Is a Stable Long Bond and TLT on the Horizon?

A bond is a debt security. Borrowers issue bonds to raise money from investors willing to lend them money for a return or interest rate. Government bonds are the safest debt securities as a government’s full faith and credit stand behind the debt. Most market participants believe government bonds carry no risk when held to maturity. While some could debate the risk characteristic, when bond prices move higher or lower, it impacts the mark-to-market value of bonds in portfolios. The trajectory of U.S. rate hikes and the Fed’s quantitative tightening program has caused bond prices to move lower, in a bearish trend since March 2020.

In mid-January 2023, I wrote about U.S. government long bonds on Barchart. At that time, the nearby June U.S. 30-Year Treasury bond futures were at the 131-29 level. I wrote:

The U.S. 30-Year Treasury Bond futures is a benchmark that tends to be a safe harbor during market storms but remains in a long-term bearish trend. Rising U.S. short-term interest rates and QT will keep upside pressure on interest rates and downside pressure on the long bond. Until the landscape changes, rallies in the long bond futures market could continue to be selling opportunities.

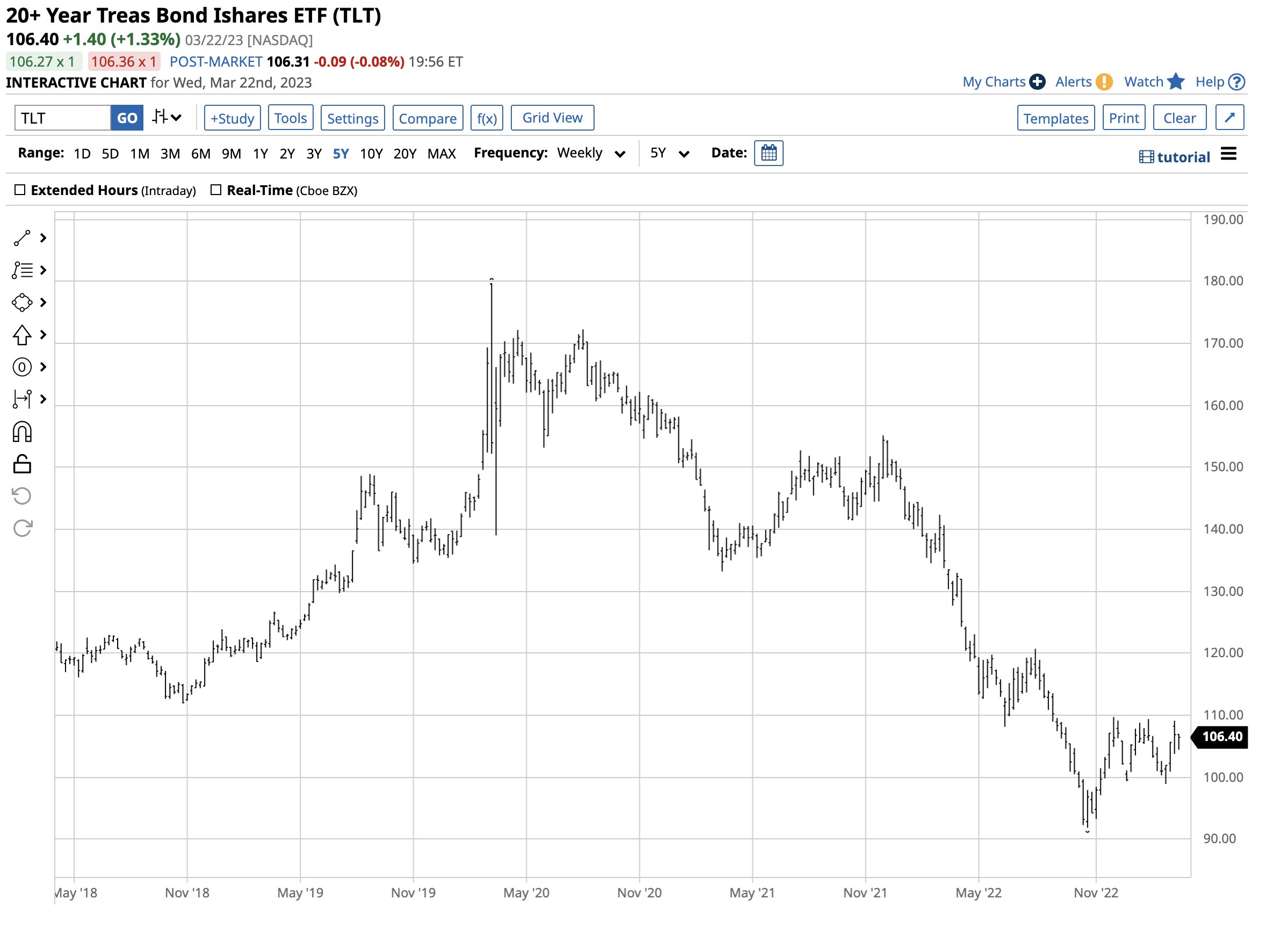

The rise to over 132 in early February was a selling opportunity, but bonds found a higher low and rallied, with the long bond futures sitting above the 131 level on March 22. The iShares 20+ Year Treasury ETF product (TLT) follows long-dated U.S. bond prices higher and lower.

