TSX Utilities Capped Index(TTUT)INDEX/TSX

Prospect Capital's Monthly Pay 9.8% Yield Is Attracting Value Investors

Prospect Capital Corp. (PSEC) pays a monthly dividend that yields almost 10% annually. The steady 6 cents per month dividend from this business development company (BDC) is attracting interest from value investors.

For example, at today's price of $7.32 per share the annual 72 cents dividend payment provides a 9.83% annual yield to shareholders.

Business Development Companies (BDCs)

BDCs like Prospect Capital can provide this high level of income to shareholders since they invest in corporate loans. These are high-yield securities such as mezzanine finance debt, leveraged buyouts, growth debt capital raises from companies, recapitalization, and other types of uses of debt by middle market companies. In effect, Prospect Capital acts as a sort of bank, except without all the regulation and capital limitations.

However, BDCs are required to pay out 90% of their income to shareholders just like REITs (real estate investment trusts). This is what BDCs have to do in order to maintain their tax-free corporate status.

Prospect Capital's Prospects

Analysts project that PSEC, one of the largest and well-funded BDCs out there, will make 83 cents per share in earnings for the year ending June 2023. This gives the dividend a margin of safety since at 72 cents it is less than 87% of the projected 83 cents in earnings per share (EPS). In fact, as of August, its underlying portfolio yields 8.7% across all its investments.

Moreover, even if earnings fall this year, the BDC could still pay out more than its EPS for a short time by taking on debt. That helps investors in PSEC stock have some comfort that the monthly dividend, which has been 6 cents per month since August 2017 (5 years), will stay level.

In addition, Prospect Capital now has a tangible book value of $10.48 per share, as of June 30. This implies that PSEC stock, at $7.32, trades for just 70% of its tangible book value per share. This gives the stock a good margin of safety.

What Are The Risks with PSEC Stock?

That does not mean that the stock could fall and that the company might be forced to cut the dividend. This could easily happen if the US economy enters into a deep recession. The stock market seems to be worried about this lately.

In this case, a number of the corporate debt holdings at Prospect Capital could fail to make their interest payments. That would lower the company's effective portfolio yield. The company would have to make writedowns and also lower its payments to shareholders.

However, the company does have reserves and it also could take on debt or even equity to maintain the dividend. It might be willing to do this if the board felt the downturn was not likely to last long.

Investors can partially protect against this by selling covered calls on their holdings.

Covered Call Income Plays

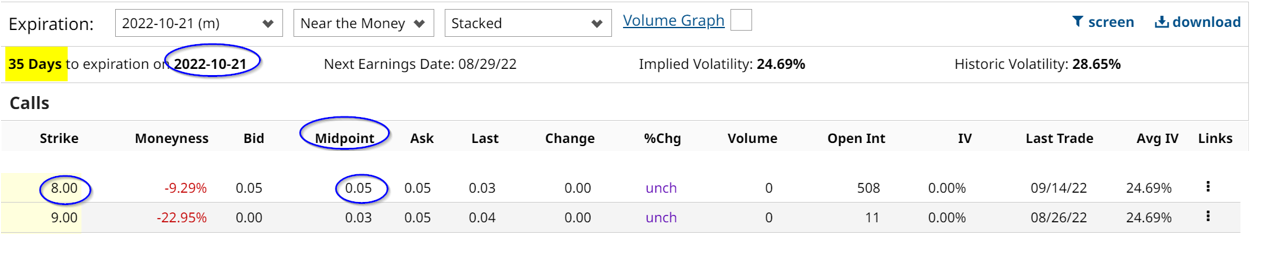

The table from Barchart below shows that the $8.00 call strike price for October 21 provides a covered call investor a 5-cent premium.

Here is what that means. If an investor were to purchase 100 shares at $7.32 for $732, and then sells one call option contract at $8.00 for Oct. 21, his account would immediately receive $5.00. Or with 1,000 shares purchased for $7,320, the investor could sell 10 contracts and receive $50.

This works out to an extra 0.683% in income for the month (i.e., $50/$7,320). If this is repeated over 12 months the return is 8.2% (0.68% x 12 = 8.2%). And that is on top of the 9.83% annual yield the covered call investor could make holding the underlying shares. And even if PSEC rises to $8.00 or higher by Oct. 21, the investor would make an additional 9.3% capital gain (i.e., $8.00/$7.32-1 = 9.3%).

For those investors more risk averse, they could sell the $9.00 strike price for 3 cents and make an additional 0.41%, or 4.91% annually. Either way the investor can use this play to hedge against a potential drop in the stock price.