Briefing highlights

- Why you won't be richer than you think

- Global markets on the rise

- Bank of Japan tweaks policy

Wealth at record. But wait

To twist the slogan of one of Canada’s big banks, here’s why you won’t be richer than you think: House prices.

The latest numbers from Statistics Canada show household net worth now at a record $9.8-trillion, or $271,300 on a per-capita basis.

That’s more than 830 per cent when measured against disposable income.

But. And there’s a big but here.

We’re wealthier in large part because of hot property values and stock investments.

Forget the latter, and focus on home prices, which Statistics Canada says was the primary driver of net worth in the second quarter of the year.

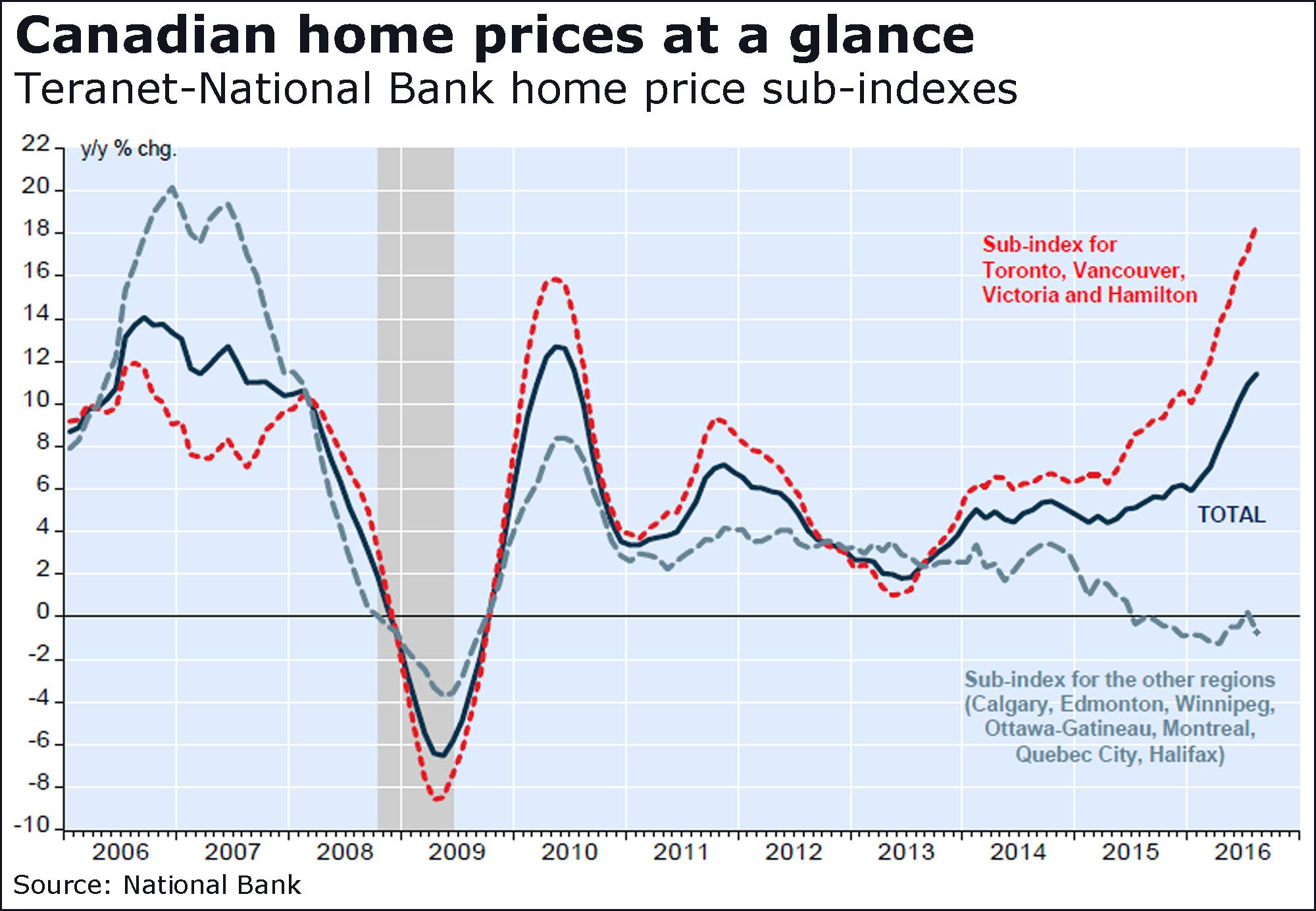

While the Toronto housing market is on fire, it and its surrounding regions are just about the only hot ones left.

The Vancouver market is cooling rapidly, and is expected to do so in the wake of a new 15-per-cent tax on foreign buyers of homes in the area.

Other markets have also cooled, and observers expect Toronto will get there, as well, in time.

While the Statistics Canada report showed net wealth at a record, the “value of assets can fluctuate considerably,” noted Paul Ashworth, the chief North American economist at Capital Economics.

“In this case a large part of the surge in net wealth over the past couple of decades is due to the rise in housing values,” Mr. Ashworth said in a recent report.

“When house prices fall, so will households’ net wealth.”

The drop in average Vancouver home prices has “already exceeded our expectations for a 10-per-cent peak-to-trough correction,” said Toronto-Dominion Bank economist Diana Petramala, projecting that market will “remain weak” through to at least early next year.

As for Toronto, “relatively tight market conditions and a lack of new initiatives to tax foreign real estate activity should keep Toronto home prices in the black, with home price appreciation to cool in line with inflation beginning in mid-2017,” Ms. Petramala said.

“Low interest rates coupled with modest economic gains are expected to keep housing activity fairly stable elsewhere in Canada. Still, following a 10-per-cent gain this year, weakness in Toronto and Vancouver are expected