Devon Energy Stock With Its 8.8% Dividend Yield Could Keep Rising

Devon Energy Corp (DVN) pays out a huge quarterly dividend in both a fixed amount of 18 cents per share. and a variable portion, or $1.37 (total $1.55 per share). As a result, at $70.34 on Friday, Sept. 2, DVN stock has an annualized dividend yield of 8.81% (based on an annualized rate of $6.20 per share). This high yield could potentially push the stock even higher. We will look at this possibility in this article.

In fact, DVN has risen over 14% since Aug. 1 when it closed at $61.57, which is also when the company announced its dividend and earnings with detailed free cash flow results.

As a result, the company effectively increased its quarterly dividend by 22% from $1.27 to $1.55. On an annualized basis, that works out to an increase from $5.08 to $6.20. But this assumes that the quarterly variable dividend will stay at these levels. Will that happen? This article will explore this issue.

The Variable Dividend Calculation

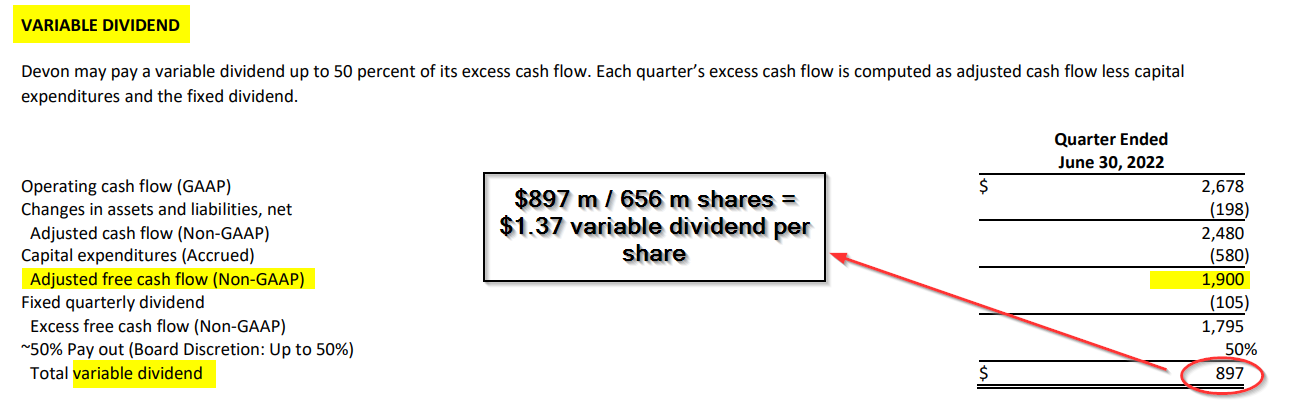

Most of the $1.55 quarterly dividend comes from $1.37 per share, calculated as 50% of it excess adjusted free cash flow (FCF). If this dividend stays level over the next year the stock will have an 8.8% dividend yield.

In fact, the fixed dividend of 18 cents quarterly or 72 cents annually (up 12.5% from 16 cents last quarter, or 64 cents annually) provides a solid base dividend yield of 1.02% (i.e., $0.18/$70.34). Given that last quarter, the fixed dividend was 16 cents and based on 656 million shares outstanding, the variable dividend expense in Q2 was $105 million

The variable dividend of $1.37 was derived from 50% of $1.90 billion in adjusted FCF, after deducting the $105 million from the prior quarter's fixed dividend expense. This can be seen in the table below.

This $897 million in adj. FCF is then divided by 656 million shares outstanding to derive the $1.37 per share variable dividend.

As you may recall, last quarter I wrote a Barchart article on June 24 showing how the Q1 Devon Energy variable dividend was calculated. The table I used in that prior article shows that the adj. FCF in Q1 was $1.436 billion. So now, this quarter ending June 30, adj. FCF rose by over 32.3% to $1.9 billion.

Where does this leave the variable dividend going forward?

Outlook for the Variable Dividend

Devon Energy provided a separate guidance data sheet for Q3 including a 4% increase in oil and gas production based on activity and working interest levels. In addition, it gave an overall 2022 outlook guidance update in its earnings press release.

Based on the fact that we know that Q3 has had lower oil and gas prices than Q2, we can expect to see a decline in adjusted FCF as well as a decline in the variable dividend.

For example, on page 8 of the supplemental data provided by Devon, we can see that the company averaged between $104 and 109 per barrel before cash settlements in Q2. This is much higher than the prices so far in Q3.

So, in order to be conservative, let's assume that the company produces adj. FCF is comparable to Q1, or $1.436 billion. After deducting $118 million in fixed dividends (i.e., 18 cents x 656 million shares), the excess FCF could be $1.318 billion. And taking 50% of that number and dividing it by 635 million shares (i.e., assuming a 2% reduction due to buybacks), the quarterly variable dividend could end up at $1.04 per share. That is 24% below the $1.37 Q2 quarterly dividend and even below the $1.11 Q1 variable dividend.

Where This Leaves DVN Stock

So the Q3 quarterly dividend would be 18 cents fixed plus a $1.04 variable dividend, or $1.22 annually. This is 21% below the Q2 $1.55 total dividend rate and 4% below the $1.27 Q1 total dividend. Nevertheless, it still gives DVN stock an annualized yield of 6.93% (i.e., $4.88/$70.34). This is still a very high yield.

Moreover, it seems sustainable at these oil and gas prices. In addition, this is well over the 3.25% average annual yield over the last 4 years, according to Seeking Alpha. In fact, Morningstar says the average yield in the last 12 months has been 5.12%.

At this rate, the $4.88 forecast dividend rate results in a target price of $95.31 per share (i.e., $4.88/0.0512 = $95.31). As a result, investors might expect to still see a 35% gain in DVN stock from its price today of $70.34 (Sept. 2).

More Stock Market News from Barchart