Debt and wealth

Statistics Canada is expected to report this morning that a key measure of household debt has hit yet another fresh high in Canada.

But interest rates are at rock bottom, and are going to remain there, so economists aren’t overly concerned.

Not only that, our net worth is on the rise as property values increase.

Royal Bank of Canada projects today’s report will show household debt rose in the fourth quarter by 1.6 per cent to $2-trillion, and that net worth swelled by $100-billion to $9.4-trillion.

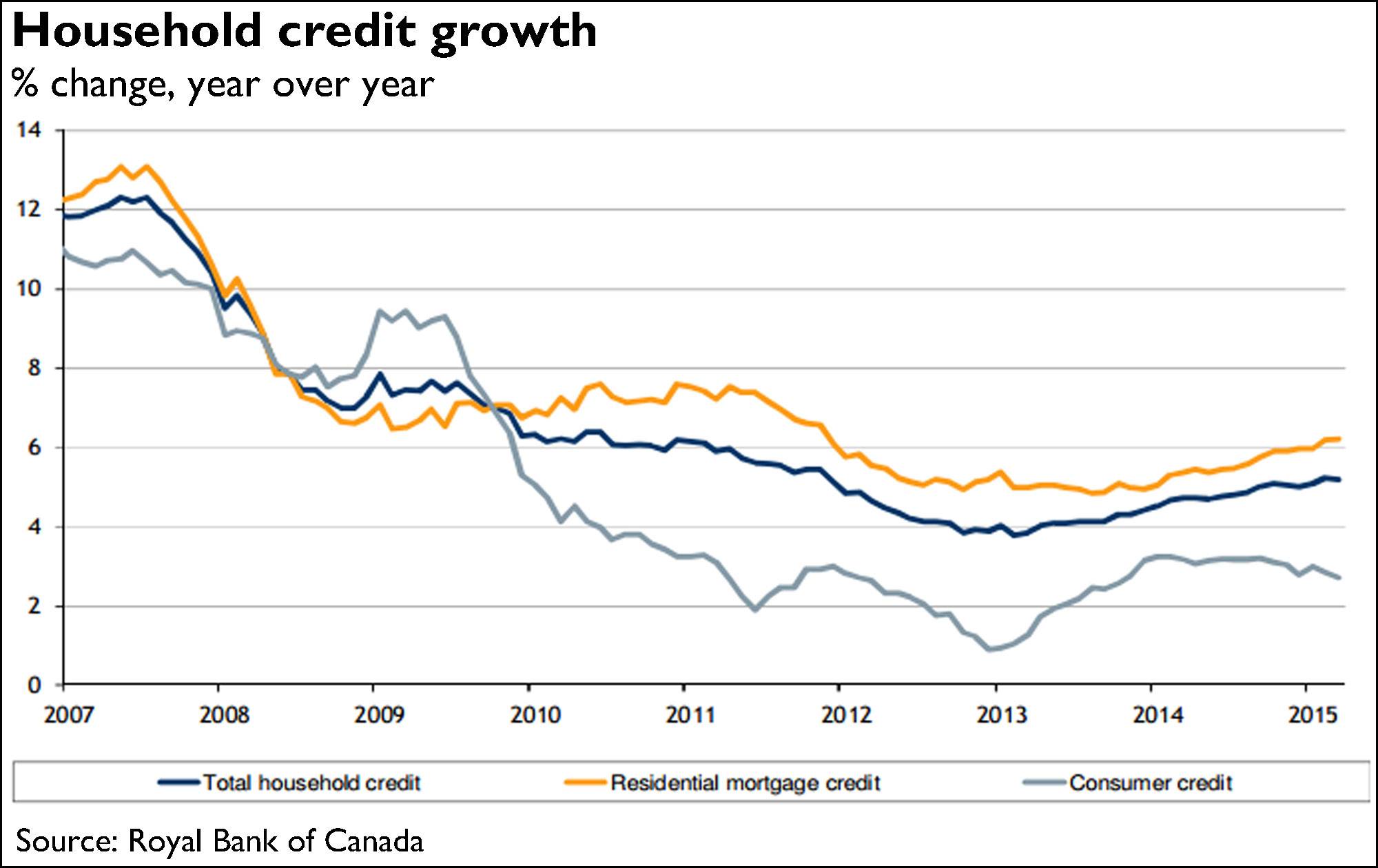

But consumer borrowing is believed to have climbed at a faster pace than disposable income, largely on the back of mortgage debt, in turn driving the key measure of debt to income to new record of 165.2 per cent.

