Saudi refusal aggravates

Saudi Arabia is standing firm - and idle - as the oil rout chokes its OPEC partners and other producers like Canada.

Saudi oil policies aren’t the cause of the slump, of course. At the heart of it all is an oil glut.

But Saudi Arabia’s refusal to cut production, and simply suffer the collapse in prices without taking at least some action, is seen as aggravating an already bad situation among producers.

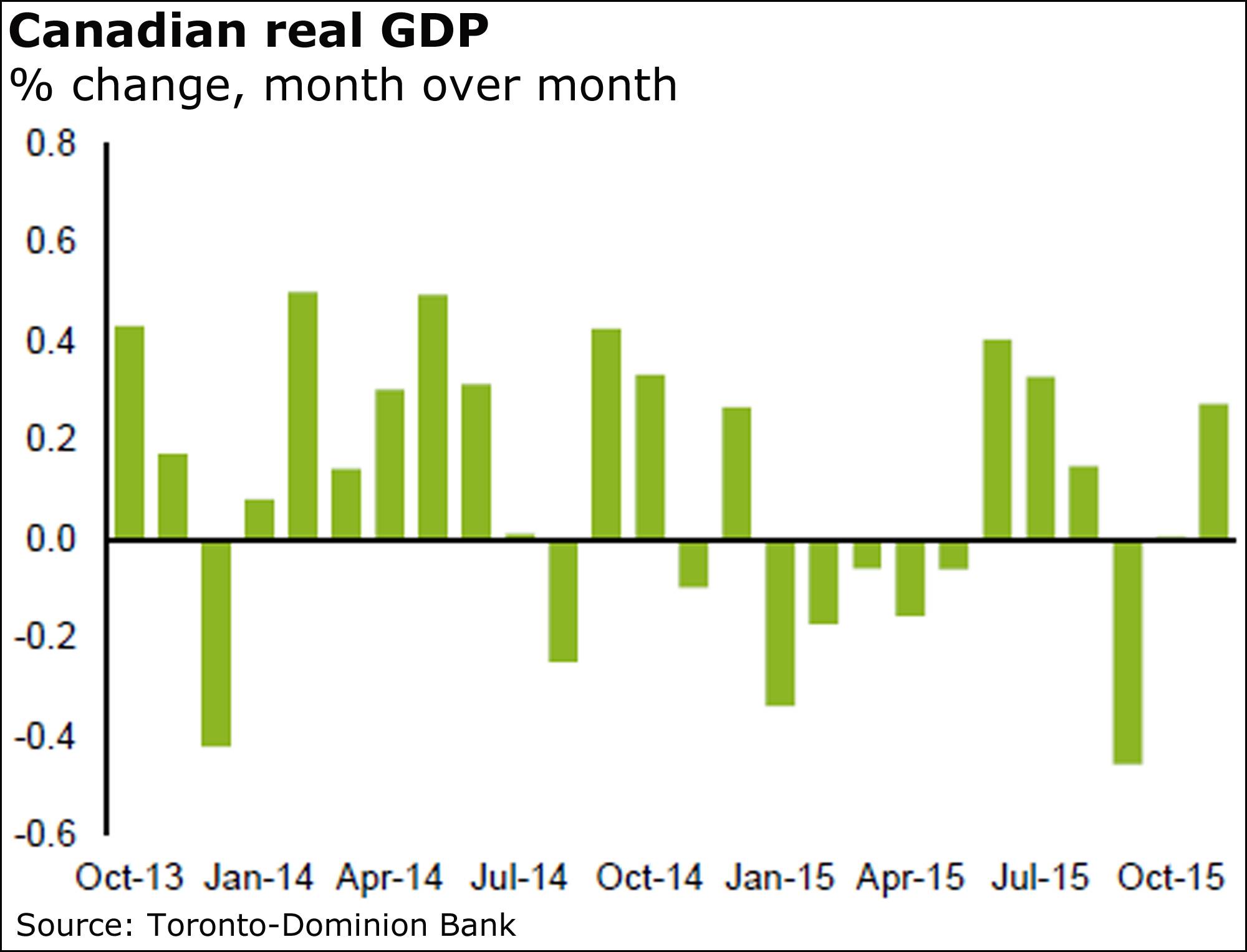

We’ll get fresh evidence tomorrow of how the oil rout is hitting home when Statistics Canada is expected to report that the economy just about stalled in the fourth quarter of last year.

Given its importance, it doesn’t take much for Saudi Arabia to have a significant impact on the oil market, as has been the case for a few weeks now.

