A proposal to boost the retirement benefits for the middle class from the Canada Pension Plan through increases in contributions is rekindling momentum for pension reform ahead of a key December meeting with Finance Minister Jim Flaherty.

Prince Edward Island Finance Minister Wes Sheridan is trying to rally his colleagues around changes that would raise the maximum CPP contribution to $4,681.20 a year from $2,356.20 starting in 2016, and increase the maximum annual benefit to $23,400 from $12,150.

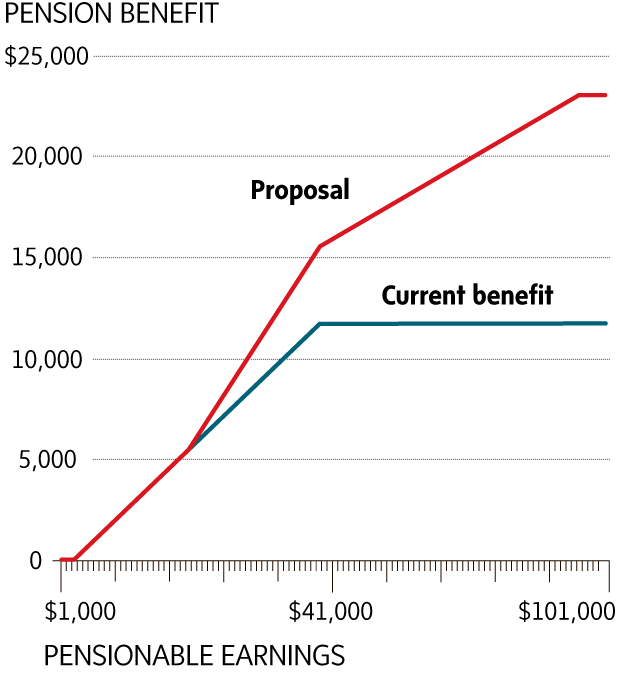

This chart shows the difference between the current pension plan and the proposed increases.

1. Find your annual income on the bottom axis

2. The line shows your corresponding annual pension (retirement income)

Under the current plan, your retirement income from CPP is capped at $12,150 per year. The average payment is $7,234. Only people who pay the maximum in premiums receive the maximum benefits. Currently, only people with income of about $51,000 or more pay the maximum premiums. The proposed changes would see that ceiling rise much higher — to $102,000. Workers who paid the new maximum premiums throughout their working life would qualify for a maximum CPP pension of $23,400 a year.

How will you pay for this higher pension?

Currently the cost of CPP premiums is 9.9 per cent (split evenly between employer and employee) of income between $3,500 and $51,100. The proposal would increase the percentage cost of premiums from 9.9 per cent to 13 per cent (still split evenly between employer and employee) on income between $25,000 and $51,000. For incomes between $51,000 and $102,000, the combined contribution rate would rise from zero to 3.1 per cent.

SOURCE: "Strengthening Canada’s Retirement Income System," Wesley Sheridan