The COVID-19 pandemic was a disruptive economic shock unlike anything seen in a generation. It was more difficult than a run-of-the-mill crisis, because its impact couldn't be blunted with financial firepower alone -- it restricted the free movement of people, which made it incredibly hard for companies to conduct everyday operations.

But in many cases, technology came to the rescue. There was a cohort of "pandemic stocks" that benefited from the situation as their innovative solutions kept the economic wheels turning. DocuSign (NASDAQ: DOCU) was one of them -- its suite of digital tools transformed from a luxury to a necessity for many organizations.

As in-person business continues to pick back up, DocuSign is facing an abrupt slowdown in growth and a stock price that has declined 80% from its all-time high.

It's still a leading innovator

DocuSign is best known for pioneering digital signature technology, but that one-dimensional business model is long in the past thanks to the company's aggressive investment in innovation. It now offers customers a full suite of digital document tools designed to help assess, negotiate, and close deals in real time, even if the parties are on opposite sides of the world.

The DocuSign Agreement Cloud is the company's flagship platform. This cloud technology allows customers to access DocuSign from anywhere, and it's the driving force behind the collaborative features in digital documents. Parties can view the same document and leave comments and suggested amendments in real time without sending a single piece of paper back and forth.

Customers can also leverage the power of artificial intelligence (AI) with DocuSign Insight, which can analyze a document and flag potential risks based on problematic clauses, or even opportunities. The technology isn't quite ready to replace actual lawyers, but it's a potential cost saver for companies that deal with a high volume of contracts. And over time, tools like AI will only develop greater capabilities.

There are multiple use cases for the Agreement Cloud, whether it's for an organization's human resources department, its sales force, or even its legal team. DocuSign says it now serves 16 different industries, from healthcare to manufacturing, which highlights its adaptability.

Times are changing (back)

Despite all of DocuSign's efforts to expand, it's struggling to maintain its momentum as operating conditions normalize for most companies. Employees are returning to their offices, and business leaders are hopping on planes and traveling again to in-person meetings.

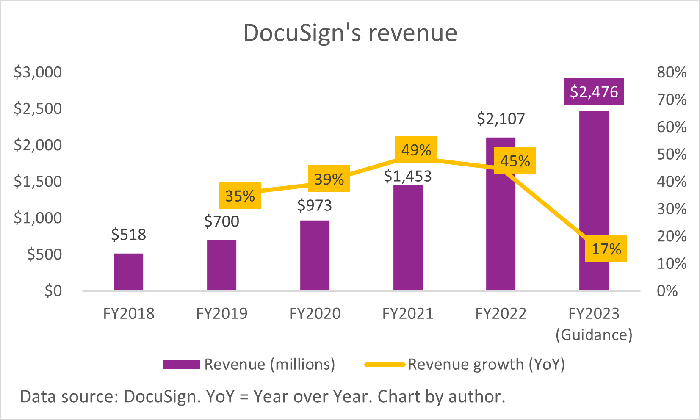

It's not the ideal environment for DocuSign, but the company is still growing. In the recent first quarter of fiscal 2023 (fiscal year ends Jan. 31), it added 67,000 new customers, bringing its total to 1.24 million worldwide. Its quarterly revenue also expanded 25% year over year to $588 million.

But based on DocuSign's full-year outlook, its sales growth is rapidly decelerating.

Repricing expectations

The broad market sell-off has been especially brutal to the tech sector, but DocuSign's slowing growth has weighed down its stock price. Additionally, the company has struggled to generate true profitability.

In fiscal 2022, DocuSign generated $411 million in non-GAAP (adjusted) net income, which excludes certain items like $409 million of stock-based compensation. The company's result under generally accepted accounting principles (GAAP) was a net loss of $70 million. The story was similar in the fiscal first quarter, and management highlighted difficulties retaining employees on its sales team, which means it may have to spend even more on compensation going forward.

The current stock market environment is pushing investors to drastically reprice companies that are perceived as risky, and profitability is the metric everybody is watching. Some tech stocks have lost as much as 90% of their value, and DocuSign isn't far off that mark having declined 80% since Sept. 2021.

But none of these things make DocuSign a bad investment if the price is right. Remote work is here to stay, as is remote deal making, so there's enormous value in the products the company offers. For now, investors might be best served waiting on the sidelines to review two or three more quarters worth of results. If DocuSign can stabilize its growth rate, that might be the signal to start building a position.

10 stocks we like better than DocuSign

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and DocuSign wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of June 2, 2022

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends DocuSign. The Motley Fool recommends the following options: long January 2024 $60 calls on DocuSign. The Motley Fool has a disclosure policy.