The Fed’s commitment to fighting inflation

With nagging inflation at the highest level in four decades, the U.S. central bank remains committed to battling the economic condition with tight monetary policy. Quantitative tightening at $95 billion monthly continues to tighten credit further out along the yield curve. The Fed increased the short-term Fed Funds Rate by 25 basis points at this week’s FOMC meeting, pushing the rate to 4.75% and 5.00%, despite the recent bank failures.

The lag between rate hikes and economic impact

Meanwhile, the Fed has slowed its trajectory of rate hikes in 2023, with only two 25 basis point increases. The aggressive 2022 increases are still filtering through the economy, and the Fed has cautioned that the tight monetary policy takes time to impact the overall economy.

The central bank expects unemployment to rise and economic growth to slow, pushing inflation lower. While the rate hikes significantly impact the economy’s demand side, the supply side is another story. The ongoing war in Ukraine and the bifurcation of the world’s nuclear powers impact trade and logistics, with supply-side economic consequences. Therefore, the geopolitical landscape has created issues beyond monetary policy’s reach.

The rate hike trajectory has had consequences

Over the past weeks, we have seen some of the consequences of the steep trajectory of rate hikes over the past year. One year ago, U.S. rates were a zero percent before the first Fed Funds rate hike and the quantitative tightening program. The increase to 5% was a shock to the system. The recent Silicon Valley Bank and Signature Bank bankruptcies, and UBS’s forced takeover of Credit Suisse, were partly caused by the rising rate environment and the trajectory of increases. While poor management and regulation may have played a role, banks that used deposit bases to invest in “risk-free” government debt securities found themselves in trouble when on-demand depositors rushed to withdraw funds. While government debt securities may be risk-free when held to maturity, rising interest rates cause a bond portfolio’s mark-to-market value to drop, creating losses if liquidated early. The bank’s matchbook or matching a percentage of deposits with longer-term debt security purchases was one cause of the bankruptcies. The Fed and other central and leading commercial banks rescued smaller financial institutions facing liquidity issues. With pressure from the Swiss National Bank to purchase Credit Suisse, preventing a disastrous bankruptcy with systemic ramifications.

The bottom line is battling inflation with tight monetary policies has come at a price in the U.S. and global financial system. Moreover, individual consumers that continue to suffer from rising prices caused by inflation also face the rising potential of job losses and a housing market that is out of reach because of high mortgage rates. A conventional 30-Year fixed-rate mortgage under 3% in late 2021 is now at the 7% level, excluding many potential buyers from ownership.

The bearish trend has run out of steam

The recent banking issues that threaten a crisis have caused the bearish trend in bonds to pause.

The U.S. 30-Year Treasury bond futures chart shows a pattern of lower highs and lower lows from March 2020 through the late October 2022 117-19 low, the lowest level since February 2011. The long bond futures have bounced from the October 2022 low and were sitting and consolidating around the 131-16 level on March 22.

The chart of the iShares 20+ Year Treasury Bond ETF (TLT) displays the same bearish pattern from March 2020 through late October 2022 that took TLT to a $91.85 low, the lowest level since April 2011. Since the late 2022 low, TLT has also stabilized, with the shares trading around the $106.40 level on March 22.

Consolidation could be the best bet in the current environment unless there is a default

Three factors favor stable to higher prices for the U.S. long bond and the TLT ETF:

- The recent bank failures increase the odds of a global recession or worse. Investors and traders tend to flock to the safety of the bond market during market turmoil.

- Interest rates at the highest level in years will likely cause investors to choose fixed-income assets over stocks for portfolios. The 60-40 stock-bond ratio will likely shift towards bonds in the higher interest rate environment.

- The geopolitical landscape with the ongoing war in Ukraine and tensions between Washington and Beijing/Moscow increases the potential for hostilities that could make investors seek safety in the bond market.

Meanwhile, the most significant risk that could undermine a stable bond market at the current lower levels would be a U.S. default caused by the rift between the slim Republican majority in the House of Representatives and the administration over the debt ceiling. Without an agreement, the U.S. could default, which would cause a credit downgrade, undermining the full faith and credit in the U.S. government, which issues debt securities and the dollar, the world’s reserve currency over the coming weeks and months.

The bear market in U.S. bonds and the TLT ETF reached a low in late October 2022. The events over the coming weeks and months will determine if the current consolidation is a gateway to lower lows or if the market will stabilize and eventually break higher into a bullish trend. The $120 level in TLT is critical technical resistance, with 145-31 as the upside level to watch in the U.S. long bond futures. In late March 2023, the odds favor continuing the sideways price action barring unforeseen financial or geopolitical events.

More Interest Rate News from Barchart

- Stocks Fall as Powell and Yellen Disappoint

- What do you call a group of Black Swans?

- What's Up at the US Fed?

- Fed Walks a Tightrope on Today’s Policy Decision

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.