The S&P/TSX Composite climbed 0.9 per cent in the week ending with Friday's close which leaves few options for this Monday edition of the most overbought Canadian stocks post. There are only two TSX constituents officially oversold by Relative Strength Index (RSI) – beleaguered Valeant Pharmaceuticals International Inc and Progressive Waste Solutions.

The domestic benchmark is still in neutral territory according to RSI with a reading of 58, but it's slowly drifting towards the overbought sell signal of 70.

This is not an easy week to pick a focus stock. Inside the Market's Jennifer Dowty featured Progressive Waste Solutions as a "wait and see" story recently which doesn't sound too exciting, and, in my opinion, there's too much uncertainty regarding Valeant to emphasize the stocks' outlook using technical analysis.

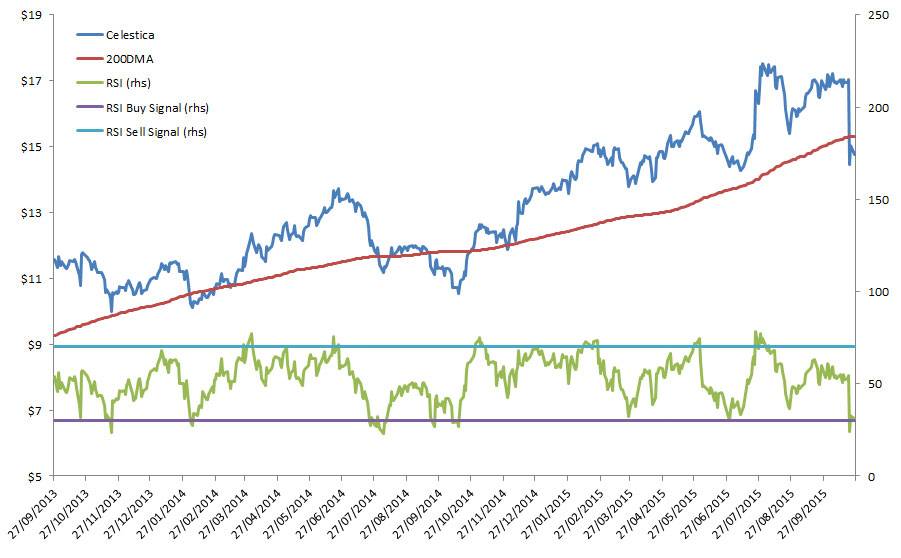

I picked Celestica Inc. even though its RSI reading of 32 is not quite in oversold territory. The stock fell 11.9 per cent in the past five trading days after missing earnings guidance.

Celestica's stock price has been dancing around its 200 day moving average for the past two years. The weakness last week pushed the price below the 200 day moving average for the first time since November 2014.

As we've discussed previously, the 200 day moving average is an important technical guideline – stocks above the 200 day are considered to have an uptrend intact. Stocks trading below the 200 day have been historically much less likely to bounce higher. This means the next few trading sessions are critical for Celestica stock. If it moves above the 200-day moving average, shareholders can breathe a huge sigh of relief.

RSI has worked very well in finding profitable buy and sell signals for Celestica stock in recent months. An oversold signal in October of 2014, for example, was followed by a 66-per-cent rally to July of 2015. An RSI overbought, sell signal in late July was followed by a 14-per-cent decline in the Celestica's stock.

On the other end of the TSX spectrum – overbought stocks by RSI that are susceptible to pullbacks – the list is growing quickly. There are now 15 stocks that are trading above the RSI sell signal of 70. In some cases, like Rogers Communications Inc and Brookfield Asset Management the companies are high quality and stable with significant dividend protection (from a significant downdraft) so there's little to worry about.

In other cases, the stocks have histories of volatility and investors should stay away until some the froth burns off.

Technical analysis with tools like RSI has a proven track record of success but as always, none of them are sufficient grounds for buy and sell decisions on their own. Extensive fundamental research should be part of every portfolio transaction.

Follow Scott Barlow on Twitter @SBarlow_ROB.