Briefing highlights

- Loonie leaps on rate hike

- Home equity loans on the rise

- Toronto home prices extend slide

- Markets at a glance

- Canada’s trade gap narrows

- Fed’s Fischer resigns

Loonie leaps

The loonie is taking flight in the wake of the Bank of Canada's decision to raise interest rates, nearing the 82-cent mark.

Starting the day below 81 cents (U.S.), the Canadian dollar traded as high as 82.05 cents as the central bank followed its July rate increase with another quarter of a percentage point.

Its benchmark overnight rate now stands at 1 per cent, as The Globe and Mail's Barrie McKenna reports.

The Bank of Canada pointed to stronger economic readings that back up its "view that growth in Canada is becoming more broadly bases and self-sustaining."

This morning brought "surprises all around," Bipan Rai, executive director of macro strategy at CIBC World Markets, said as the currency shot up.

"The market was expecting that a hike would be accompanied by language that would push back against the recent surge in the loonie, but what we got was a statement that was very hawkish," Mr. Rai said.

"The odds of another rate hike before the end of the year have increased, and the next stop for USD/CAD is likely at the 1.20 mark," he added, referring to the U.S. and Canadian currencies by their symbols.

What he meant by that is a loonie above 83 cents.

Mark McCormick, North American chief of foreign exchange strategy at TD Securities, agreed the market was somewhat taken by surprise.

"Given that the rates market was pricing in a roughly 50/50 split ahead of the meeting, the hike has caught USD/CAD off guard," Mr. McCormick said.

"The details of the statement read more like a central bank that removed the insurance cuts and will now sit back and assess the state of the economy," he added.

"It's important to consider that much of the good CAD news have gotten priced in, so the burder of proof will hinge on the economic momentum in Canada," he added.

"In this regard, the high-frequency data we track has been showing signs of moderation, so CAD needs more good news on the economic front. At the same time, we still expect broad-based USD weakness, so that alone is likely to remain supportive of CAD."

Read more

Equity loans on rise

Define precarious: When households borrow billions more against their homes each and every month, and then interest rates rise.

That's a recent trend in Canada that economist Laura Cooper believes is worth pointing out, particularly since the Bank of Canada just raised its benchmark interest rate twice.

Canadians are known around the world for what the Royal Bank of Canada economist called their "voracious appetite" for debt.

Some of that has eased of late as federal and provincial governments try to deflate housing bubbles largely in the Vancouver and Toronto areas, and the central bank's move to a tightening cycle, but the pace of consumer credit is picking up even as growth in mortgages slows.

Like other economists, Ms. Cooper believes Canadian borrowers will be able to handle the higher cost of their debt, but many are vulnerable.

"A notable shift in major housing markets alongside elevated household indebtedness and tighter financial conditions are likely to dampen credit growth and eventually temper consumer spending growth," she said in a report.

"We anticipate that households on the whole will be able to absorb rising costs given an expected gradual pace of policy tightening and ongoing hiring gains. But as is the case with all goods things – the borrowing binge is likely coming to an end."

But the shift – consumer credit balances swelling by $10-billion to $12-billion in each of the last four quarters – certainly ups the ante.

"Lines of credit – and consumer credit in general – tend to be tied to variable rates, so the ramp-up increasingly leaves households exposed to higher interest rates," Ms. Cooper said later.

"While the pace of growth remains low when compared to the rates seen leading up to the 2008/09 recession, there are risks alongside the uptrend given exposure to rate increases."

Some of Ms. Cooper's points:

1. Most of that $10-billion to $12-billion was borrowed from banks, largely via lines of credit, and specifically home equity lines of credit, or HELOCs. Indeed, those accounted for more than half of the overall growth in the second quarter, the most they've represented since 2011.

2. Overall household credit balances climbed in July by 5.7 per cent from a year earlier, or the fastest since October, 2011: "This compared to a recent low of 2.6 per cent in January, 2016, and resulted in the amount of debt owed by Canadians climbing to nearly $2.1-trillion."

3. The consumer credit portion of that, from personal loans to plastic, rose 4.4 per cent, for the fastest since February, 2011: "An uptrend in consumer credit accumulation has continued relatively unimpeded since early 2016 and is now well above the cycle-lows seen in the latter half of 2013 – before the Bank of Canada cut policy rates in response to the crude oil price plunge."

4. Mortgage borrowing, having eased last year amid a "minimal dampening effect" from federal qualifying measures, perked up in the first half of this year: "But higher borrowing rates against a backdrop of regulatory change – notably Ontario's Fair Housing Plan introduced in April – are expected to dampen housing demand and, consequently, slow mortgage growth over the coming quarters."

At this point, delinquency rates are stable, according to Equifax Canada.

