Is Yellen right?

Federal Reserve chair Janet Yellen certainly spooked investors with her warning yesterday that stocks are looking frothy.

She didn’t put it that way, of course.

The chief of the U.S. central bank warned that stock valuations “generally are quite high” and that long-term yields could rise once the Fed starts down the interest-rate-hike path.

That caused an upset in the market initially this morning, though things settled down later. Nonetheless, it prompted Bank of Montreal senior economist Jennifer Lee to ask whether this was “Yellen’s ‘irrational exuberance’ moment.”

Is Ms. Yellen right?

Analysts have certainly been sounding alarms off and on.

“This is something we’ve been seeing for a while,” said senior economist Robert Kavcic, Ms. Lee’s colleague at BMO.

There are a range of measures that show stock values anywhere from “somewhat expensive” to “very expensive,” Mr. Kavcic said in an interview.

And the truth, he added, is probably somewhere in between.

“The bottom line being that valuations are pretty rich,” Mr. Kavcic said.

Mr. Kavcic cited one measure, in the chart above, that may well tell the story.

“Here, the cyclically-adjusted p/e ratio (based on 10-year average earnings) is pushing the highest levels seen outside of two notorious periods – 1999 and 1929,” he said in a research note.

“But, of course, this is just one measure.”

Bombardier plans rail IPO

Bombardier Inc. is poised for an initial public offering of a minority stake in its rail unit but says it has no intention of selling the entire division.

The move will help boost the plane and train maker’s financial position while also allowing for the possibility of taking part in future rail industry consolidation, the company said today as it posted a decline in first-quarter earnings and flat revenues.

Montreal-based Bombardier also said the launch customer in 2016 for its new C Series aircraft will be Deutsche Lufthansa AG’s Swiss arm -- Swiss International Air Lines, The Globe and Mail's Bertrand Marotte reports.

The company also said the C Series will make its global debut at the International Paris Air Show at Le Bourget next month.

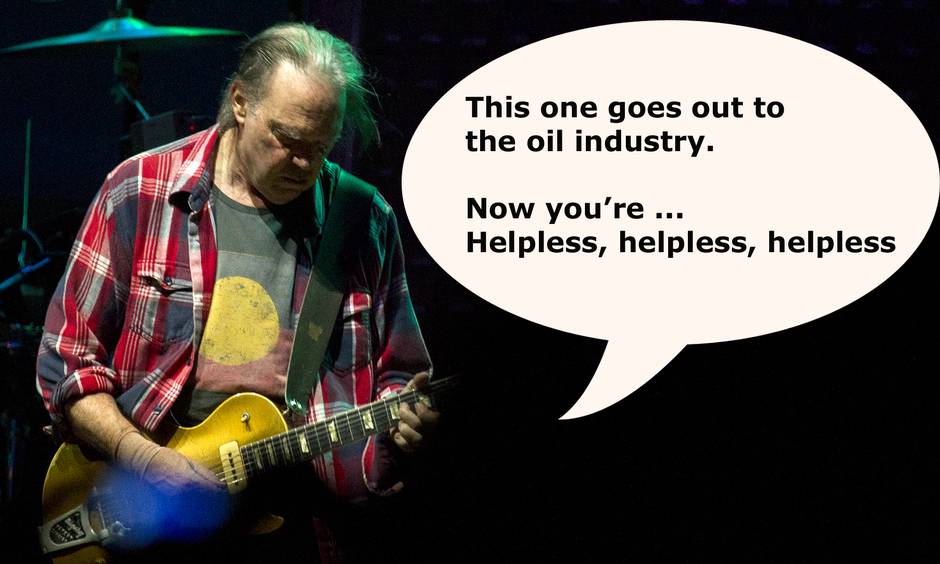

Songs I'd love to hear

What Canadian-born rocker Neil Young, who has campaigned against the oil sands, might want to sing after the NDP’s sweep to power in Alberta.

Manitoba Tel slashes

Manitoba Telecom Services Inc. is cutting deep.

After a four-month review, MTS today revealed a new strategy along with 500 job cuts at its Allstream division and a cut to its annual dividend, The Globe and Mail's Christine Dobby reports.

One hundred employees have already left Allstream, MTS’s troubled enterprise IP services division, and an additional 400 will leave this year and next.

