A lot of personal finance involves numbers shown as percentages, which is informative but also a bit abstract. So let’s switch to actual dollars and cents to document how low interest rates are killing returns for savers.

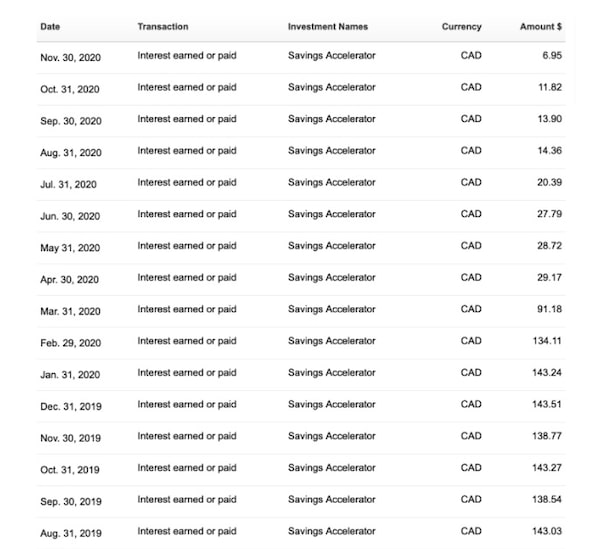

Killing is the right word here, at least as far as big-bank savings accounts go. Last week, a reader disgusted by low returns on a savings account sent me a screen-capture showing monthly interest payments received over the past 18 months or so on a balance of roughly $169.000. It takes a lot to shock this veteran personal finance writer, but these numbers kind of did that.

Here they are (shown with permission):

Rates are low to encourage businesses and people to borrow and generate activity that helps the economy. We don’t talk enough about the collateral damage of low rates, which is the elimination of almost all the reward for keeping money safely parked for emergencies or near-term financial goals. Big-bank savings rates these days are typically about 0.05 per cent.

You can do much better – as much as 1.3 to 1.8 per cent – with a savings account from an alternative bank or credit union that is a member of Canada Deposit Insurance Corp. or a provincial credit-union deposit-insurance plan.

Wait, let’s use dollars and cents to highlight the benefit of a better savings rate. On $169,000, 1 per cent interest works out to $140 per month. Compared to the $6.95 paid to that reader’s account in November, that looks pretty good.

Subscribe to Carrick on Money

Are you reading this newsletter on the web or did someone forward the e-mail version to you? If so, you can sign up for Carrick on Money here.

Rob’s personal finance reading list

A $350,000 house in Toronto?

All about how a young Toronto woman sold her parents on the idea of building a laneway house on their property. She gains an affordable home in an expensive city and her parents have a more valuable property.

‘We had to keep things secret from daddy’

Erica Alini of Global News on how women are affected by financial abuse, where a partner exerts control of a relationship by monopolizing financial resources. One woman talks about worrying over what her husband would say about buying new shoes for her growing children.

RRSPs for business owners

The benefits of registered retirement savings plans for people who operate a business through a corporation, as explained by Jamie Golombek, managing director of tax and estate planning at CIBC Private Wealth Management.

For a stress-free retirement, try these countries

An, um, offbeat listing of countries by how stress-free they are for retirement. Canada ranks 8th. We’d have done better, but traffic congestion’s a problem. I visit Toronto a lot, so I get that.

Ask Rob

Q: Do you know a free app to track ETF gains and losses for when you sell in a taxable account? If none are free, what is the best way to do this?

A: Take a look at ACB Tracking, an online service that offers this type of calculation for a fee. Anyone know of other sites or apps that do this job?

Do you have a question for me? Send it my way. Sorry I can’t answer every one personally. Questions and answers are edited for length and clarity.

Today’s financial tool

Just over nine in 10 tax returns last year were submitted electronically. If you’re one of the few who prefer file a paper return, check out this notice from the Canada Revenue Agency advising that processing paper returns could take longer as a result of COVID-19. People who filed on paper last year will receive the 2020 tax package by Feb. 19, 2021.

The money-free zone

Barack Obama on New York-style versus Chicago-style deep-dish pizza. I’m with the former U.S. president on this – Chicago deep-dish is great as a novelty, but New York-style wins for overall appeal. Mr. Obama also disses pineapple as a pizza topping.

ICYMI

Recent Globe and Mail personal finance stories:

- Ryan and Tracy weigh their pension options in the face of early retirement

- Gift cards remain popular despite pandemic but come with a risk if store closes (for Globe Unlimited subscribers)

- Next year could be one of the best for earnings growth, and push stock prices higher (for Globe Unlimited subscribers)

More Rob Carrick and money coverage

Subscribe to Stress Test on Apple podcasts or Spotify. For more money stories, follow me on Instagram and Twitter, and join the discussion on my Facebook page. Millennial readers, join our Gen Y Money Facebook group.

Even more coverage from Rob Carrick:

- 🎧 Catch up on Stress Test: How to survive the gig economy • How to get out of debt • Is now the right time to buy a house? • Crisis-proof your finances • Does investing change during a pandemic? • Can you afford to live downtown? • The cost of kids • Should you move back in with your parents?

- ✔️ A 10-point pandemic personal finance checklist: Create a "wartime" family budget; stop worrying about bank deposits; clean out your big-bank savings account; get relief on car payments; get preapproved for a mortgage; WFH? Save $1,000 a month; save, save, save; build resilience by not anxiety-buying; consider the cost of mortgage deferrals; get ready for the second wave of financial distress.

- 📈 Investing: The case for a tight portfolio of big blue chips dividend stocks; robo-advisers beat human advisors (and they’re thriving), why online banks that are better than the branch; is it time to invest your 2020 TFSA; don’t get your mortgage at a bank; why it’s so hard to invest in preferred shares; stock up on stocks to retire early; and are you following the 10-year rule with your investments?

- 💰 Saving: Food waste is wasted money; why you might regret that SUV and find out if CAA is worth it; juice your PC Optimum points; how an ex-Bay Street lawyer got out of debt; blindly easy tweak to your retirement investments to survive economic downturn; should you buy that latte?

Are you reading this newsletter on the web or did someone forward the e-mail version to you? If so, you can sign up for Carrick on Money here.

Rob Carrick

Rob Carrick