No matter how you look at it, the past several months have been tough for investors. Both the stock and bond markets have struggled and with interest rates remaining near historic lows, it's been hard to make a buck. Even conservative asset allocations have been hit, and my Balanced Income Portfolio is no exception.

I started this portfolio for income-oriented investors in September 2011, so we now have more than four years of experience with it. That includes both good markets and bad, although no crashes so far (fingers crossed).

The portfolio is a combination of above-average cash flow and reasonable risk. The initial portfolio valuation was $25,027.75.

I made no distinction between registered and non-registered accounts, so keep in mind that the tax advantages of dividend-paying securities will be lost if they are held in an RRSP, RRIF, TFSA, RESP, etc.

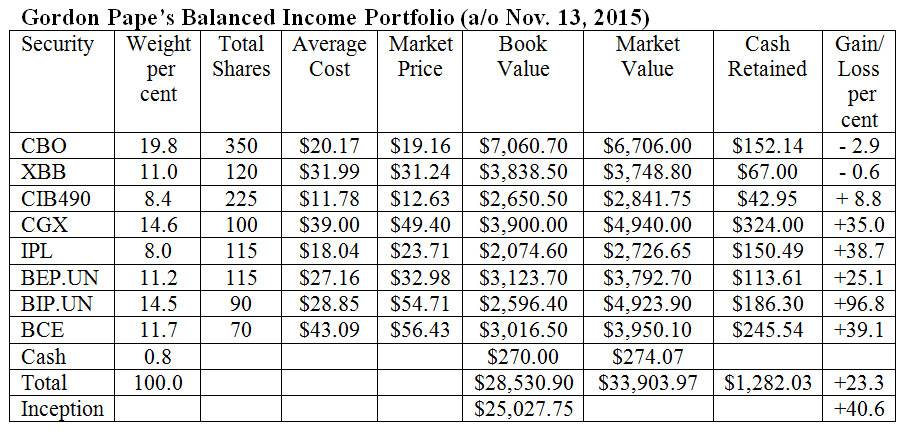

Here's a summary of how the securities performed over the seven months since I last reviewed this portfolio in late April. Prices are as of mid-day on Nov. 13.

iShares 1-5 Year Laddered Corporate Bond Fund (CBO-T). This is a low-risk way to own bonds. It will never score big gains, but it will never lose much either because of the short duration of the portfolio. During the latest review period, the unit price slipped by 45 cents. We received 36 cents in distributions so the net result was a small loss.

iShares Canadian Universe Bond ETF (XBB-T). This ETF provides exposure to the full range of Canadian bonds, including government and corporate issues of all maturities. It's a stabilizing force in the portfolio but sometimes even quality bonds experience price declines and we saw that in the latest period as the units lost $1.06. That was partially offset by 45 cents in distributions.

CIBC Global Bond Fund (A units) (CIB490). I added this mutual fund to the portfolio in March 2014 to increase our bond exposure and to provide diversification outside Canada. During the latest period we saw small uptick of 4 cents in the fund's net asset value, giving us a total return to date of 8.8 per cent. The downside is that this fund does not provide much cash flow. Distributions are paid only twice a year and the latest two were less than 3 cents per unit.

Cineplex Inc. (CGX-T). Cineplex was added to this portfolio in September 2013 and it continues to be a strong performer. The shares are up $0.29 since the last review in April, which may seem modest but is a good performance in a miserable market. Last spring the dividend was increased to 13 cents a month so we have received payments totalling about 91 cents per share since the time of the last review. Since Cineplex was added, the total return is 35 per cent.

Inter Pipeline (IPL-T). The hard times continue for all companies associated with the oil and gas industry. Everything's coming up toadstools instead of roses these days. This company's stock took another big hit in the latest period, losing 24.3 per cent. Ironically, Inter Pipeline is raising its monthly dividend by half a cent in November to 13 cents a share ($1.56 a year). Perhaps the directors know something the rest of us don't.

