The cases of the nine current and former senators that the Auditor-General is recommending be referred to the RCMP.

Pierre-Hugues Boisvenu

Sitting, Appointed as a Conservative

The auditor found Mr. Boisvenu received $15,826 in ineligible living expenses by claiming, during 2012, that his primary residence was in Sherbrooke, Que., when he spent most of his time in the Ottawa area. He is also accused of claiming more than $40,000 in mileage, accommodation and per diems for trips that did not involve parliamentary business, much of it related to activities he performed for a victims’ rights organization.

Mr. Boisvenu says that during the period he is accused of claiming improper residence expenses, which occurred during a marital breakup, he kept his personal belongings in Sherbrooke and continued to file taxes and pay the bills for his residence in that city. As for the other expenses, he says he did improperly claim travel expenses to be with his mother as she was dying. But the work of raising awareness about victims’ rights, he says, is “integral to part of my duties as a senator.”

Sharon Carstairs

Retired, Appointed as a Liberal

The auditor found she claimed her home in Winnipeg to be her primary residence but was living most of the time in Ottawa and that she improperly received $2,399 in living expenses as a result. She is also accused of taking $5,129 to travel from Ottawa to Winnipeg and back after her resignation, which would not be allowed if her primary residence was in Ottawa.

Ms. Carstairs says her home was in fact in Winnipeg and there are no rules about how much time must be spent at a primary residence. With regard to the travel expenses, she says, “I believed that to be well within the rules of the Senate of Canada.”

Marie-Paule Charette-Poulin

Resigned, Appointed as a Liberal

The auditor discovered $131,434 in expenses for which there was conflicting or insufficient information to conclude they had been incurred for parliamentary business, or if they were taken as part of her other job as a lawyer, or for personal reasons. Those expenses were related to travel, contracts, hospitality and other office expenditures that were not sufficiently documented.

Ms. Charette-Poulin did not respond to the auditor’s findings.