MTS is also cutting its annual payout by about 24 per cent to $1.30 from $1.70 and boosting its prefunding of its pension plans, where solvency has been a perennial concern.

New CEO Jay Forbes said today the changes come after a “situational assessment that openly challenged our understandings and beliefs of the business.”

Manulife hikes dividend

Manulife Financial Corp.’s profit fell in the first quarter as investment performance weighted on results, while the company hiked its quarterly dividend, The Globe and Mail’s Jacqueline Nelson reports.

The Toronto-based insurer said today that its net profit fell to $723-million or 36 cents a share in the first quarter, down from $818-million or 42 cents a share a year earlier.

The insurer’s core earnings increased to $797-million in the quarter, or 39 cents a share, up from $719-million, or 37 cents a share, a year earlier.

The insurer also said it would increase its quarterly dividend by 10 per cent, or 1.5 cents per share, to 17 cents per share.

Results pour in

Other corporate earnings results are also flooding in again today.

Canadian Natural Resources Ltd. is but one example, and notable in that it posted its first loss in more than four years amid the oil shock.

“Without a clear answer to whom will be in Downing Street come Friday, dealers are giving sterling a wide berth.”

David Madden, IG

What to watch for today

The British election is the biggie, of course, but there’s plenty more for shareholders far and wide to chew on.

With so much at stake, markets are closely watching the U.K.

“But the trends may not become clear until early Friday morning,” said Julian Jessop of Capital Economics.

“Even when all the results are known it may be days – or weeks – before the make-up of the next government is determined,” he added in a report.

“This suggests that political uncertainty could drag on U.K. markets for some time. We have identified four main risks: protracted coalition negotiations, the prospect of an in-out referendum on the U.K.’s membership of the EU if the Conservatives win (especially if the anti-EU party UKIP also does well), a perceived anti-business bias if Labour wins, and the heightened risks to the integrity of the U.K. if the pro-independence Scottish National Party holds the balance of power.”

Just like the rest of us

With an obvious exception, millionaires seem to feel just like the rest of us.

“Many millionaires, particularly those with children at home, feel pressure to keep working hard to improve or just maintain their family’s lifestyle,” UBS says in a new study.

“Half of these millionaires feel stuck on a treadmill where slowing down at work would mean giving up the lifestyle to which the

whole family has grown so accustomed.”

Here’s the obvious exception from the bank’s second-quarter Investor Watch: Two-thirds of those surveyed think that “the whole point of working to build wealth” is to be financially secure, but only those with at least $5-million believe they’ve reached that point.

Some 52 per cent of the 2,215 American millionaires surveyed in mid-March feel stuck on that treadmill, and 63 per cent say a “major setback” would hit them hard.

Asked what they’d do differently if they had just five more years to live, here’s how millionaires answered:

Sixty-four per cent say they’d travel more. (So would I, presumably to a doctor who could cure me.)

Just 44 per cent say they’d retire. (Maybe the rest would prefer to work themselves to death sooner?)

Thirty-seven per cent say they’d “be a better person.” (Why bother if you’re going to live?)

About the same number say they’d spend more time on their passions. (Of course, those passions would presumably be dictated by why they only have five years left.)

Twenty-eight per cent would want to “enjoy the finer things in life.” (As millionaires, I’d assume they’re doing that now.)

And the kicker: Just 3 per cent would “work harder to provide for my family.” (Screw ‘em, right?)

Some other interesting findings:

Sixty-five per cent say their children don’t understand the value of money. (Mine do: I’m supposed to give mine to them.)

Eleven per cent say their biggest regret in life was “not taking care of my health.” (Which may be why they’re going to die in five years.)

Asked what socioeconomic class they’re in, 24 per cent describe themselves as middle class. (Hello? I’m middle class.)

On the same question, 1 per cent think they’re working class. (Not exactly the 1 per cent that the Occupy movement was talking about.)

The Bottom Line: Don't count on a soaring loonie for long

- David Berman: Currency strategist Sutton assumes new role at Scotiabank

Streetwise (for subscribers)

- Glen Hodgson and Danielle Goldfarm: Services exports: Canada’s quiet growth engine

ROB Insight (for subscribers)

- Gordon Pape: Brookfield rewards long-term investors