Commodity prices are more volatile and sensitive to change than equities, so it makes sense that lumber prices are a leading indicator for the U.S. housing industry. At this point, unfortunately, what they are indicating for U.S. homebuilder stocks is far from positive.

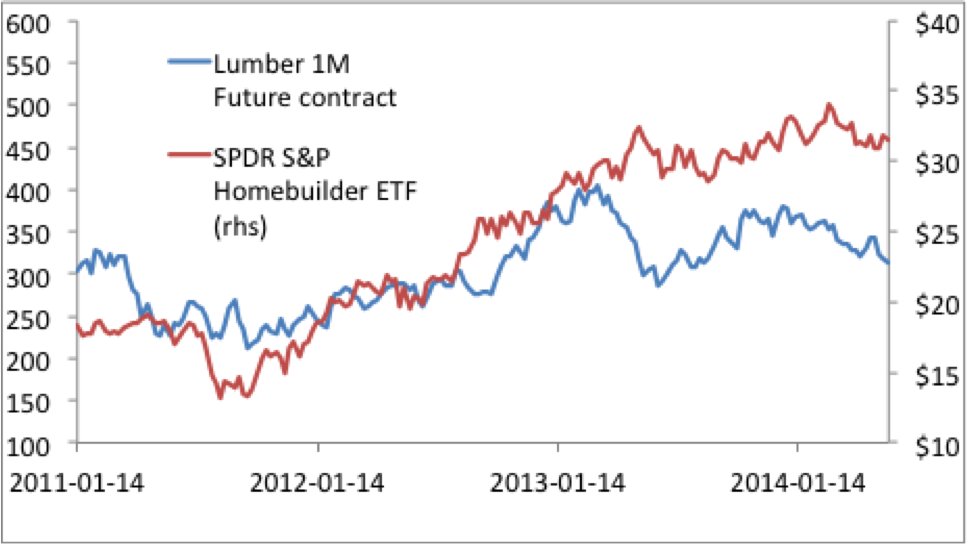

The first chart compares lumber prices to the SPDR S&P Homebuilder index. From early 2011 to mid-2013 the lines move in tandem, as demand for new homes, and the price of lumber to frame their walls, both climbed.

After that, home-building stocks remained stable while lumber prices cratered, and then attempted a recovery that failed in December of last year. Lumber prices fell 17.8 per cent while home builders' shares eased back by a much smaller 2 per cent.

Brutal winter weather that prevented new construction is no doubt partially responsible for the weakness in lumber. But if weather was the only culprit, lumber prices should be staging a recovery thanks to pent-up demand from the winter. Lumber prices have continued lower, however, which suggests a general lack of demand for new homes.

The Mortgage Banker’s Association Basic Index, which measures mortgage applications, shows the same softness in the U.S. housing market. The past twelve months have seen the index collapse by 62 per cent.

U.S. home prices have continued to rise according to the S&P/Case-Shiller Home Prices Index and total home sales have remained stable despite the decline in mortgage applications.

Stephanie Pomboy, economist and co-founder of research firm Macromavens LLC, believes that the difference between stable home sales and falling mortgage activity can be explained by institutional asset managers like BlackRock Inc. and Brookfield Asset Management Inc.

In a recent presentation, Ms. Pomboy says, “the gap between mortgage applications …. And total home sales, which went berserk, implies the role institutions are playing in this market.”

Asset managers snapping up homes at bargain prices and renting them as a source of income is a legitimate source of demand for the U.S. housing industry. But it’s also clear that outside of this strategy, housing demand is weak. A self-sustaining, broad recovery in the U.S. housing market does not appear to be in the cards, at least in the near future.

To make matters worse, valuations for the stocks in the SPDR S&P Homebuilder ETF index are reaching prohibitively expensive levels.

The three largest stocks in the ETF are Temper Sealy International Inc., Leggett & Platt Inc. and DR Horton Inc. In the past two years, Temper Sealy’s trailing price earnings ratio has tripled from 7.8 times to 24.3 times. Leggett & Platt’s PE has climbed from 17.9 to 22.2 and DR Horton’s ratio has more than doubled from 7.1 times to 15.4 times trailing earnings.

Lumber prices and mortgage applications suggest underlying weakness in the U.S. housing industry while stocks in the sector are getting expensive. There is little evidence of a housing market recovery at this point and investors in U.S. homebuilding stocks should take profits.