In June 2012, I launched a Buy and Hold Portfolio for people who don't want to spend a lot of time reviewing their positions and are not interested in active trading.

The focus is on blue-chip stocks that offer long-term growth potential plus regular dividend payments. When the portfolio was created, I included both Canadian and U.S. issues and each original stock was given a 10 per cent weighting. I also added a bond ETF to provide some downside protection.

I used several criteria to choose the stocks including a superior long-term growth profile, industry leadership, good balance sheet, solid dividend record, and relative strength in bad markets. Given the nature of the portfolio, the intention is to make changes only when necessary.

At the time, I stated that the objective was to generate decent cash flow and slow but steady growth. The target rate of return is 8 per cent annually.

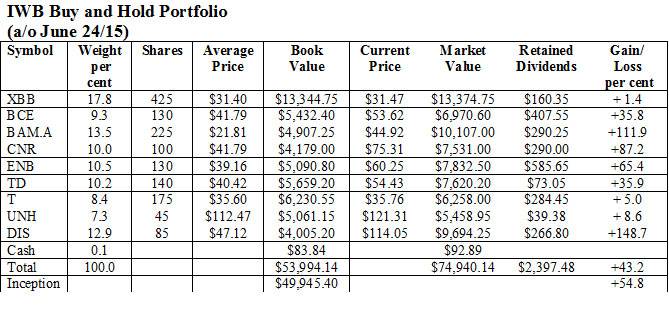

These are the current securities we hold with some comments on how they have performed since my last review in January. Prices are as of the morning of June 24.

iShares Canadian Universe Bond Index ETF (TSX: XBB): Bond prices have retreated because of concerns that the U.S. Federal Reserve Board will begin to raise interest rates in the fall. As a result, the price of the units is off 80 cents since my last review. The distributions, which have been running at more than 7 cents per month, have not been enough to offset this so we experienced a small loss in the latest period. Downward pressure on bond prices is likely to continue so we shouldn't expect a much different result for the rest of the year. However, we will retain a fixed-income component in this portfolio for stability and as a cushion against a stock market drop.

BCE Inc. (TSX, NYSE: BCE): Telecom stocks have struggled recently, in part due to interest rate concerns and in part because of uncertainty over the financial implications of recent CRTC rulings. BCE shares are down more than $5 since the January review. We did receive some good news in the form of a 5.3 per cent dividend increase, to 65 cents quarterly, but that was nowhere near enough to make up for the decline in the share price.

Brookfield Asset Management (TSX: BAM.A, NYSE: BAM): Brookfield's shares split 3 for 2 on May 13 so I have adjusted the numbers in the portfolio to reflect that. Previously, we owned 150 shares of the stock; we now have 225. The average cost has been recalculated as a result. The dividend is now 12 cents (U.S.) per quarter. Based on post-split prices, the stock is up 3.4 per cent since January. That may not seem like much but it's a good showing in what has been a lacklustre market.

CN Rail (TSX: CNR, NYSE: CNI): Rail stocks have been hurt by a decline in oil shipments and a slow growth economy. CN shares, which had been performing very well, lost more than $9 in the latest period. We still have an impressive three-year record, but the recent setback hurt. The dividend was raised 25 per cent effective with the March payment.

Enbridge (TSX, NYSE: ENB): Enbridge shares pretty much held their ground as energy-related stocks retreated in the first half of the year in the face of low oil prices. The stock was down slightly ($1.54 a share) but that loss was partially made up for by a significant increase in the dividend to 46.5 cents per quarter.

Toronto Dominion Bank (TSX, NYSE: TD): The bank stocks have been weak this year but TD shares managed to gain about $2 since the last review. We also received a dividend increase of 8.5 per cent to 51 cents quarterly, effective with the April payment.

AT&T (NYSE: T): We finally found a spark of life in this U.S. telecom giant. The shares are up $2 since January and the dividend was increased by a penny to 47 cents per quarter. Even with that, we still are ahead only 5 per cent on this stock since the portfolio was launched. We'll give it a little more time but it may be necessary to make a switch here at some point.

UnitedHealth Group (NYSE: UNH): This health care stock was added to the portfolio in January as a replacement for McDonald's, which has been having its problems. That turned out to be a good move. UNH was trading at $112.47 (U.S.) when I added it; the price is now up to $121.31 plus we have received dividends of 87.5 cents per share. That adds up to an 8.6-per-cent gain in five months. The company raised its quarterly payout by one-third earlier this month, to 50 cents per share.

Walt Disney Corp. (NYSE: DIS): The Disney juggernaut just keeps rumbling along. The share price is up more than $19 since the January review, bringing our total return on this investment to close to 150 per cent. We did not receive any dividends during the period as the company only makes one payment per year, in December.

Cash: At the time of the last review, our cash reserves, including retained dividends, were $1,722.94. We invested that money at 1.05 per cent, earning $9.05 in interest.

Here is the status of the portfolio as of the morning of June 24. For simplicity, the Canadian and U.S. dollars are considered to be at par, although obviously the differential in the currencies makes U.S. dollar dividends and capital gains more valuable to Canadian investors. Trading commissions are not factored in although in a buy and hold portfolio they are not significant in any event.

Comments: Canadian stocks struggled during the latest period, with only Brookfield and TD posting modest gains. However, the U.S. component of the portfolio came to the rescue, with a small advance from AT&T and big moves from UnitedHealth Group and Walt Disney Co.. That was enough to carry the portfolio to a small gain of 2.2 per cent for the six months. It's not a lot but these have been tough markets.

Since inception in June 2012, the Buy and Hold Portfolio has gained 54.8 per cent, for a three-year average annual compound growth rate of 15.7 per cent. That's down from 17.3 per cent in January but it is still well ahead of my target return of 8 per cent annually.

Changes: I won't change any of the securities in the portfolio at this time, although I'm keeping a close watch on AT&T – not because I think it has much downside risk but because it seems to be moribund. We'll use some of the retained dividends to add to a few positions, as follows.

XBB – We will buy five shares at $31.47 for a total cost of $157.35. This will reduce retained dividends to $3 and bring our position to 430 shares.

BCE – We'll also add five shares here, for a cost of $268.10. We now have 135 shares and $139.45 in retained dividends.

BAM.A – We have enough for five more shares at a cost of $225.60. That brings our holding to 230 shares, with $64.65 left in dividends.

ENB – We will buy 10 more shares, to bring our total to 140. The cost will be $602.50, which will take all of our retained dividends plus $16.85 from cash reserves.

T – Finally, we will add another five shares of AT&T at a cost of $178.80, leaving $105.65 in retained dividends.

Here is a look at the revised portfolio.

Remember that I do not recommend doing small trades unless you are using a discount broker and paying minimum commission. These transactions are only for purposes of this model portfolio. The most effective way to add small positions to your own portfolio is by using DRIPs (dividend reinvestment plans).

I will review this portfolio again in December.