Brookfield Renewable Energy Limited Partnership (BEP.UN-T). After a strong run, this hydro and wind power limited partnership gave back $6.88 a share over the summer, as investors retreated from everything energy-related even if it had nothing to do with oil. We received two dividends of 41.5 cents (U.S.) per share.

Brookfield Infrastructure Limited Partnership (BIP.UN-T). This is a companion limited partnership to Renewable Energy but in this case the assets are infrastructure – everything from coal terminals and railways to power transmission lines. It held up well through the latest review period, with the shares gaining 34 cents. We also received two dividends of 52.99 cents (U.S.) each. This is the top performing security in the portfolio by a wide margin.

BCE Inc. (BCE-T). BCE shares were the best performers in the portfolio over the latest review period, adding $1.77 in what was generally a down market. We received two dividends of 65 cents each for a total return of 5.6 per cent during the period.

Cash. We invested $904.08 in a high interest savings account paying an average of 0.9 per cent over the period for interest of $4.07.

Here's how the portfolio stood as of mid-day on Nov. 13. Commissions have not been factored in. For simplicity, Canadian and U.S. dollars are treated as being at par for purposes of the calculations, although obviously the dividends received from the two Brookfield partnerships are worth more in Canadian dollar terms.

Comments: The market volatility of recent months took its toll on this portfolio, which had previously performed very well. The big losses suffered by IPL and BEP.UN pushed the overall result into the red for the period by 3.1 per cent. Still, that was a lot better than the return from the Toronto Stock Exchange over the same period. Especially important for income investors is the fact that we have not seen any dividend cuts from the stocks in the portfolio.

Since inception, the portfolio is showing a total return of 40.6 per cent for an average annual compound growth rate of 8.5 per cent. That's down from our last review but still well above our target of the best available five-year GIC rate plus two percentage points. Based on current rates, that target is currently 4.6 per cent.

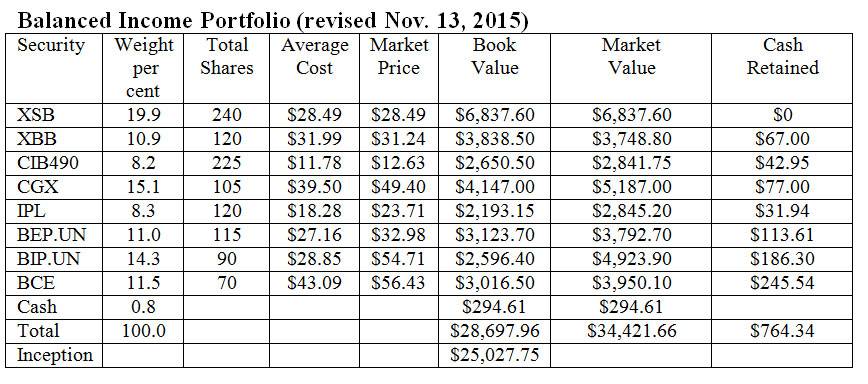

Changes: I am not happy with the performance of CBO. Because of the short-term nature of the portfolio, we don't expect large gains but we should at least be doing slightly better than break-even. Instead, we're looking at an overall loss of 2.9 per cent. I think we need to improve, especially since this is our largest single position.

Accordingly, we will sell our entire holding in CBO for $6,858.14, including retained income. We will switch that money to the iShares Canadian Short Term Bond Index ETF (XSB-T), which has been holding up better in a difficult market. The shares of XSB were trading at $28.49 at the time of writing. We will buy 240 shares for a cost of $6,837.60 and add the remaining $20.54 to our cash fund. XSB pays monthly distributions, which are currently running at just under $0.06 per unit.

We will add another five shares of IPL while the price is low at a cost of $118.55. That will increase our position to 120 shares and reduce our cash retained to $31.94.

Finally, we will spend $247 to purchase another five shares of CGX. That will bring our holding to 105 shares and reduce the cash retained to $77.

Readers are reminded not to make small trades unless they have a discount brokerage service or a fee-based account. Small quantities of five or ten shares are better accumulated through DRIP programs.

Here is the revised portfolio. I will review it again in April.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters.