Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

One call option is being sold, which generates a credit for the trader. Another call option is bought to provide protection against an adverse move.

The sold call is always closer to the stock price than the bought call.

As the name suggests, this trade does best when the stock declines after the trade is open.

However, there can be many cases where this trade can make a profit if the stock stays flat and even if it rises slightly.

We’ll look at lots of examples later in this post, including how to manage the trade when it goes against you.

Bear call spreads are risk defined trades, there are no naked options here, so they can be traded in retirement accounts such as an IRA.

Traders should have a bearish outlook on the stock and ideally look to enter when the stock has a high implied volatility rank.

Let’s take a look at Barchart’s Bear Call Spread Screener for August 9th:

As you can see, the screener shows some interesting Bear Call Spread trades on stocks such as CAT, JPM, INTC, MU, META and PFE.

Below are the full parameters for this scan:

Let’s look at the first line item – a Bear Call Spread on CAT.

Using the August 19 expiry, the trade would involve selling the 200 call and buying the 210 call. That spread could be sold for around $0.22 which means the trader would receive $22 into their account. The maximum risk is $978 for a total profit potential of 2.25% with a probability of 92.8%.

The breakeven price is 200.22. This can be calculated by taking the short call strike and adding the premium received.

As the spread is $10 wide, the maximum risk in the trade is 10 – 0.22 x 100 = $978.

The Barchart Technical Opinion rating is a 72% Sell with a weakening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

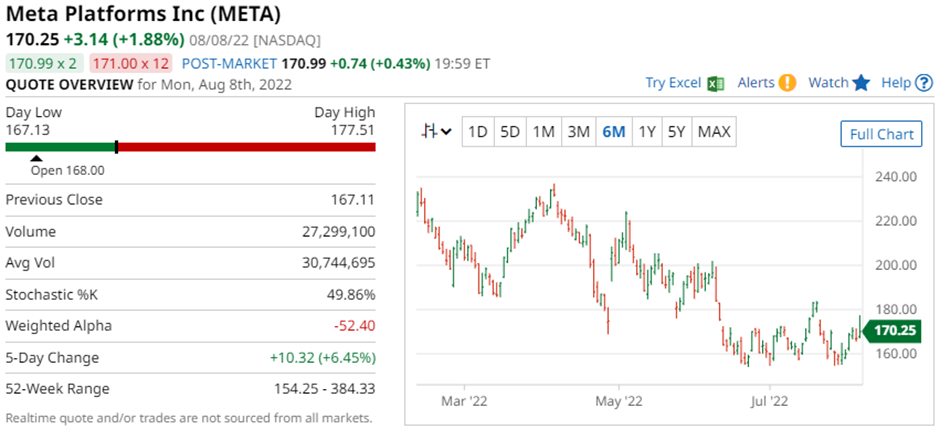

Let’s analyze the first META bear call spread.

This Bear Call Spread involves selling the 185 August call and buying the 225 call.

That spread could be sold for around $0.94 which means the trader would receive $94 into their account. The maximum risk is $39.06 for a total profit potential of 2.41% with a probability of 87.5%.

The breakeven price is 185.94.

META is rated a Strong Sell and the Barchart Technical Opinion rating is an 88% Sell with a weakest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

META is showing an IV Percentile of 57% and an IV Rank of 30.47%. The current level of implied volatility is 41.98% compared to a 52-week high of 108.64% and a low of 12.76%.

Mitigating Risk

Thankfully, Bear Call Spreads are risk defined trades, so they have some build in risk management. The most the CAT example can lose is $978.

These examples have a low credit received in comparison to the maximum potential loss, so it’s important to close the trades early if they are not working. Trades like this should never lose more than two times the premium received.

Bear Call Spreads can also contain early assignment risk, so be mindful of that if the stock breaks through the short strike and it’s getting close to expiry.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Steven Baster did have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, August 8th, 2022.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).