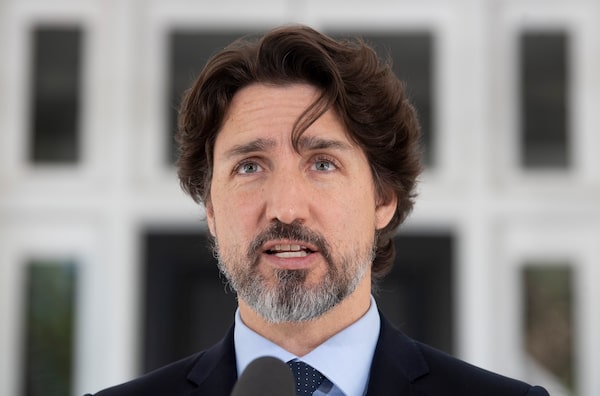

Prime Minister Justin Trudeau, seen here on May 22, 2020, had one-on-one discussions with the heads of Canada’s six big banks for the first time since the start of the novel coronavirus pandemic.Adrian Wyld/The Canadian Press

Prime Minister Justin Trudeau has reached out to the heads of Canada’s six big banks to get their reading on the state of the economy and how COVID-19 relief efforts are faring, banking sources and federal officials told The Globe and Mail.

It was the first time that Mr. Trudeau has had one-on-one discussions with the CEOs since the start of the novel coronavirus pandemic, multiple banking-industry sources say, adding that the calls took place around the Victoria Day long weekend.

The consultations with the CEOs were high-level check-ins rather than deep policy discussions, intended to take the pulse of the efforts to deal with the economic effects of COVID-19, the sources said. They covered topics such as how relief efforts rolled out jointly by government and banks might need adjusting, where bank clients are feeling pressure most acutely, and which parts of the economy may need further support to recover.

The Trudeau government, federal officials say, has largely finished rolling out its emergency response to the pandemic and is now starting work on the “recovery” phase that will aim to salvage sectors of the economy that are most damaged by the crisis.

The officials say the government is preparing a diagnosis of the economic damage inflicted by COVID-19 and has started to determine the sectors of the economy that will need the most help in the next phase.

The Globe is not identifying the banking and federal sources who spoke about the recent discussions with the bank CEOs because they were not authorized to comment publicly on the matter. Spokespeople for Canada’s six largest banks and for the Canadian Bankers Association declined to comment.

Although Mr. Trudeau has called the bank CEOs on occasion in the past, such direct discussions are not common. In the fall of 2018, Mr. Trudeau briefed them in separate calls at a key juncture in negotiations to redraw the North American free-trade agreement.

The Prime Minister and his top ministers have been engaged in a series of talks with corporate figures, union leaders and academics to determine the country’s economic needs now that provincial governments are allowing businesses to resume operations, albeit at varying speed across the country.

Up until now, Ottawa publicly emphasized the emergency response to the short-term effects of the economic crisis, such as direct payments to workers and families, as well as wage subsidies and rent relief for businesses. Inside Ottawa, that phase was known as “contain and survive,” according to a senior federal official.

“As provinces start to slowly reopen, our goal is always to ensure that the federal government is a strong partner in the economic recovery,” said Ann-Clara Vaillancourt, a spokeswoman for the Prime Minister’s Office.

University of Saskatchewan professor Janice MacKinnon, a former provincial finance minister, said Mr. Trudeau is doing the right thing by consulting widely with bankers and others to target the sectors that need help on the path to recovery.

“If you look at specific sectors of the economy – petroleum, tourism, airlines, agri-food – they have unique problems that are significant and longer term,” she said. “If those sectors flounder, the workers won’t have jobs to go back to.”

What is the reopening plan in my province? A guide

Coronavirus guide: Updates and essential resources about the COVID-19 pandemic

Don Drummond, a former federal Department of Finance official and later a bank economist, said the uncertainty facing the country requires constant consultations between government officials and the private sector to shape future federal action.

“They are operating in a black box,” Mr. Drummond said.

He added that “the banks saved the government” by overseeing new lending programs to businesses, lowering credit-card interest rates and offering deferrals on mortgage payments.

Hassan Yussuff, the president of the Canadian Labour Congress, said he hopes that governments will ensure the safety of workplaces as the economy starts to reopen, and find longer-term solutions for jobless Canadians who have been relying on emergency benefits and wage subsidies. Eventually, he said, the Canadian government will have to step in and save the worse-hit sectors of the economy.

“If you are simply relying on the private sector right now, I don’t think that will get the economy back on its feet,” he said. “The federal and provincial governments will have to collaborate really strongly and they will have to spend money.”

Finance Minister Bill Morneau held weekly calls with bank CEOs starting in mid-March. He will soon launch consultations on the future of the 75-per-cent wage subsidy.

“We will soon consult with key business and labour representatives over the next month on potential adjustments to the program to incentivize jobs and growth, including the 30-per-cent revenue decline threshold,” said Pierre-Olivier Herbert, a spokesman for Mr. Morneau.

Other ministers involved in consultations on the federal role in the economic recovery include Treasury Board President Jean-Yves Duclos, who has been speaking with business leaders and academics.

“As much as our focus is currently set on helping each and every Canadian get through these challenging times, as a government, we also have a duty to look ahead,” said Karl Sasseville, a spokesman for Mr. Duclos.

Banks have been in close and frequent contact with policy makers to co-ordinate the response to COVID-19. That has primarily been through Mr. Morneau and staff at the Department of Finance, as well as officials at the country’s banking regulator, the Office of the Superintendent of Financial Institutions, and at the Bank of Canada.

Globe health columnist André Picard examines the complex issues around reopening schools and businesses after the coronavirus lockdown. He says whatever happens as provinces reopen, there's also a second wave of COVID-19 illnesses looming in the fall. André was talking via Instagram Live with The Globe's Madeleine White.

Sign up for the Coronavirus Update newsletter to read the day’s essential coronavirus news, features and explainers written by Globe reporters.

James Bradshaw

James Bradshaw