“Moreover, with growth in both assets and net worth expected to be more modest than that of debt, the debt-to-asset and debt-to-net worth ratios will both likely edge up as well to 16.9 per cent and 20.3 per cent, respectively, from 16.8 per cent and 20.2 per cent,” said RBC assistant chief economist Paul Ferley.

While ever-rising debt levels have been a concern in Canada for years, observers aren’t ringing alarm bells particularly loudly.

“Unseasonably warm weather helped drive housing market strength (centred in B.C. and Ontario), suggesting that borrowing was stronger than normal,” said senior economist Benjamin Reitzes of BMO Nesbitt Burns.

“However, the Bank of Canada has made it clear that household debt concerns are secondary and policy will only respond once other avenues have been exhausted.”

Helping things along are stronger home values and the low Canadian dollar, Mr. Reitzes said, though both he and Mr. Ferley noted softer equity markets.

“Over all, debt loads may be significant, but interest rates are low and unlikely to rise soon, leaving Canadian balance sheets in decent shape,” Mr. Reitzes said.

Of course, some of that depends on just how swollen your debt levels are.

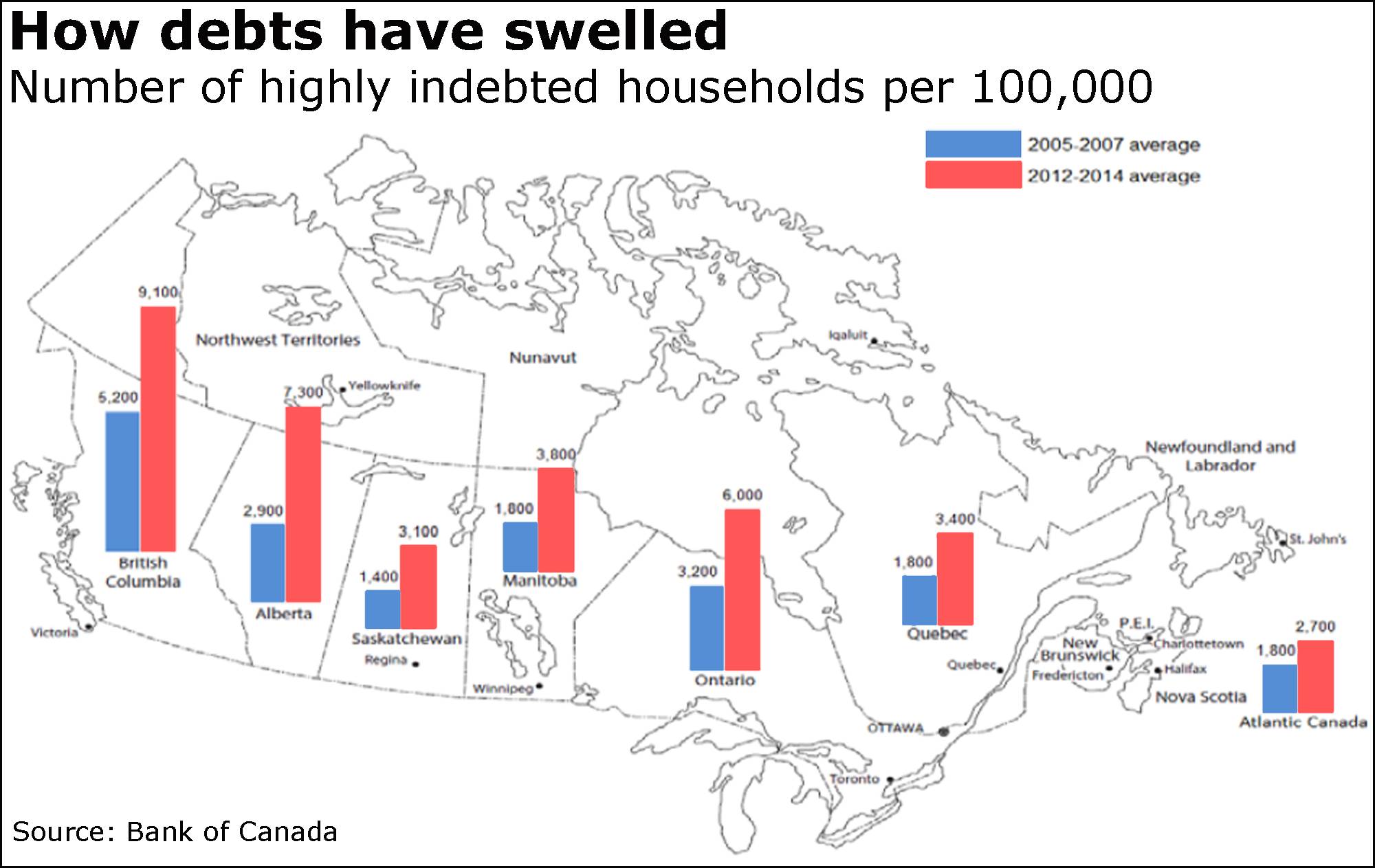

As this chart shows, the Bank of Canada has cited the growing numbers of households with debt-to-income at or above 350 per cent.

They’re concentrated in Alberta, B.C. and Ontario.

And while the latter two may not be a big source of worry at this point, Alberta is in the midst of an oil shock, and unemployment has spiked.

A scene I'd love to see ...

“The Canadian dollar is worth how much?”

Markets rise

Investors can’t seem to make up their minds on the latest stimulus measures from the European Central Bank.

Stocks initially climbed after the ECB’s announcement yesterday morning, but quickly tumbled after comments from central bank chief Mario Draghi.

And so far this morning, markets are up sharply in Europe, while New York appears headed for a stronger open.

