The S&P/TSX Composite index rose 0.6 per cent for the market week ending with Thursday's close.

The primary domestic equity benchmark now stands 10.4 per cent higher for the year, including dividends, but, for a lot of investors, it doesn't feel that positive because of severe market volatility.

The index as a whole has a Relative Strength Index (RSI) reading of 54, which puts it in neutral territory in terms of technical analysis, about mid-way between the buy signal of 30 and sell signal of 70.

There are three S&P/TSX constituent stocks trading in officially oversold territory with an RSI reading below the buy signal of 30. But, each of Intertain Group Ltd., Empire Co. Ltd. and Magna International Inc. are trading well below their respective 200 day moving averages and, as we've seen, RSI buy signals are less effective when this is the case.

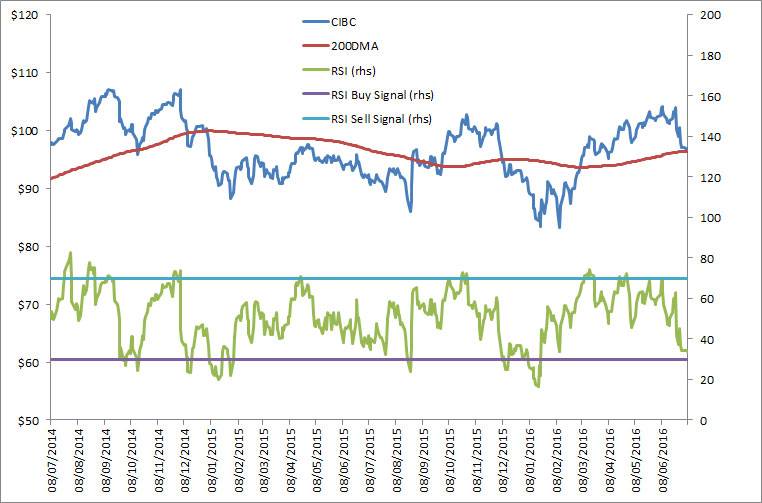

I picked Canadian Imperial Bank of Commerce for the focus stock this week even though it is not quite oversold. Canadian bank stocks rarely get oversold, and the stocks' current 5.0-per-cent yield makes it a tempting buy for many. CIBC stocks is also exactly at its 200 day moving average.

RSI has worked reasonably well as a means of finding profitable entry points for CIBC stock. An oversold reading in October of 2014, for example, was followed by a 12-per-cent rally to early December 2014. CIBC fell below its 200 day moving average in January 2015 and the RSI buy signals became less reliable, followed by small, unsustainable rallies in the stock price.

In a technical sense, CIBC looks like another case where the 200 day moving average matters more than RSI in the short term. If the stock falls below the 200 day, all bets are off, and it could fall further. A bounce off the trend line and a move higher could very well be the start of a significant rally.

As always, technical analysis should only be used along with detailed fundamental research before any transactions are made in the market.

There are 15 S&P/TSX Composite stocks trading above the RSI signal of 70 and are thus vulnerable to a pullback. Transcanada Corp. and Hydro One Ltd. are the two most technically extended stocks, followed by Smart REIT and Silver Standard Resources Inc..

REITs are the largest contingent on the overbought list. In addition to Smart REIT, Canadian Real Estate Investment Trust, Boardwalk Real Estate Investment Trust, and Milestone Apartments Real Estate Investment Trust are also on the list.

Follow Scott Barlow on Twitter @SBarlow_ROB.