Briefing highlights

- ‘Rocky Horror Election Show’

- How I'd recast the cult classic

- TD group in Scottrade deal

- Wallonia says no

- Global markets on the rise

‘Rocky Horror Election Show’

Here’s “The Rocky Horror Election Show,” as presented by BMO Nesbitt Burns chief economist Douglas Porter, whose latest report on Hillary Clinton vs. Donald Trump is pegged to The Rocky Horror Picture Show.

Mr. Porter’s report follows the final Clinton-Trump debate, and the economic issues raised. As he and others have noted, markets believe Ms. Clinton will walk away with the presidency, although Congress is up in the air.

“Heading into the final two weeks (mercifully), here’s a quick recap of what could be affected most by the election results (with a Rocky Horror theme reflecting the lack of decorum, at least from one candidate),” Mr. Porter said.

On trade: ‘It’s just a jump to the left’

“By far the most remarkable, and troubling, aspect of this year’s election campaign from an economics standpoint was the lurch toward protectionism by both parties,” Mr. Porter said.

“The shift by the Democrats was perhaps less notable, but it’s unusual to say the least to have the party’s candidate disavowing a trade deal (TPP) reached by the President of the same party,” he added.

“Moreover, Clinton’s defence of freer trade during the debates was half-hearted, at best, and her pledge to appoint a trade prosecutor scarcely bodes well for U.S. trading partners.”

Mr. Trump, of course, could affect Canada most with his vow to redraw, or even rip up, the North America Free Trade Agreement.

On taxes: ‘and then a step to the right’

“Both candidates have pledged relief for the middle class, but they differ significantly on where to go with rates on higher incomes,” Mr. Porter said, noting Mr. Trump’s pledge to reduce taxes on the wealthy and Ms. Clinton’s vow to raise them, along with social security charges.

Mr. Trump would also ease corporate taxes.

On budget deficits: ‘rose tint my world’

Observers think both the Democratic and Republican nominees would run swelling deficits, Ms. Clinton because of spending on infrastructure and Mr. Trump because of tax cuts, Mr. Porter noted.

He cited the fact, though, that Ms. Clinton promises to hold the line on other spending, and that Mr. Trump says not to worry because he would oversee a strengthening economy.

“Sadly, demographic realities and sluggish productivity trends suggest an economic boom in coming years is extremely unlikely, regardless of who’s in charge,” Mr. Porter said.

BMO forecasts that the United States will be lucky to see economic growth above the 2.1-per-cent rate of the past several years.

And, oh, Mr. Porter noted, the fiscal 2015-16 deficit is a fat $587-billion.

On the central bank: ‘dammit, Janet’

“Despite their best efforts to lay low, the Federal Reserve managed to become an item in this year’s election,” Mr. Porter said.

“Moving beyond a call among many in Congress to audit the Fed – which may yet become a reality – Trump flatly avowed to excuse Fed Chair Janet Yellen from her job at the first opportunity (her term expires early 2018).”

Thus, he added, a Trump win would mean huge uncertainty for the markets.

On the election results: ‘wild and untamed thing’

“Given Donald Trump’s musings that he reserves the right to challenge the election results, this drama may not be over for the markets on Nov. 9,” the BMO economist said.

“We can only hope that we don’t head into a Time Warp, falling back to the post-election drama of 2000.”

That’s where Mr. Porter leaves us.

Me, I neither threw toast at the screen, nor sat in the back row, although I did have a journalism school friend who landed at The Plain Dealer in Cleveland, which die-hards will remember is the newspaper Janet uses to shield herself from the storm.

Despite my reserved nature at the late-night show, I’d like to add a few of my own:

‘You look like you’re both pretty groovy’

‘Well, you got caught with a flat. Well, how about that?’

‘I’ve been making a man with blonde hair and a tan’

