From left to right: Kim Shannon, president of Toronto-based Sionna Investment Managers; Laura Rittenhouse, financial author and analyst; Warren Buffett; and Barbara Ann Bernard, founder of Wincrest Capital.JFackler/Handout

When Kim Shannon, founder of Toronto-based Sionna Investment Managers, helped set up a female-led value investing conference in Omaha, Neb., it was a struggle just to get attention and secure sponsors.

Then Warren Buffett showed up.

“Within the first few minutes of the conference starting, he became our keynote speaker,” Ms. Shannon said. “It was a cause that he wanted to lend some support to.”

While the gender gap has narrowed significantly in other professions such as law and medicine, asset management is still utterly dominated by men.

Roughly 90 per cent of U.S. and Canadian fund managers are male, while female-led fund firms account for less than 1 per cent of total assets under management.

Doubling the latter figure is the goal of the Variant Perspectives conference, which is intended to be an annual gathering. The first conference took place two weeks ago against the backdrop of the Berkshire Hathaway shareholders meeting, which has come to be known as “Woodstock for Capitalists.”

“A 2-per-cent target for assets under female management doesn’t seem outlandish from an equity of opportunity perspective,” Ms. Shannon said.

And yet, reaching that target will be no small feat, she acknowledges. The asset-management industry does not seem to be making any progress in attracting, cultivating and supporting female talent.

By contrast, female physicians accounted for 41 per cent of the Canadian total in 2017, according to the Canadian Institute for Health Information. And about 44 per cent of Canadian lawyers are female, according to data from the Federation of Law Societies of Canada.

“There really isn’t much of a market for women here,” said Ms. Shannon, who runs the largest female-led asset-management firm in Canada with just shy of $5-billion in assets.

There’s no evidence that a lack of performance can explain the gender gap.

A recent study conducted on behalf of the Knight Foundation found no statistical underperformance by “diverse-owned firms,” which it defined as those with at least 25-per-cent ownership by women or minorities.

A recent Morningstar report examined mutual fund returns between 2003 and 2017, and reached a similar conclusion, that “men and women deliver equally competitive fund performance.”

“Despite the fact that they are just as good at generating returns for their investors, female managers see significantly lower inflows into their funds,” wrote Josh Lerner, Harvard Business School professor and lead author of the Knight Foundation report.

“Experimental evidence suggests that implicit bias on the part of investors may partially explain the reluctance to invest with female-managed mutual funds.”

Mr. Buffett agreed with that preponderance of evidence at the Variant Perspectives conference. “The stock doesn’t know who owns you,” he said. “It’s not going to do anything different because female eyes are looking at it.”

His impromptu appearance helped draw attention to the conference, Ms. Shannon said, and the group now has plans to expand to Toronto, New York and London next year.

But there are also things that individual asset-management firms can do to get more women involved, she said.

While the industry in general tends to lean toward more experienced hires, Ms. Shannon said she prefers to recruit entry-level candidates straight out of school, and guide them into more senior roles within the firm over time.

“It's important for young women to actually see women in finance,” she said. “You see men in all kinds of interesting roles, and women have to triangulate – ‘I could be a feminine version of him.' It's not quite the same.”

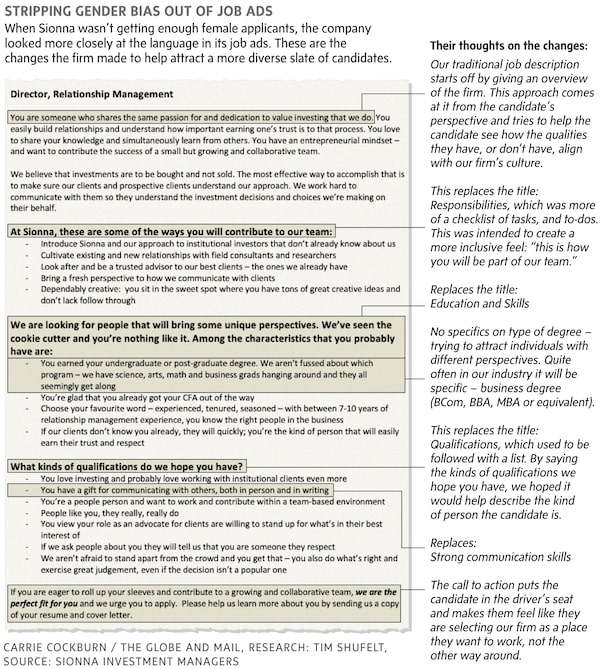

When Sionna wasn’t getting enough female applicants, the company looked more closely at the language in its job ads.

“Some terms appeal more to men,” said Kelly Battle, Sionna’s vice-president of relationship management. As an example, an ad for an analyst job might ask for something like a “numbers ninja,” Ms. Battle said.

Services such as Textio suggest changes in wording to make job ads gender-neutral, which can attract a broader pool of candidates and which tend to fill faster, the company said on its website.

Additionally, female applicants tend to assume a strict adherence to the preferred qualifications listed in a job ad, Ms. Battle said. “Women are less inclined to apply for the job if you don’t check every single box, whereas men will often be more inclined to just try anyway.”

Stripping gender bias out of job ads.The Globe and Mail

Tim Shufelt

Tim Shufelt