"In Alberta, the delinquency rate increased by just 1.7 per cent compared to a year ago, following two years of larger quarterly increases," Equifax said in a second-quarter report.

"Ontario, PEI and B.C. saw lower delinquency rates, with decreases of 8.1 per cent, 10.6 per cent and 9.8 per cent, respectively."

(Of course, if you're one of Alberta's 1.7 per cent, you might not find the numbers all that stable.)

The Bank of Canada first shifted gears in mid-July and raised its key overnight rate by one-quarter of a percentage point to 0.75 per cent. Another move today brought the rate to 1 per cent.

"The period marked by a voracious appetite for debt accumulation may thus be nearing its end," Ms. Cooper said.

Read more

Prices slide

Home prices continued their multi-month slide in the Toronto area in August, driven by falling demand for detached houses even as condominium prices climbed, The Globe and Mail's Janet McFarland reports.

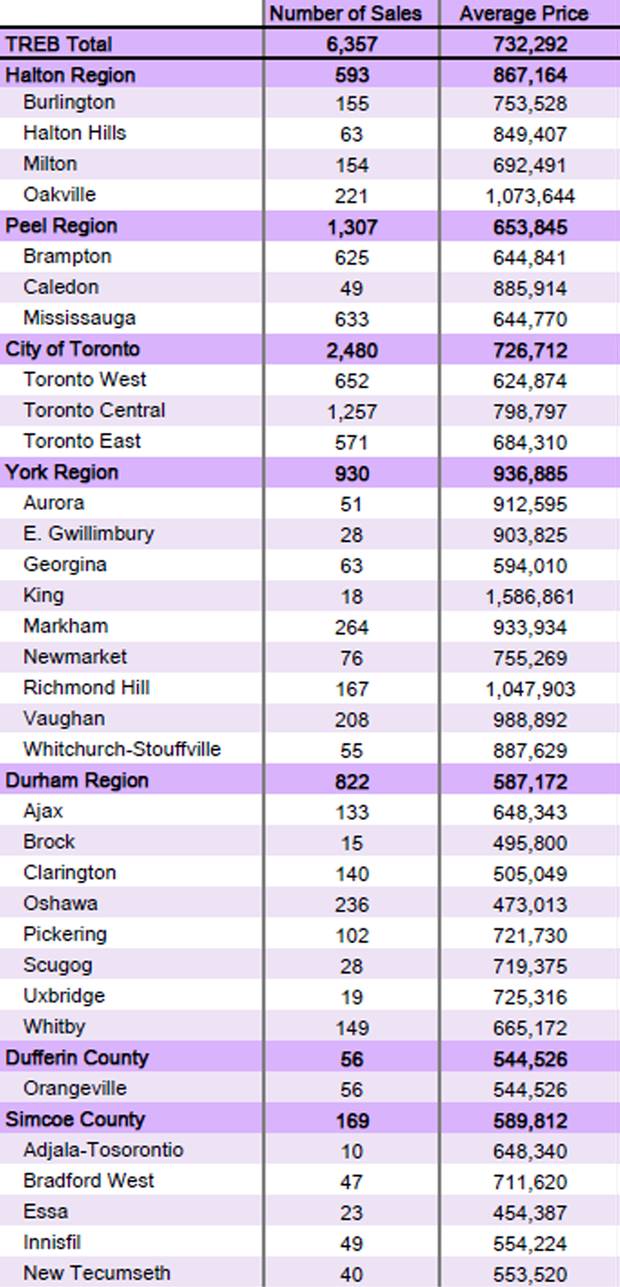

The average home in the Greater Toronto Area sold for $732,292 in August, a 20.5-per-cent drop from the market's peak in April, when prices for all types of homes averaged $920,791, according to the Toronto Real Estate Board.

Compared to a year ago, the average price for a home in the GTA is up just 3 per cent, which means a four-month drop in prices since April has eroded almost all of the gains the Toronto market recorded late last year and earlier this year.

Here's a breakdown of prices across the region:

Source: Toronto Real Estate Board

Read more

Markets at a glance

Read more

Trade gap narrows

Canada's trade deficit narrowed in July but still tallied a hefty $3-billion.

Imports tumbled 6 per cent, outpacing the 4.9-per-cent drop in exports, leading to the lower shortfall from June's $3.8-billion gap, Statistics Canada said. Both declines were largely because of lower prices.

Remember, the Canadian dollar surged against the greenback in July as the Bank of Canada moved to a tightening cycle.

"As the loonie continues to push stronger, trade fundamentals are pointing the other way," said Royce Mendes of CIBC World Markets.

"Prices did play a significant role, but weaker volumes also contributed and point to a slowdown in growth in the third quarter," he added.

"Declines in key manufacturing areas, namely autos, suggest a weak monthly report for that sector, and as a result the monthly GDP result as well."