?

- The good news: Some evidence suggests that mutual funds and exchange-traded funds that focus on stocks with high ESG scores are outperforming the broader market, which is encouraging.

The sustainable investing arm of Morgan Stanley found that U.S. sustainable equity funds outperformed traditional peer funds by a median average of 4.3 percentage points in 2020 and 2.8 percentage points in 2019. They also found that sustainable bond funds outperformed their peers in 2020 and 2019.

The less good news: There is no guarantee of success here. While sustainable stocks might enjoy an expanding market for renewable energy and electric vehicles, intense competition can weigh on profitability. As well, the rising popularity of sustainable stocks can drive valuations to – pardon the play on words here – unsustainable levels, leading to concerns about bubbles and volatility.

A case in point: Take a look at the iShares Global Clean Energy ETF.

- It’s a basket of stocks that includes sustainable energy companies ( A/S), wind turbine manufacturers (Vestas Wind Systems A/S) and solar technology developers (SolarEdge Technologies Inc.).

The fund surged 141 per cent in 2020 – but the fund has slumped about 20 per cent in 2021, challenging green investors to stay on board.

The bottom line: Green investing is about aligning your values with your investments. Ideally, this approach should deliver a strong return – but keep in mind that there is no guarantee that an environmentally sound stock will perform well.

Key takeaways

Green investing is becoming a big deal, driven by small investors who want to help drive environmental solutions, and large investors who see a long-term opportunity. If you’re thinking about embracing the theme, remember that all investments come with risk: Green can do well, but it doesn’t come with guarantees.

Here are three key points to remember:

- Green stocks can be a good bet on solutions to global warming.

- It’s at least as risky as typical investing.

- Many companies involved in green energy are enjoying strong growth, as the world pivots to more wind and solar power.

Green investing is a great opportunity, but don’t see it through rose-coloured glasses. There are still the same risks involved, as any other type of investment.

Pop quiz

When was the concept of ESG first coined?

- 1971

- 2000

- 2005

- 2010

Keep going!

This week, flex your research skills with the help of these resources. Here’s your homework:

- Self-directed investing: A beginner’s guide to getting started as a DIY investor.

- If you aren’t already familiar with Investopedia or Market Watch, they are great resources to get more familiar with investing basics and news.

Thanks for reading. If you took action using tips from this newsletter, let us know using #GlobeGreenInvesting on social media or e-mail us with the subject line Green Investing 101. We would love to hear from you.

How green should you get? That’s up for discussion next week.

Pass it on

- If you liked this e-mail, forward it to a friend.

- If you were forwarded this e-mail, sign up for the full course here.

Evergreen investing reading

- A guide to socially responsible investing in Canada, and how to get started.

- As ESG evolves, a ‘more thoughtful’ approach to investing emerges.

- And you can get acquainted with investing content on Globe Investor.

Pop quiz answer: The term ESG was first coined in 2005, in a UN Global Compact report called “Who Cares Wins.”

David Berman

David Berman