The sharp slide in the U.S. dollar and the outright bludgeoning of multinational bank stocks means Wednesday's global market sell-off was not a continuation of January's market weakness but something almost entirely new.

As usual, interest rate markets provide the best clues. The previously-strong greenback was predicated on expectations of the U.S. economy accelerating. Now, with fears that U.S. growth is slowing, investors are selling growth-oriented equities and buying U.S. Treasuries, sending bond yields lower. U.S. Treasury yields have now accomplished an about face in a few short weeks – from climbing immediately before and after December's Fed rate hike, to falling as investors seek safe havens. The trend has weakened the greenback, benefited the loonie and other major currencies tremendously.

Merrill Lynch's worldwide fund manager survey has identified positive bets on the greenback as the industry's most popular portfolio bet. It also means that a big percentage of global investment assets were blindsided by market action Wednesday and are now struggling for an explanation as to what's going on.

During the fourth quarter of 2015, two-year U.S. bond yields steadily climbed as markets realized the Federal Reserve was serious about raising interest rates. The yield on the U.S. two-year bond climbed from 0.57 per cent in early October to 1.05 per cent by year-end. The trend attracted foreign investment in Treasuries – bond managers looked to increase portfolio yields by buying higher yielding Treasuries – and the resulting demand for greenbacks in currency markets helped pushed the U.S. dollar sharply higher. The trend has now reversed, with U.S. bond yields falling quickly.

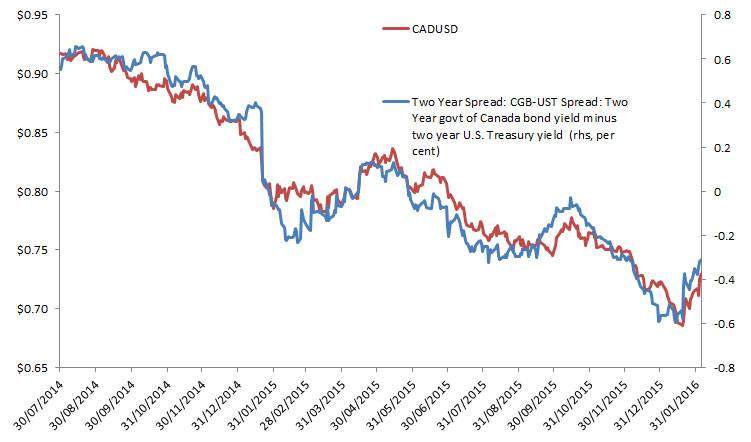

The chart below shows the effects of bond market action on the loonie. The red line shows the value of the Canadian dollar. The blue line shows the difference between the yield on the two-year government of Canada bond and the two-year Treasury bond (I just subtracted the U.S. bond yield from the Canadian bond yield).

On Jan.13, U.S. two-year bonds yielded 0.59 per cent more than two-year Government of Canada bonds. Since then, the decline in U.S. yields has caused a narrowing of the gap – domestic bonds now yield only 31 basis points. The loonie has rallied in accordance with the lower yield differential. This process is happening throughout global bond markets and most major currencies are rallying against the dollar.

The high intensity sell-off in global bank stocks is another new wrinkle for investors in February. Rumblings in the global banking sector began in Italy. The rising value of non-performing loans in the country have been a worry for years, and when the regulators' 'bad bank' solution to the problem were deemed weak, the sector sold off hard.

Problems have now spread. Deutsche Bank is getting hammered, trading below 2009 stock price lows, after announcing poor profit results. Credit Suisse is joining them in the post-earnings results penalty box this morning and Bloomberg cites sources suggesting that the entire European bank sector will require wholesale restructuring,

"It's already been a grim year for bankers' jobs. But it's not been the only one. In all, half a million jobs have been eliminated across the industry since the global financial crisis of 2008, according to Bloomberg News. And it's likely to get worse in Europe this year as revenue stagnates."

Two separate reports from the Financial Times' brilliant (and free with registration) Alphaville site argue that negative interest rates – there are almost $6-trillion U.S. dollars in sovereign debt currently trading with negative yields – are destroying profitability for the global banking system. First, Alphaville's David Keohane notes the sharp decline in Japanese bank stocks following the Bank of Japan's announced negative interest rate policy. In effect, the banks will stop receiving income from the massive bond positions on their balance sheets while being unable to lower rates paid to depositors for savings.

Izabella Kaminska is more brutal.

Ms. Kaminska notes that negative interest rates "eat" net interest margins[NIMs], the difference between the banks' cost of borrowing funds and the interest rates it charges on loans.

Net interest margins are the core of bank profits, "Without NIM, there is no banking. .. The brutal possibility coming into play: [the Federal Reserve] increasing the cost of borrowing in a global economy which isn't ready for it … Cash burn-through risk is not an option for bank investors. But neither is negative NIM. Both result in a similar level of capital destruction."

The trends in the U.S. dollar are creating volatility everywhere, but the declining probability for a U.S. rate hike in March may help create stability. The stresses on the global banking sector, while worrisome, could merely amount to a violent lurch towards adjusting to a new global credit environment marked by higher U.S. benchmark rates. Still, it would be difficult to over-estimate the panic and confusion among professional investors Wednesday and investors should prepare for further market volatility in the days ahead.