How I'd recast

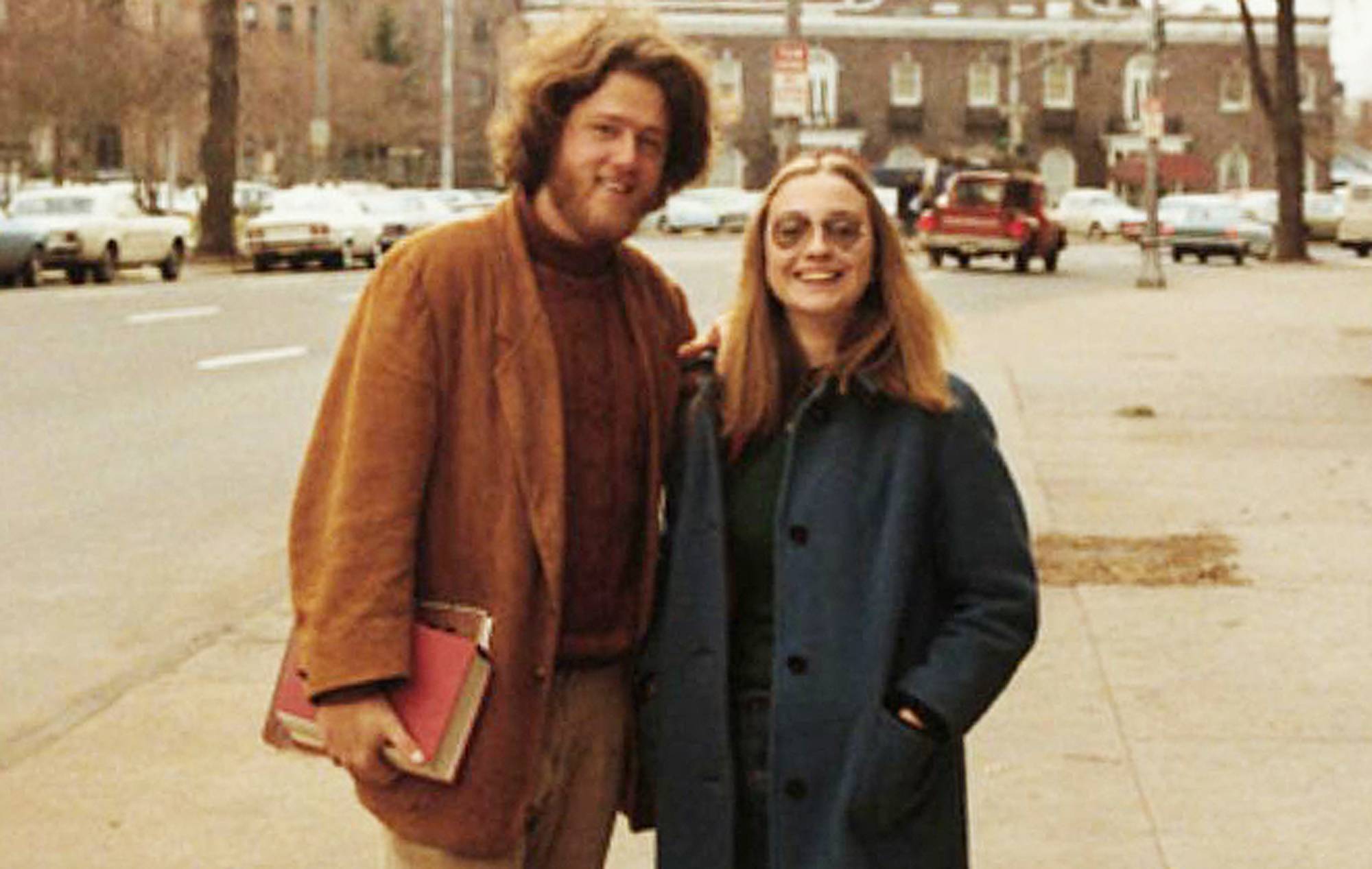

And in the spirit of Mr. Porter’s unique look at the U.S. presidential race, here’s how I’d cast a remake of the 1975 cult classic, a new version of which appeared on television last week:

TD in Scottrade deal

Toronto-Dominion Bank and discount broker TD Ameritrade have struck a $4-billion (U.S.) deal for rival Scottrade Financial Services Inc.

It’s actually a series of deals.

Toronto-Dominion Bank will first acquire Scottrade Bank from its parent for $1.3-billion, merging it into its North American unit.

TD plans to then buy 11 million more shares of TD Ameritrade, worth $400-million. After that, TD Ameritrade buys Scottrade Financial Services for $4-billion, or $2.7-billion when you strip out the Scottrade Bank portion.

The Globe and Mail’s Andrew Willis and Rita Trichur reported earlier this month that the deal was close.

Wallonia says no

The problems surrounding the “surrealist” standoff over a trade deal between Canada and the EU highlights global trade tensions, analysts say.

As The Globe and Mail’s Steven Chase reports, the EU has slapped a Monday afternoon deadline on the Belgian region of Wallonia to agree to the deal, or it will cancel a summit with Prime Minister Justin Trudeau.

An official of Wallonia said his government can’t meet that deadline.

“The surrealist development had the Canadian trade minister reportedly ‘on the verge of tears’ and hinted at the pitfalls ahead of the Brexit negotiations,” said Alvin Tran of Société Générale, referring to the stalemate over the deal known as CETA.

“More than that, CETA’s plight and the opposition to the TPP and TTIP highlight the growing backlash against globalization. But this is an issue that is still beyond the market’s present gaze.”