Illustration by Erick M. Ramos

Hello,

Welcome back for the second week of the MoneySmart Bootcamp. Let’s dig into how to use money you don’t have yet. I am, of course, talking about borrowing and managing debt.

Naturally, the spend-less-than-you-make principle stands. But for some of life’s biggest expenses – from getting a postsecondary education to buying a house – debt is hard to avoid. And there’s nothing inherently wrong with whipping out a credit card at the check-out either. If you can pay on time and in full when the bill comes, using credit costs you nothing and may even earn you reward points.

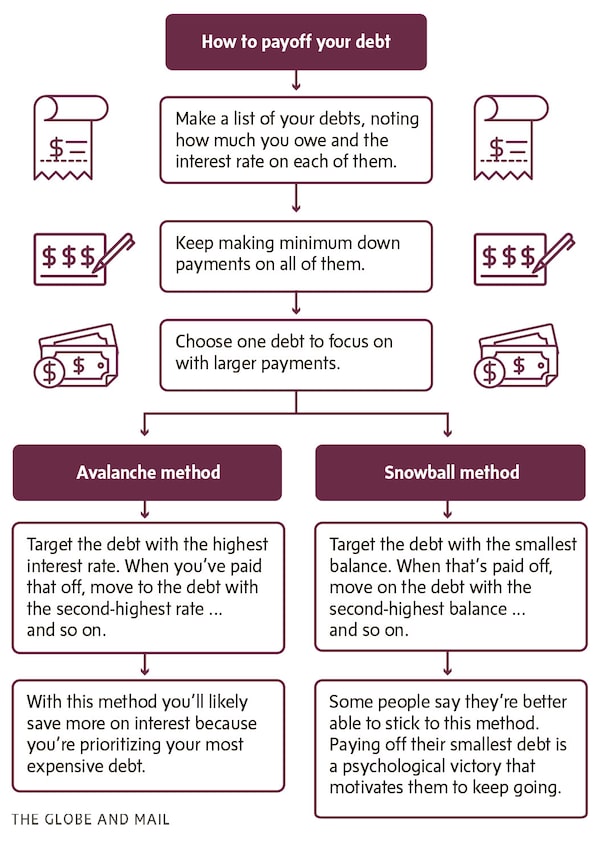

So today’s session isn’t about avoiding debt at all costs. Rather, it’s about becoming a debt connoisseur. Below we’ll go over some basic – and some not-so-basic – debt features everyone should understand. We’ll also look at different approaches to pay down debt. At the bottom you’ll find some try-at-home exercises.

Debt details to look out for

Interest rate: How lenders charge it – and hide it

Interest is, of course, the cost of borrowing. That cost is usually expressed as a percentage of the amount you’re borrowing, which is known as the principal. And that percentage typically indicates the annual interest rate, or what it will cost you to borrow the money over one year. Here’s a quick look at some of the ways in which lenders charge interest:

- Simple interest. Let’s say you’re borrowing $10,000 with a 5 per cent annual interest rate and repaying it all at once after three years. At the end of Year One, you’ll incur $500 in interest. By the end of Year Three you’ll have incurred $1,500 in interest, which is your total cost of borrowing. Student loans and car loans, for example, often charge simple interest.

- Compound interest. Now let’s say you’re borrowing that $10,000 over three years with a 5 per cent interest rate that compounds annually. As in our first example, at the end of Year One, you’ll incur $500 in interest. At the end of Year Two, though, the 5 per cent charge will be based on the principal plus interest from Year One. That’s 5 per cent of $10,500, or $525. And at the end of Year Three your interest charge will be 5 per cent of $11,025 ($10,500 plus $525), which yields $551.25. Think of it as “paying interest on the interest,” or 5 per cent of the accumulated interest of previous periods. Your total cost of borrowing over three years is: $1,576.25 instead of the $1,500 you’d have paid with simple interest. Borrowing can quickly get expensive when you’re paying compound interest, especially if the interest is compounded frequently (more on that below).