The Saudis had buoyed hopes when they agreed with Russia and two other players to cap production at January levels, which some observers believed could be setting the stage for a production cut that would help buoy prices.

No such luck.

Saudi oil minister Ali al-Naimi shot that down rather quickly, and, indeed, went much further at a conference in Houston last week.

He not only rejected OPEC production cuts, but went as far as to say the Saudis were ready to suffer crude at just $20 (U.S.) a barrel.

While Canada’s economy is hurting, things are nowhere near as bad as among certain other OPEC members.

The Saudi minister’s comments no doubt “went down like a ton of bricks on many OPEC capitals and will likely deepen the divisions within OPEC,” said Royal Bank of Canada strategists Helima Croft, Michael Tran and Christopher Louney.

“Al-Naimi’s explicit rejection of the official OPEC mandate to pursue stable prices and professed comfort with $20 a barrel will once again fuel speculation that Saudi Arabia is entirely indifferent to the economic and political calamities facing numerous cartel members,” they said in a report.

“A country like Venezuela is on the precipice of a humanitarian crisis, with the economy set to contract by 10 per cent, inflation set to reach 720 per cent, and with clean water, electricity and essential medicine in increasingly short supply,” they added.

“Its fate will hinge in large part on whether China will continue to provide emergency financing. Nigeria, Iraq and Angola are also seeking economic lifelines from China, the IMF and World Bank.”

Mr. Al-Naimi also fired a shot across the bows of the United States and Canada, saying “uneconomic producers will have to get out.”

He probably sees the U.S. as a bigger issue, Ms. Croft said in an interview.

“I think the Saudis would say that under no circumstances was this aimed at Canada’s fiscal health,” said Ms. Croft, RBC’s head of commodity strategy in New York.

“But are they prepared to live with the economic pain on producing countries? Yes.”

