With metal prices in a prolonged slump and costs being cut across the board, it’s easy to understand why mining companies aren’t spending more on research and development.

New technologies to reduce energy and water use often require extra work and financial investments up front, but the benefits of lowering costs and reducing project risk are often not obvious in the short-term.

“We have to change what we are doing,” says Peter Bryant, co-chair of The KIN Catalyst: Mining Company of the Future, an industry framework launched recently to help miners embrace innovation.

“We need to provide resources at a price point that’s effective to continue economic development, but at the same time it has to be done in a way that has good outcomes for society.”

Mining industry behind the times

The mining industry is far behind other sectors in R&D, says Bryant.

Even when commodity prices were soaring in 2007-08 and again in 2010-11, many miners remained reluctant to increase spending on innovation.

Bryant cites research showing that mining industry expenditures on R&D have dropped by about half since the 1990s to about half of one per cent. That compares to about 1.5 and 2 per cent in the industrial sector and between about 4 and 5 per cent in the oil and gas sector.

According to another 2011 report, R&D spending in the Canadian mining industry dropped almost 70 per cent from 1995 to 2004, while similar spending in the global pharmaceutical industry was growing by about 10 per cent.

“As the world enters a period of economic uncertainty, the sector will need to revise its approach towards R&D, reconsider its position against collaborative research with academia and other institutions, and be more creative when it comes to R&D funding,’ the report says.

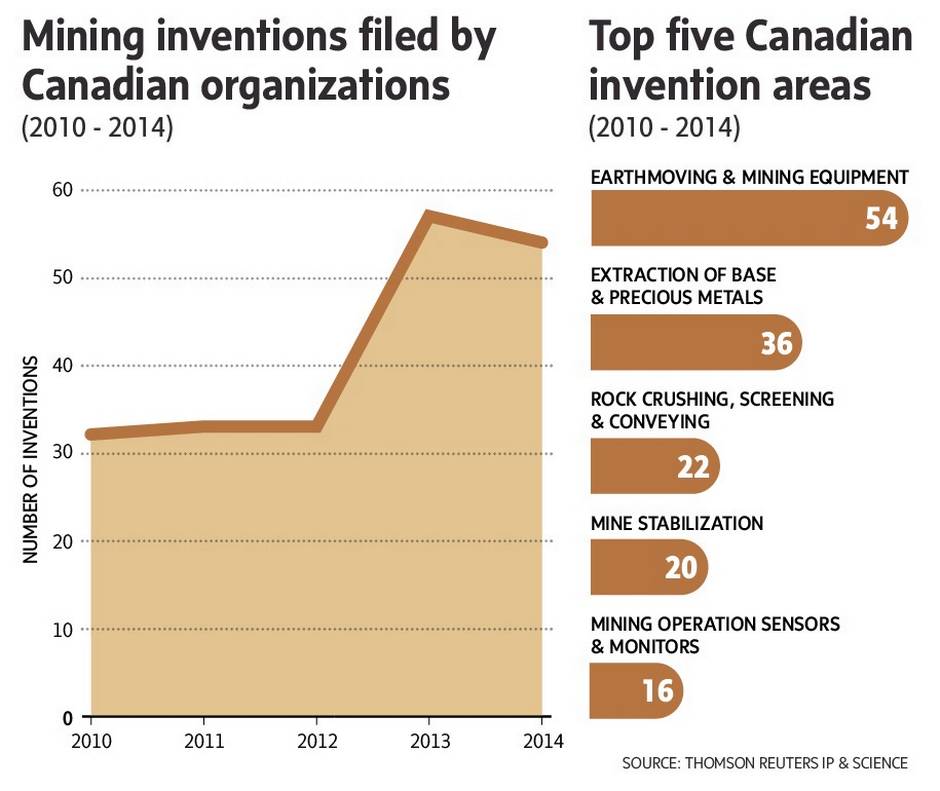

There has been some progress, according to a review of Canadian mining patents and academic reports done by Thomson Reuters IP&Science, which shows that domestic innovation in mining has grown over the last five years across both mining and mining service companies.

Some of the top companies with mining innovations include Esco Corp., which makes blades, shrouds and other parts used across the resources sector, as well as diversified mining exploration, development and production company Vale SA.

There has also been a growing body of scientific papers production about mining technology, particularly from institutions in mining-focused provinces such as McGill University, the University of British Columbia and the University of Toronto.

Innovation as an investment

Even some cash-strapped junior miners are recognizing the need to put some resources towards innovation. Some experts say it’s particularly important for juniors to focus on innovation since they are usually on the ground first with exploration and set the stage for future operations and relationships with the local community.

“Corporate responsibility is an investment, not an expense. We need to change the corporate mindset,” says Gordon Bogden, chief executive of Alloycorp Mining Inc. (formerly Avanti Mining Inc.).

He says his company is weaving some of the KIN Mine of the Future framework into its five-year corporate strategy and has established a corporate responsibility committee on its board.

Some of its recent innovations include the implementation of site-specific water quality standards that go beyond provincial standards at its Avanti Kitsault mine development in B.C. The company also hired an independent review panel of geotechnical engineers to assess the project’s tailing development, which comes after the tailings breach at Imperial Metal Corp.’s Mount Polley mine in B.C. last year.

Bogden says his team is also looking into adopting technologies such as automated trucks, drones during pit survey work and 3D printing of spare parts at the site.

“Much of this takes a willingness to engage in new thinking, and of course a massive amount of bandwidth,” says Bodgen.

Innovation adoption the key challenge

In its 2015 report on top issues facing the mining industry, experts at Deloitte’s mining consultancy say innovation is the key to survival for the industry amid pressures such as declining ore grades and rising costs.

“Companies that have invested in such technologies as remote mining, autonomous equipment and driverless trucks and trains have reduced expenses by orders of magnitude, while simultaneously driving up productivity,” the report states.

However, mining companies need to stop being so conservative in their operations, with more executive-level management adopting an innovation mindset.

“It is rapidly becoming clear that innovation can do much more than reduce capital intensity. Approached strategically, it also has the power to reduce people and energy intensity, while increasing mining intensity.”

Numbers are step one. Capitalize applies context to data – helping professionals leverage powerful information to make confident decisions. For more information, go to www.thomsonreuters.ca

Now experience Thomson Reuters Exchange. A new digital publication for fresh ideas and insights in a dynamic, interactive format. Download the free App from the App Store, Google Play and Amazon Appstore.

This content was produced by The Globe and Mail's advertising department, in consultation with Thomson Reuters. The Globe's editorial department was not involved in its creation.