“After a roller-coaster session on Thursday, the European equity markets popped to the upside,” said London Capital Group analyst Ipek Ozkardeskaya.

Tokyo’s Nikkei gained 0.5 per cent, Hong Kong’s Hang Seng 1.1 per cent, and the Shanghai composite 0.2 per cent.

Europe is absolute flying, with London’s FTSE 100, Germany’s DAX and the Paris CAC 40 up by between 1.7 per cent and 3 per cent by about 5:45 a.m.

New York futures are also up.

“The chaos of yesterday has subsided as traders have come back into the office having had a little more time to digest all of the changes that Draghi introduced,” said IG market analyst Alastair McCaig, referring to the ECB’s cut in key rates and more money for an asset-buying stimulus program known as quantitative easing, or QE.

“It’s amazing what the concept of an extra €20-billion of QE working its way into the markets on a monthly basis can do for confidence,” Mr. McCaig said.

“Expectations had been high, and to be fair the ECB delivered at the top of the range. Traders, though, are a cynical bunch, and the extent of stimulus measures was taken as a signal of how worried the ECB was about the current state of affairs in Europe, as opposed to how determined it was to help improve the outlook.”

What else to watch for today

More important than the debt-and-wealth report this morning will be Statistics Canada’s latest look at the jobs market.

As always, economists are divided on what to expect, projecting anywhere from a loss of 10,000 jobs in February to a gain of 10,000.

They also believe the report will show the jobless rate holding at an elevated 7.2 per cent.

This is the last reading of unemployment that Finance Minister Bill Morneau will have before he unveils a March 22 budget expected to include billions of dollars in stimulus spending.

“Over the next few months, the national unemployment rate should reach 7.5 per cent,” warned Nick Exarhos of CIBC World Markets, who expects this morning’s reading to show that 10,000 jobs were shed last month.

“The pain will be concentrated out west, while more constructive forces east of the prairies will drive healthier labour markets in central Canada.”