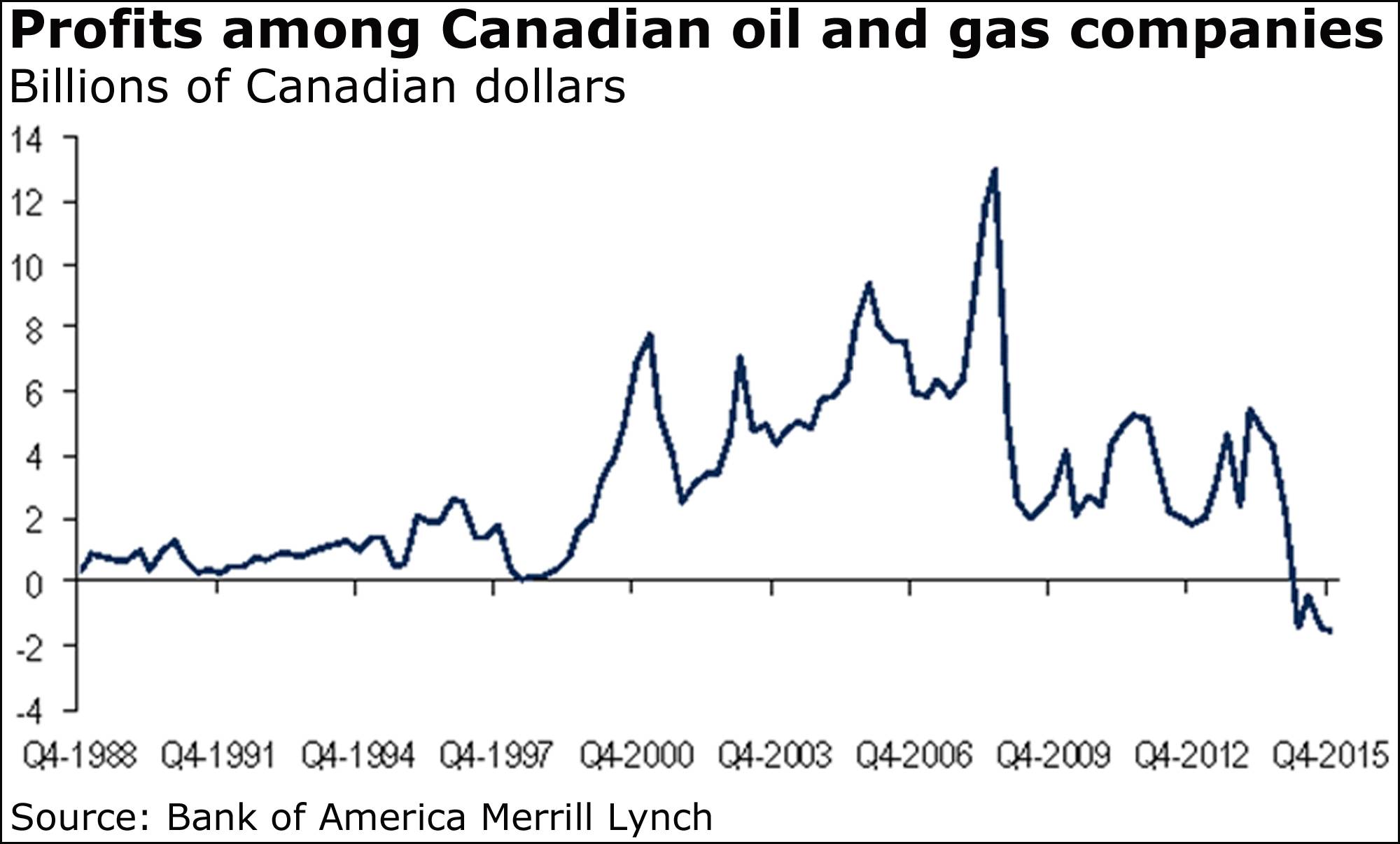

We see that economic pain in Canada on a constant basis, from spiking unemployment in Alberta to swelling government budget deficits in Edmonton and Ottawa.

And, of course, the projections for economic growth in Canada this year, which range from about 1.5 per cent all the way down to below 1 per cent.

“The largest risk is a continued deterioration in the energy sector,” said Emanuella Enenajor, the North America economist at Bank of America Merrill Lynch.

She noted the promise of aid to energy companies from Export Development Canada, which will help short term, but “beyond that, Canada’s energy patch will continue to feel the pressure to cut additional capital spending and workers.”

For the record, Mr. Al-Naimi said Saudi Arabia hasn’t “declared war” on any country or company, referring to speculation that his country is trying to strangle U.S. shale producers.

(Editor's note: An earlier version spelled Mr. Tran's name in correctly.)

A scene I'd love to see ...

“Vote for Donald. And I’ve got a bridge I can sell you.”

China cuts ratio

China’s central bank moved again today, cutting the reserve requirement ratio for banks by half a percentage point.

This came after Chinese stocks, which have been exceptionally volatile of late, plunged again.

The People’s Bank of China said the move, effective tomorrow, was done to maintain “adequate” liquidity and a stable financial system and to “guide steady moderate growth of money and credit.”

The rate for big banks now stands at 17 per cent, and it may not end there.

“Expect more,” said Derek Holt and Dov Zigler of Bank of Nova Scotia.

“China’s RRR has been cut by 450 basis points since it peaked in mid-2011 and is now back down to where it stood in May, 2010.”

Valeant CEO returns

Michael Pearson is back on the job as chief executive officer of Valeant Pharmaceuticals International Inc. today after a bout of what the company described as severe pneumonia with complications.

At the same time, Valeant announced it’s separating the roles of CEO and chairman, the latter being filled by Robert Ingram.

The company also delayed its plan to unveil fourth-quarter results today.

“Given the timing of Mr. Pearson’s return, the company will be rescheduling its previously announced call to discuss preliminary fourth-quarter 2015 results, deliver a business review, and provide updated guidance for 2016,” it said.

Notably, it added that it’s “withdrawing its prior financial guidance.”

What to watch for this week

There’s a smattering of other economic reports this week along with Canadian GDP, and some quarterly corporate results worth watching, too.

As The Globe and Mail’s David Parkinson writes, expect details tomorrow of how Canada’s economy stumbled to close out 2015.

Economists expect the Statistics Canada report to show no economic growth, or possibly something you’d describe as teeny, in the fourth quarter.

“Taking a forward-looking view, the more recent monthly data has generally been supportive of growth, and industry-level GDP is expected to have made a modest advance in December,” Toronto-Dominion Bank economists said in a research note.

“This should provide some decent momentum heading into the first quarter of 2016, although our current tracking suggests that the start of the year is likely to see only modest growth.”