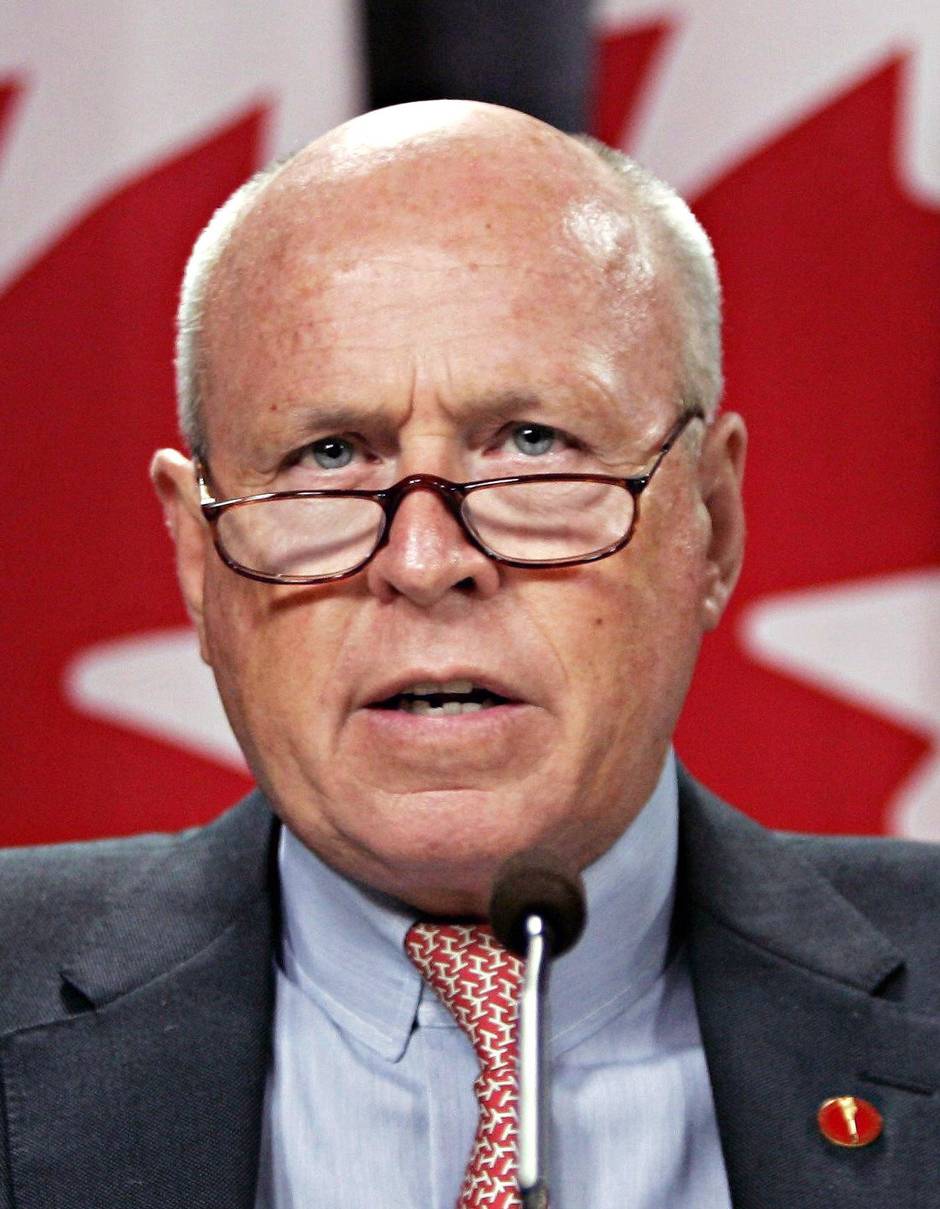

Colin Kenny

Sitting, Appointed as a Liberal

The auditor says he incurred at least $35,549 in travel expenses for which he could not provide sufficient evidence that the trips, some of which incorporated personal events, were for parliamentary business. The auditor also says he paid his staff salaries and benefits for doing personal work for him.

Mr. Kenny says he does not concur with the conclusions of the audit and that he was not given sufficient time to respond to its findings. And, he says, “Invalidating an entire trip on account of one personal appointment seems disproportionately punitive.”

Rose-Marie Losier-Cool

Retired, Appointed as a Liberal

The auditor found she declared her primary residence to be in Moncton when she spent most of her time living in Gatineau, across the river from Ottawa, and thus claimed ineligible living expenses in excess of $21,000. She was also found to have claimed more than $40,000 in travel expenses to Moncton that were for personal, rather than parliamentary, business. In addition, there were trips in the amount of $46,225 that were not properly documented.

Ms. Losier-Cool says she carefully followed the rules and that the auditor has refused to consider the “particular features” of her work as an Acadian senator and the expense claims she has submitted. In addition, she said, the auditor has rejected the explanations, supporting documents and arguments presented by her lawyers.

Donald Oliver

Retired, Appointed as a Progressive Conservative

The auditor says he incurred expenses of $48,088 that were not for parliamentary business or for which there was insufficient documentation. On two occasions, the senator’s staff drove his car from Ottawa to Halifax and flew directly back to Ottawa, at a cost of $1,559. The auditor could not determine if $22,982 claimed in travel expenses was for Senate business or to attend meetings of a non-profit organization he founded to promote wines and cuisine of Burgundy in France.

Mr. Oliver says he has provided a “reasoned justification” for each claim that was called into question, and frequently sought and obtained authorization for expensing his activities before they occurred.

William Rompkey

Retired, Appointed as a Liberal

The auditor found he improperly declared his primary residence to be in St. John’s when, in fact, he spent most of his time in Ottawa and that he claimed $3,134 in improper living expenses. He was also found to have improperly claimed $14,158 for trips back to Newfoundland after he retired.

Mr. Rompkey says he does not agree with the conclusions of the audit and says Senates rules require a senator to claim residence in the province they represent. As for the post-retirement trips to Newfoundland, he says, he was assured by Senate Finance that they fell within the rules.

Gerry St. Germain

Retired, Appointed as a Progressive Conservative

The auditor found $55,588 in expenses that were not primarily for parliamentary business. Although Mr. St. Germain said he travelled to Edmonton to meet with First Nations, the auditor said he was a member of the board of directors of a private group of companies in that city and attended board meetings during those trips. He was also found to have paid staff and contractors to attend political fundraisers and other events, including a 50th wedding celebration and an awards gala. The auditor says he paid a contractor $12,000 for work that may not have been done and to have amended that contract to increase the contractor’s daily rate. The auditor also found that he improperly paid a communications professional $6,250 to help with plans for his retirement.

Mr. St. Germain says he disagrees with the presentation of the findings. He says he has proved that he went to Edmonton to talk with First Nations. And he says he needed his staff with him on the trips, for which their expenses were paid. As for the contracts, he says, “I required extra support during my final year. I demanded significant results from these people and compensated them fairly and within the rules of the Senate for the work that was performed.”

Rod Zimmer

Resigned, Appointed as a Liberal

The auditor says Mr. Zimmer claimed that his primary residence was in Winnipeg, even though he lived mainly in Ottawa, and was thus able to improperly claim living expenses of $47,132. In addition, the auditor says Mr. Zimmer and his wife improperly claimed a number of round trips to Winnipeg in which no parliamentary business was conducted, racking up improper travel expenses of $102,542. Plus there were other trips to places such as Montreal, Toronto and Saskatoon for which the senator could provide no proof that he was doing Senate work. There were two contracts, amounting to $12,453, for which the senator could not provide documentation or proof that the work had been performed. And there were other expenses found to be improper for taxis and personal activities, as well as Senate equipment that was not returned after his retirement.

Mr. Zimmer says there is no requirement that senators spend a certain percentage of their time at their primary residence. “Winnipeg,” he said, “was always my home.” Plus, he says, he does not know how the auditor could make a pronouncement on residency rules without interfering in the trial of Mike Duffy, which involves similar questions and is currently before the court.