Expedia Group Inc(EXPE-Q)NASDAQ

Unusual Options Activity For September 20th

When a stock experiences unusual option volume, it can indicate large traders making a big bet on the direction of that stock. Unusual option volume is generally referring to activity in a specific option contract or group of contracts that is much higher than the usual daily volume.

When looking for unusual options activity, most trader look for volume that is:

- At least 5 times higher than average

- Short term (less than 30 days to expiration)

- Far out-of-the-money

Another way to spot unusual activity is to look for volume that is much higher than the open interest in that contract. This can indicate a new trade being placed, rather than a closing out of an existing position.

Unusual Stock Options Activity Screener

At Barchart, we have an excellent screener for unusual options activity. The screener identifies options contracts that are trading at a higher volume relative to the contract's open interest.

Unusual options can provide insight on what "smart money" is doing with large volume orders, signalling new positions and potentially a big move in the underlying asset.

When the last price is at or above the ask price the strike price is highlighted in green; when the last price is at or below the bid price the strike price is highlighted in red.

If you would like more details on how to use this screener, you can watch this video.

Let’s take a look at the screener for September 20th:

There are some popular names on the list include F, PBR, LVS, XOM, BAC, GME, APPS, EXPE, CHWY and KO.

Let’s take a look at the first line item, the September 23, 13.50 strike call option on Ford. This call option traded 26,781 contracts which is far great than the open interest of 220. This contract was traded at or above the ask price, as indicated by the green color of the strike price.

The Barchart Technical Opinion rating is a 40% Sell with a weakening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Ford Motor Company designs, manufactures, markets and services cars, trucks, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles. Apart from vehicles, the company provides financial services through Ford Motor Credit Company LLC. Ford has three reportable operating segments: The Automotive segment is engaged in the design, development, manufacture, sale and service of Ford and Lincoln vehicles as well as service parts, and accessories. The company's wholesales primarily consisted of vehicles sold to dealerships. It also sells parts and accessories to authorized parts distributors and offers extended service contracts. The Mobility segment focuses on designing, building, growing and investing in mobility services, and autonomous technology businesses for the company. The segment works as a subsidiary of Ford under the name Ford Smart Mobility LLC. The Ford Credit'segment deals with vehicle-related financing and leasing activities.

Unusual Call Option Activity in XOM

Scrolling down the list, there was also some large volume in the XOM 99 calls with an October 21 expiration. This call option traded 5,034 contracts which is more than the open interest of 132. This contract was also traded at or above the ask price, as indicated by the green color of the strike price.

The Barchart Technical Opinion rating is a 64% Buy with a weakest short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

ExxonMobil's bellwether status in the energy space, optimal integrated capital structure that has historically produced industry-leading returns and management's track record of capex discipline across the commodity price cycle make it a relatively lower-risk energy sector play. The company owns some of the most prolific upstream assets globally. Other aspects of the company's story include the largest global refining operations, substantial chemicals assets and a dividend history and credit profile that are second to none in the space. ExxonMobil's capital spending discipline is quite aggressive. The company has a plan in place to allocate significant proportion of its budget to key oil and gas projects. The company's business perspective looks different from most peers since big oil rivals have pledged to lower carbon emissions to tackle climate change. ExxonMobil divides its operations into three main segments: Upstream, Downstream and Chemical.

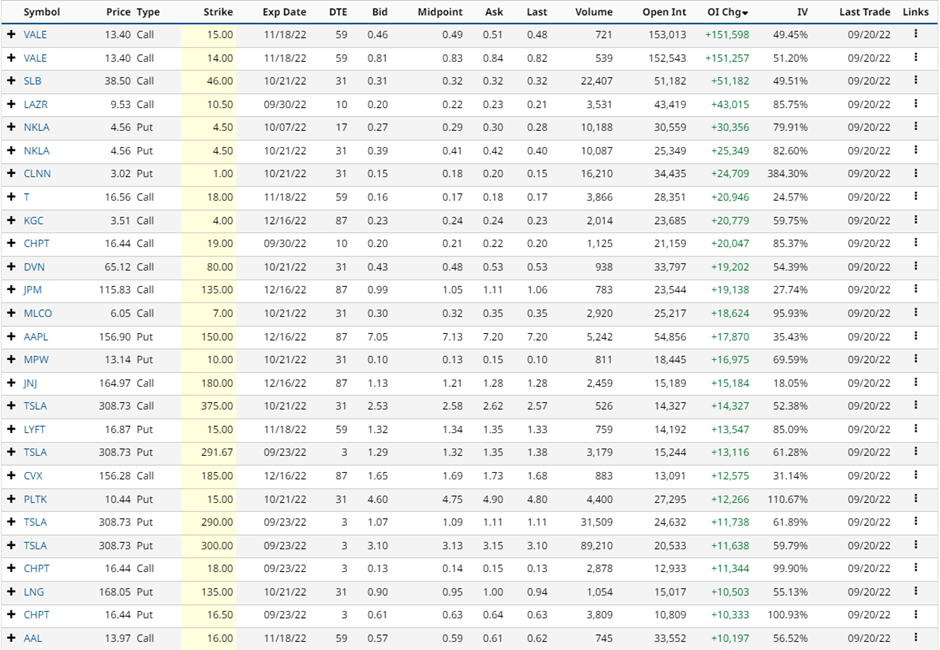

Options Change In Open Interest

The Options Change In Open Interest is another interesting report that can be used to spot unusual options activity.

Here we can see there were large changes in the November 14 and 15 strike call options on VALE and also the SLB 46 strike October calls amongst others.

You can also flip the screener from Stocks to ETF’s:

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, September 20, 2022.

More Stock Market News from Barchart

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.