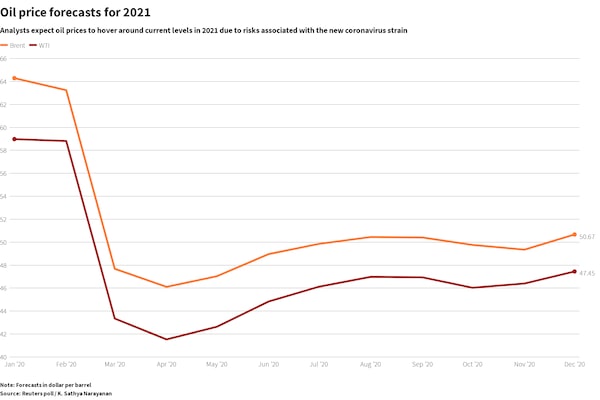

Oil prices are unlikely to mount much of a recovery in 2021 as a new coronavirus variant and related travel restrictions threaten already weakened fuel demand, a Reuters poll showed on Thursday.

The poll of 39 economists and analysts conducted in the second half of December forecast Brent crude prices would average US$50.67 a barrel next year.

That is up from a poll last month that forecast a 2021 average price of US$49.35 a barrel but little changed from Brent trading at around US$51 on Thursday. [O/R]

West Texas Intermediate U.S. crude futures are expected to average US$47.45 a barrel in 2021, the poll showed.

That, too, is up from a November consensus of US$46.40 a barrel but little changed from Thursday WTI trading near US$48.

Reuters

A new variant of the novel coronavirus detected in Britain this month raises the risk of renewed restrictions and stay-at-home orders, which along with a phased rollout of vaccines might restrict further price gains.

Oil demand recovery will depend on the pace of deployment of the vaccines being developed to combat the virus, analysts said, with some expecting no return to prepandemic levels before late 2022 or 2023.

“New virus strains might complicate the outlook and lead to harsher lockdowns that will cripple the crude demand outlook for the first quarter,” Edward Moya, senior market analyst at Oanda, said.

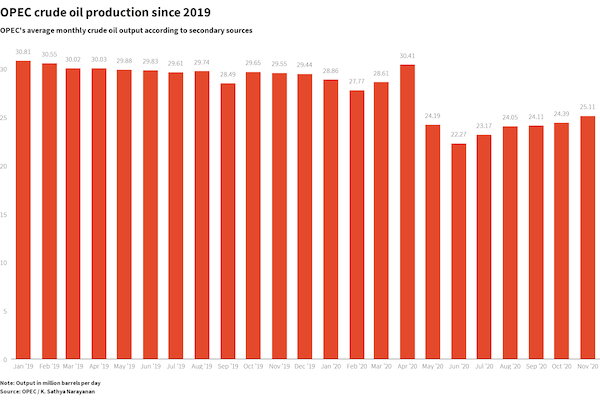

“Additional lockdown measures and the careful OPEC+ dance of raising output will be the focal point for the first half of the year.”

OPEC producers and allies including Russia, or OPEC+, have agreed to loosen their output cuts by 500,000 barrels a day from January.

OPEC+ is scheduled to meet on Jan. 4 to discuss policy, including a possible additional loosening of 500,000 b/d in February.

“If OPEC+ loosens the production cuts too quickly, there is a threat of a price setback. But if it is too cautious (and prices rise significantly), a rift could arise and U.S. shale oil production could rise again,” Commerzbank analyst Carsten Fritsch said.

Reuters

Brent and WTI futures are down more than 20 per cent this year, although Brent has more than tripled since April, when it hit a more than 20-year low of US$15.98 a barrel.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.