New highs

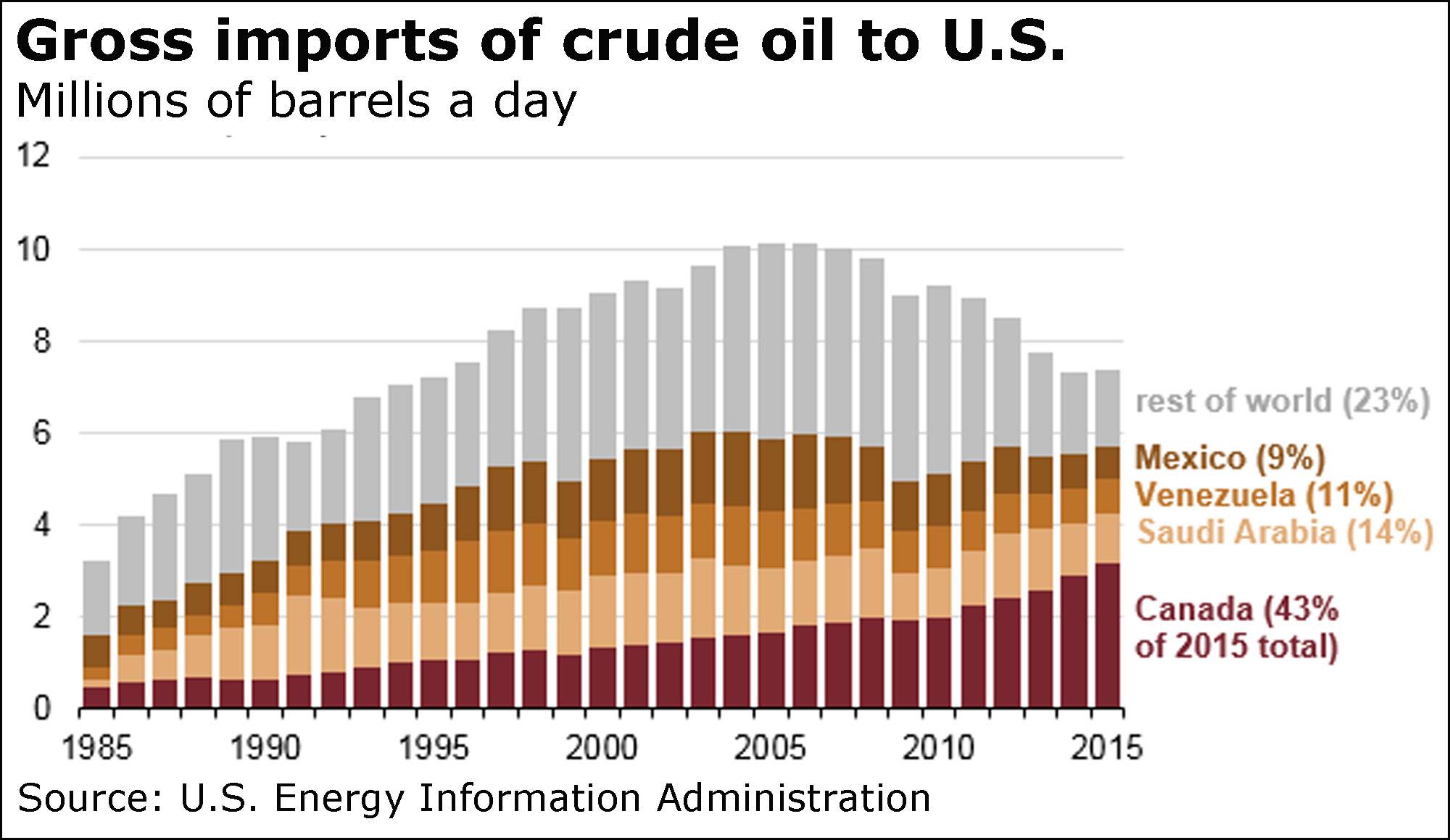

Canada has hit fresh records in oil trade with the United States, now accounting for four of every 10 barrels imported into America.

While imported oil has generally been on the decline since peaking in the mid-2000s, imports from Canada hit a record 3.2 million barrels a day of gross exports to the U.S. last year, according to the U.S. Energy Information Administration.

That marked a 10-per-cent increase from a year earlier, the EIA said today.

Not only that, Canada’s share of the total pie rose to 43 per cent.

Canada, meanwhile, took in 92 per cent of America’s 458,000 barrels a day of exported crude.

“Canada generally produces heavy, sour crude oil that is well matched to processing capacity in the United States, where many refineries have the equipment needed to process such oil,” the EIA said.

“Canada has few alternative outlets for the heavy crude produced in Alberta, where most of Canada’s proved oil reserves are located,” it added.

“Canada is expected to continue to provide a large share of U.S. oil imports for the foreseeable future, especially given the expansion of pipeline and rail shipping capacities to transport Canadian oil.”

Loonie climbs

The Canadian dollar is pushing the 78-cent mark today, and could shoot even higher tomorrow.

The loonie has traded between 77.4 cents (U.S.) and 77.8 cents so far today, but that’s generally because of a “soggy” U.S. dollar and firmer oil prices, rather than on anything specific to Canada, said Royal Bank of Canada currency strategist Adam Cole in London.

Tomorrow, however, the currency could move on what is expected to be a new, and brighter, economic forecast from the Bank of Canada.

The central bank isn’t expected to change its benchmark interest rate from the current 0.5 per cent, but observers believe it will signal the economy is performing better than it had forecast.

Mr. Cole said the loonie could near the 79-mark tomorrow, depending on the comments from Bank of Canada Governor Stephen Poloz and his colleagues, while 80 cents would be an “ambitious” outlook.

“The Canadian dollar is surfing on the upswing,” said London Capital Group market analyst Ipek Ozkardeskaya, noting the move in U.S. oil prices to back above $40 heading into an upcoming meeting of oil producers to talk about freezing output levels.

“The Bank of Canada meeting this week could hint at a better economic recovery given that the latest growth figures were, although not sufficiently brilliant, enough to keep a balanced tone, whereas the [Federal Reserve] appears to be stuck with one, if feasible, rate hike in 2016,” she added.

Canada’s economy has certainly been on the upswing of late, from recent readings of gross domestic product to last Friday’s jobs report, and the central bank is expected to flag this with its rate decision and monetary policy report.

“Canada’s economy was battered and bruised in 2015, but already it seems to be exiting its slump briskly,” said Emanuella Enenajor, the North America economist at Bank of America Merrill Lynch.

“As a result, we believe the Bank of Canada will likely have to revise up its growth forecasts in the April monetary policy report (MPR), with Q1 GDP growth set to be raised from 1 per cent to roughly 3.5 per cent.”