The recent rise in government of Canada bond yields does not yet threaten the outlook for domestic real estate investment trusts. Yet. But any further weakness in the bond market should serve as an alarm bell for investors in the sector.

The yield on REITs relative to government bonds is a major determinant of investment returns. When the dividend yield on REITs is substantially above bond yields (the difference between the two is knows as the "spread"), investment assets gravitate to the real estate sector, driving unit prices and investment returns higher. When the difference in yield is small, investors sell REITs, depressing unit prices, and move to risk free government bonds.

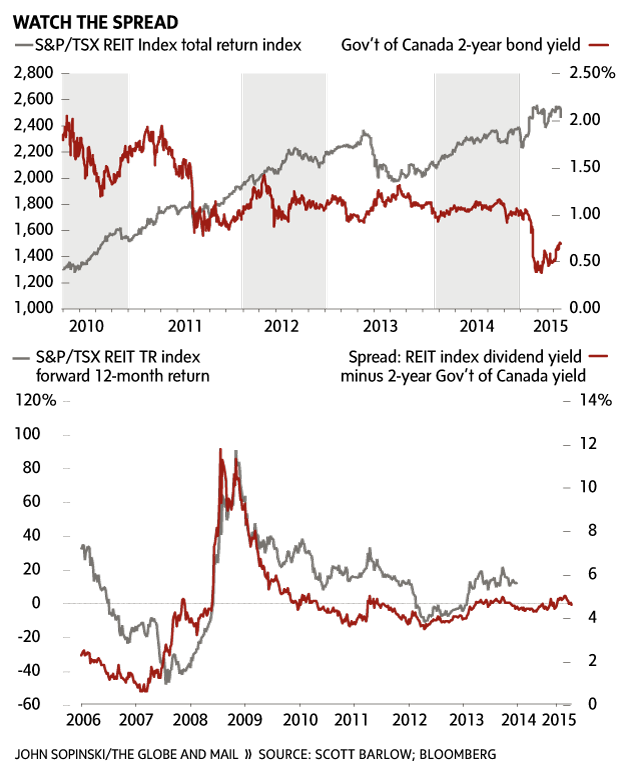

The top chart shows the important relationship between bond yields and the REIT sector. With rare exceptions, two-year bond yields move in the exact opposite direction – when bond yields fall, REITs perform well and when yields rise, which has been the case recently, REIT performance is weak.

Since the end of January, the bond yield has climbed by 30 basis points to 0.7 per cent – a significant move in an ultra-low interest rate environment. The Total Return REIT index fell 2.9 per cent for the same period – confirming the inverse relationship.

The second chart uses long term historical performance data to estimate future returns for REIT investors. The red line shows the spread – the difference in yield between the REIT index and two-year government of Canada bonds. The grey line shows the 12-month performance for the index following that point.

The pattern is similar throughout the history of the REIT index – returns on REITs fall along with declining yield spreads. This is particularly visible in the three-year period after March, 2009, when the spread was a miraculous, crisis-driven 11.4 per cent (the REIT index yield was more than 11 per cent higher than two-year bonds). Investors brave enough to buy REITs at this point were amply rewarded with a 91 per cent return in the following year.

From that point, the spread steadily declined from 11 per cent to 3.5 per cent. At that point, forward total returns on the REIT index turned negative.

Based on past performance, forward returns in the next 12 months are likely to track the red line showing the yield spread. This implies that future returns will fall close to negative territory in the coming months.

REIT investors are not yet in the danger zone, but expected returns look scant based on relative yields. Further significant increases in government bond yields however, without a rise in REIT dividends, would narrow the spread further and eventually make future negative returns a distinct probability. Declining spreads could also result in a raft of selling in the sector, which would create a downward spiral for performance.

Again, there is no reason to panic at present. But investors in the real estate sector should watch two-year government bonds extremely closely in the coming weeks, and reduce exposure if they continue to rise quickly.

Follow Scott Barlow on Twitter @SBarlow_ROB.