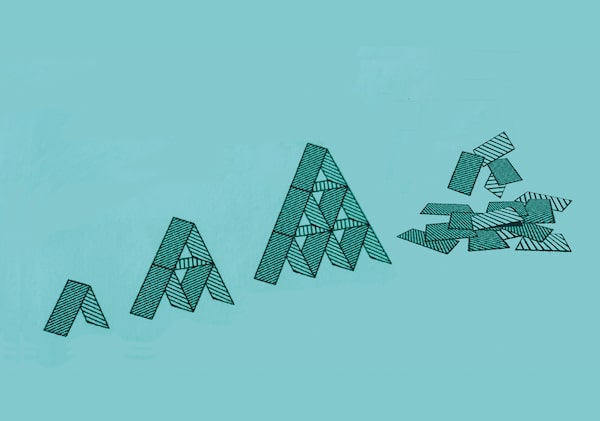

Illustration by Bryan Gee

Jeff Booth is the author of The Price of Tomorrow: Why Deflation Is The Key To An Abundant Future.

You and your neighbour, let’s call him Bob, choose two very different paths. The year is 2001. You choose to live within your means, only paying for what you can in cash and never taking a loan.

He, instead, takes a $1-million loan to fuel lavish spending. He builds a new house, hires gardeners, buys new furniture and a big-screen TV. To you and all of your neighbours, looking in from the outside, Bob is very wealthy.

As a byproduct of his lavish spending, he also spurs job growth to support his purchasing. Factories, construction, real estate agents and transportation companies all benefit. The next year, he cannot support his spending, so he decides to borrow $2-million more, part of it to make interest payments on his initial $1-million, and part of it to keep up with his lifestyle. With that additional money, he ramps up his spending – driving many more new jobs. He also decides to buy an additional home and rents it out to gain new income.

Because you know him, you decide to move into his rental home, still believing that saving your cash and living within your means is the right course of action. With his additional income from the rent you pay, Bob decides to borrow $4-million more, buying more homes and hiring staff to support his growth. He buys a boat, takes vacations with his family in Europe and ramps up his personal spending again.

A lot of people look at Bob’s success and decide to copy it. Banks are happy to lend against that success because they stand to make a lot of money on lending. With that additional growth of debt in the economy, jobs grow substantially to support the consumer spending, which itself is supported by a massive rise in debt. House prices rise as well – with rents rising in lockstep.

The house you could have bought in 2001 for $100,000 is now worth $500,000. The money that you have been saving to buy a house isn’t going up as fast as housing prices. Worse still, your rent is going up each year. You say to yourself, well, at least the economy is strong, and my job is safe.

With the rise in the value of housing, Bob’s assets easily cover any liabilities, so Bob decides to borrow $50-million and create a business of buying and renting homes – employing many people along the way. He is asked to appear on TV, to tell how he made his fortune. Many others follow his success, taking out loans of their own. Again, banks are happy to lend against it. Housing prices always rise over the long term, the banks tell themselves, so those loans are safe. They fail to see that they themselves created the rise in housing prices with the massive amount of credit they applied to the system.

You prepare yourself – saving your money – knowing that when credit is eventually pulled from the economy, there will be a once in a lifetime opportunity to make your riches as Bob and all of the people are only living an illusion of wealth because of easy credit. You believe that as they try to cover their losses, they will be forced to sell at any price. Others would be forced to sell, too, creating a downward spiral in prices. You will wait patiently, believing that your cash will one day be valuable so you can come in at the bottom and pick off assets for pennies on the dollar.

Then, starting in 2006, it finally starts to happen. Housing prices start to fall. They unwind, starting slowly at first – then accelerating. Bob starts to sell his homes at any price trying to create cash – the problem though, is that most of the cash doesn’t cover the loans from the banks.

This repeats across the world and banks realize that they don’t have the money to cover the loan losses arising from this failed bet on housing.

Governments are also fooled. They didn’t see that many of the high-paying jobs in the economy were only there because that easy credit applied to housing. Everyone felt richer so they spent more and that created more jobs. The cycle was self-reinforcing on the way up and brutal on the way down.

Bob’s company is forced to lay off all of its employees. But that’s not all. Many other companies also start to lay people off as their survival depends on it. Consumers have stopped spending because they too are scared. The cycle is reinforcing. As jobs are destroyed, cash becomes king, so businesses start hoarding it. The cycle that was self-reinforcing on the way up is now self-reinforcing on the way down, with each day getting worse for the economy.

As the cycle gets to a critical point, banks around the world stop lending to each other – each worried about the credit worthiness of the other. They are right to be worried – they do not have the cash. Global trade is about to stop and the world is about to enter a severe depression. There are many people in despair, having lost their income, wealth. Every day, the news seems to get worse.

You stand ready, cash in hand. You grew up realizing that for capitalism to function properly, excesses such as this had to be cleared from the system for the system to function properly. No matter how hard it was, if you made a big bet and were wrong, you were wiped out. The banks made big bets and for a long time were handsomely rewarded while prices were going up. Now you believe, it’s time for them to pay the price.

One problem: You fail to recognize that the entire global economic order rested on that same system, and governments would do anything to protect it.

So, in late 2008, something extraordinary happens. Instead of allowing the system to fail as capitalism calls for, governments bail out the system. By doing so, they save the same people that created the crisis in the first place, effectively guaranteeing their wins and socializing their losses.

The “real” value of your cash is destroyed as new money is created out of thin air and the system is bailed out. Bets that should have gone to zero are made whole, and a staggering amount of new debt is created to pretend the economic system still works.

You think to yourself: This is crazy. A currency only holds value because of the deemed trust we have in it. Beyond that, it is just a piece of paper with faces and numbers on it. Trust is just an agreed upon exchange of value and that government will keep its promises. That trust is compromised if governments do not keep their promises – even if they pretend to by changing the value of the paper the promise is written on.

You wonder how more debt could be used to solve a problem that was created by debt in the first place. Wouldn’t that delay the inevitable and make the whole system even more fragile?

But ... it works, and most people forget. Everyone once again believes in the fairy tale.

Until a virus starts spreading across the globe.

Keep your Opinions sharp and informed. Get the Opinion newsletter. Sign up today.