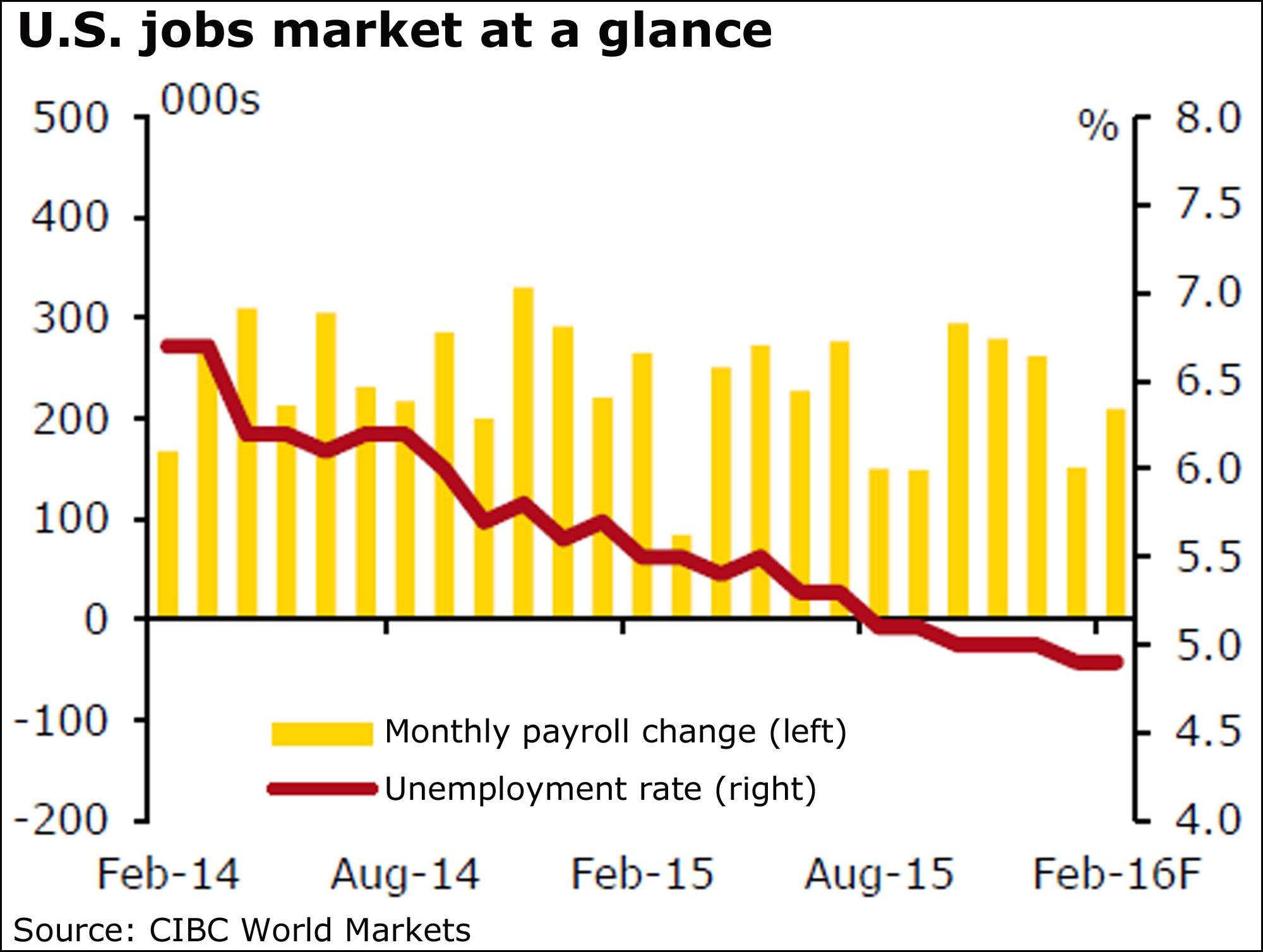

Another key market number comes out on Friday as the U.S. government releases its latest jobs report.

Economists expect to see net job creation of between about 190,000 to 195,000 positions, with the unemployment rate holding at 4.9 per cent.

“Looking ahead, it will be key for the economy to continue decreasing slack in the labour force for the [Federal Reserve] to get back on track with its rate hike cycle,” said Royce Mendes of CIBC World Markets.

On the corporate front, today brings a quarterly earnings report from PrairieSky Royalty.

Tomorrow, Bank of Nova Scotia rounds out the first-quarter reports of Canada’s big banks, while Maple Leaf Foods and Glencore also report.

Later in the week, we’ll get Costco, Newalta, Barnes & Noble, Canadian Natural Resources, Canadian Western Bank, George Weston, Martinrea International, Paramount Resources, SNC-Lavalin, Sprott and Staples.