Some investors don't want to be bothered with following their stocks on a regular basis. They prefer to buy and forget, checking in maybe once or twice a year to make sure there's nothing seriously amiss.

This Buy and Hold Portfolio was created in June 2012 for this type of person. It contains a bond fund and a mix of Canadian and U.S. stocks, which will rarely change.

The equity focus is on blue-chip stocks that offer long-term growth potential plus, in all cases but one, regular dividend payments. The original weighting was 10 per cent for each stock with the bond ETF given a 20-per-cent position.

I used several criteria to choose the stocks including a superior long-term growth profile, industry leadership, good balance sheet, and relative strength in bad markets.

At the time, I stated that the objective was to generate decent cash flow and slow but steady growth. The target rate of return is 8 per cent annually.

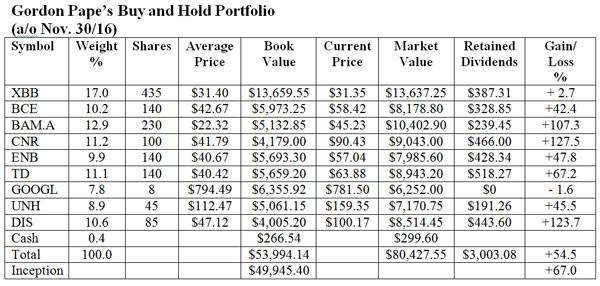

These are the current securities we hold with some comments on how they performed since my last review in June. Prices are as of mid-day on Nov. 30.

iShares Canadian Universe Bond Index ETF (XBB-T). The rally in the bond market began to peter out in late summer and the election of Donald Trump has sent prices tumbling amid concerns over rising interest rates and higher inflation. This ETF is down 83 cents since our last review in June, which was only partially offset by distributions totalling 43 cents per unit.

BCE Inc. (BCE-T). After a strong rally at the start of the year, BCE shares pulled back in the past six months, dropping $1.47 in value. We received two dividends of totalling $1.365 per share, which almost offset the stock price drop.

Brookfield Asset Management (BAM.A-T). Brookfield's shares pulled back by 69 cents over the summer and fall. We received two dividends totalling 26 cents (U.S.) per share.

CN Rail (CNR-T). After a stumble early in the year, CN Rail went on a strong run, with the shares up $14.68 since the last review. Because of timing, we received only one dividend during the period, for 37.5 cents per share. The big capital gain over the summer has vaulted this stock to the top of our performance list.

Enbridge (ENB-T). Enbridge has had a good run this year. The shares hit a 52-week high of $59.19 in August, before pulling back a little to the current level. They are up $3.42 since the last review. We received two dividends totalling $1.06 per share during the period.

Toronto Dominion Bank (TD-T). After a rough start to the year, bank stocks have been on a roll recently, fuelled by speculation of higher interest rates and an easing of restrictions on U.S. banks under a Trump presidency. Many people are surprised to learn that TD has more branches in the U.S. than it does in Canada, and is therefore in a good position to benefit from any bank-friendly developments in Washington. The stock is up $7.11 from the June review plus we received two dividends of 55 cents each. Total return over the period was 14.5 per cent.

Alphabet (GOOGL-Q). This company, which comprises the Google empire, got off to a bad start after we added it to the portfolio last year. It bounced back over the past six months, gaining $47.24 (U.S.) per share, which brings us back close to break-even. The stock does not pay a dividend.

UnitedHealth Group (UNH-N). This health insurer stock was added to the portfolio in January 2015. It has done very well for us, gaining $19.72 (U.S.) in the latest review period. We received three dividends of 62.5 cents each during the period for a total six-month gain of 15.5 per cent.

Walt Disney Corp. (DIS-N). After a tough stretch, Disney stock turned around over the last period, gaining $2.77 (U.S.) per share. We received a semi-annual dividend of 71 cents per share in July. On Thursday, the company announced an increase of 7 cents in the dividend, so the December payment will be 78 cents.

Cash. At the time of the last review, our cash reserves, including retained dividends, were $2,358.08. We invested that money at 2.25 per cent in an account with EQ Bank, earning $26.53 in interest.

Here is the status of the portfolio at mid-day on Nov. 30. For consistency, the Canadian and U.S. dollars are considered to be at par. However, the currency differential magnifies U.S. dollar gains and losses for Canadians. Trading commissions are not factored in although in a buy and hold portfolio they are not significant in any event.

Comments: The new portfolio value (market price plus retained dividends/distributions) is $83,430.63, compared to $78,753.11 at the time of the last review. That represents a gain of 5.9 per cent over the period.

Since inception, we have a total return of 67 per cent, which represents an average annual compound rate of return of 12.1 per cent, comfortably ahead of our 8-per-cent target.

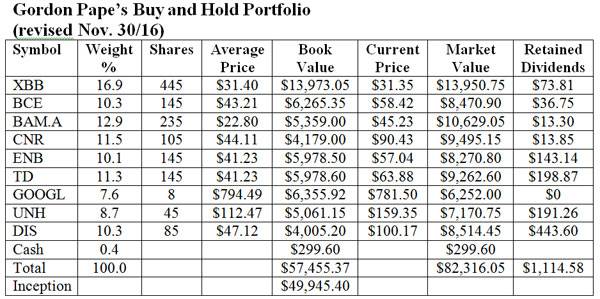

Changes: We will not change any of the securities in the portfolio, as you might expect given its Buy and Hold mandate. However, we will reinvest some of our dividends as follows.

XBB – We will buy 10 new units at a cost of $313.50. This will bring our total to 445 and reduce our cash position to $73.81.

BCE – We'll add five shares for an outlay of $292.10. This will give us 145 shares and reduce retained dividends to $36.75.

BAM.A – An additional five shares of Brookfield will cost $226.15. Our total position is now 235 shares, with $13.30 remaining in the cash account.

CNR – We will add five shares for a cost of $452.15. We now own 105 shares and have $13.85 left in cash.

ENB – Five more shares will cost us $285.20. Our position is now 145 shares with $143.14 in cash.

TD – Finally, we will purchase five shares of TD Bank for $319.40. We now own 145 shares and have cash remaining of $198.87.

Readers are reminded not to execute small trades through their brokers unless they have a fee-based account. Use dividend reinvestment plans instead.

Here is the updated portfolio. I'll review it again in June, on its fifth anniversary.

Gordon Pape is editor and publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to buildingwealth.ca.