Alexandria Real Estate Equities(NYSE: ARE) is now in its 25th year as a publicly traded company and the pioneer in life sciences office space appears positioned for more solid performance.

The San Diego-based real estate investment trust (REIT) provides specialized lab and general office space to more than 1,000 tenants in the nearly 75 million square feet it leases in what it calls "innovation cluster locations" in and around Boston, San Francisco, New York City, San Diego, Seattle, suburban Maryland, and North Carolina's Research Triangle.

If you had plunked down $10,000 on Alexandria at its 1997 initial public offering (IPO) you'd have a total return -- that's capital gains and dividends growth -- of about $160,000. Here's an illustration of just how much effect dividend payouts have on an investment.

What have you done for me lately?

That's not too shabby, but it's also not to say that Alexandria is a world-beater in this regard. The chart below shows Alexandria's total return performance since its 1997 IPO compared with both the Vanguard Real Estate ETF and the S&P 500.

ARE Total Return Level data by YCharts

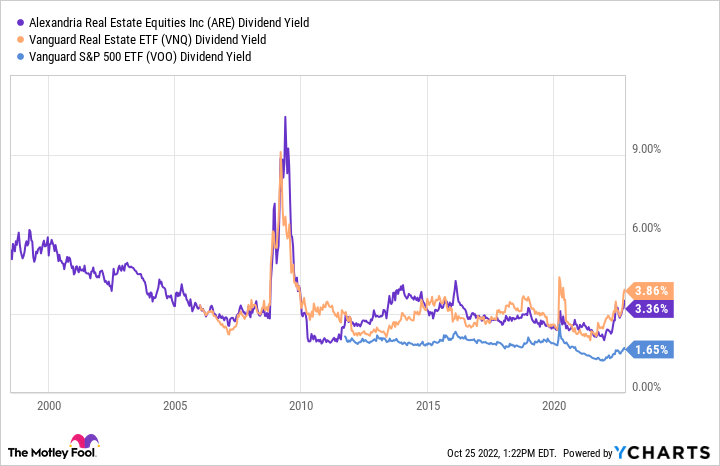

There is a significant difference, but there's still plenty of reason to consider this life sciences trust for a diversified portfolio that's focused on income and growth. First, let's consider income. The chart below compares Alexandria's yield to the benchmark Vanguard Real Estate ETF and Vanguard S&P 500 ETF. Note that the latter launched in 2010.

ARE Dividend Yield data by YCharts

And one more chart, this one showing how much the dividend itself has grown over that same 12-year period for Alexandria and those two benchmark stocks.

ARE Dividend data by YCharts

But what will you do for me next?

Alexandria's share price is down about 36% so far this year. This is a beaten-down stock, but not a beaten-down company. The company has grown revenue by nearly 25% year to date through the third quarter and funds from operations (FFO) per share by more than 8% over that same period.

Occupancy remains above 94% and October rent and receivables were at 99.9% collected for the 41 million square feet now in operation. And there are another 32 million square feet in various stages of construction. The REIT also reports that leasing volume is continuing to outpace its 10-year quarterly average, with renewals and new leases coming in with rate increases of 27.1% and 22.6%, respectively.

Alexandria recently raised its dividend by 5%, continuing a run of 11 straight years of payout increases. A modest FFO payout ratio of 56% for the third quarter, along with a fortress balance sheet, speaks to the sustainability of that dividend and the company's aggressive expansion plans set the stage for continued revenue growth and divided payouts alike.

I own shares of Alexandria Real Estate Equities and am considering adding more before the market once again turns and pushes share prices for this office REIT higher.

10 stocks we like better than Alexandria Real Estate Equities

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Alexandria Real Estate Equities wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of September 30, 2022

Marc Rapport has positions in Alexandria Real Estate Equities and Vanguard Real Estate ETF. The Motley Fool has positions in and recommends Alexandria Real Estate Equities, Vanguard Real Estate ETF, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.