- Hidden interest. Here’s a magic trick some lenders pull: They’ll make your interest look lower and apply a variety of fees and charges they’re not calling interest. Do not let them fool you. Look for something called the annual percentage rate (APR), which is a standardized way of calculating the total cost of borrowing every year. The APR will also help you compare different ways of borrowing.

Interest math

Even if you know the APR, how lenders actually calculate interest matters. Take credit cards, for example. In Canada, some charge simple and others compound interest.

With annual interest rates typically around 20 per cent on purchases, your borrowing costs can quickly swell even with simple interest. Here’s a simplified example. Let’s say you make a single purchase for $1,000 with your credit card, on which the interest is calculated annually but charged monthly. Your first interest charge will be $16.70 (that’s that annual interest of $200 divided by 12 months of the year). If you make only the minimum payment – which is usually 3 per cent of the principal or $30 in this case – your balance will dip to $986.70. If you only made minimum payments for a year, over 12 months you’ll pay just under $186 in interest, according to this nifty calculator from the Financial Consumer Agency of Canada, the federal financial consumers watchdog. Click on Summary Report for Option A to see how payments would work out every month if a borrower only made the minimum payment.

But what if your card charged compound interest? The lender will charge you interest not just on any balance owing, but on any unpaid interest as well. This can get especially expensive if your credit card charges interest daily, as many do. For example, the FCAC warns: “A credit card with an APR of 28.8 per cent that is compounded daily has an effective rate of 33.36 per cent.”

Always look beyond the interest rate

There’s more to borrowing than the interest rate you’ll be paying. Here are a few examples of other details to consider:

Repayment length. All else being equal, the longer your loan term, the lower your installment payments will be. The flip side of that is you’ll be paying interest for longer, with a higher overall cost of borrowing.

- Warning: Watch out for long loan terms, especially when buying a vehicle, which will quickly lose value after you drive it off the lot. More on that here.

Prepayment privileges. Can you pay off a chunk of your debt ahead of schedule? That would save you a lot of interest but also deprive your lender of part of the expected return on the loan. Your loan contract will say whether, and how much, you can pay early without penalties.

- Warning: When it comes to mortgages, so-called prepayment penalties can vary significantly based on what kind of interest rate you have and whether you’re borrowing from a big bank.

Flexibility. Credit cards and lines of credit allow you to borrow only what you need and free up room to borrow more, up to a set limit, as you repay what you owe. This can come in handy when you don’t know exactly how much money you’ll need, as when you’re using a student line of credit to help pay for your living costs while in school.

- Warning: This flexibility can also be a psychological trap because you’re allowed to make minimum payments – which sometimes amount to the interest charge alone. With no set schedule to pay off what you owe and the ability to keep tapping your credit, both credit cards and lines of credit can turn into a slippery slope of unmanageable debt.

Perks. If you’re a student, borrowing from the government typically comes with perks. For example, you can usually claim a portion of the interest on your student loans on your tax return. And if you hit a financial rough patch, the Repayment Assistance Plan will allow you to reduce or temporarily pause payments.

- Warning: If you consolidate your government student loans into a line of credit, you’ll lose access to the tax perks and repayment assistance.

Picture this

Try this at home

- Check out your credit card agreement: How is the interest calculated?

- Should you pay down debt first or invest any extra money instead? It’s time to crunch the numbers (but keep in mind, as you use the calculator, that investment returns often aren’t guaranteed).

- If you have a mortgage, check the contract with your lender. What does it say about prepayment privileges? Curious how your mortgage payments might change based on payment frequency, amortization or term? Use our mortgage calculator.

- POWER-UP MOVE: If you have an outstanding balance on your credit card, use the FCAC credit card payment calculator to see how much faster you’d be paying off your debt if you bumped up your payments by just $10.

UP NEXT: How to invest and make compound interest work for you.

If you like this newsletter course, you might also like Stress Test, The Globe’s award-winning personal finance podcast for Gen Z and millennials. Listen for free wherever you get your podcasts.

Erica Alini

Erica Alini